Welcome: Difference between revisions

No edit summary |

|||

| (5 intermediate revisions by the same user not shown) | |||

| Line 19: | Line 19: | ||

# Trade Autumn for Winter, and when Winter becomes the most expensive: | # Trade Autumn for Winter, and when Winter becomes the most expensive: | ||

# Trade Winter for Spring. | # Trade Winter for Spring. | ||

---- | |||

At this point you will have more Spring than if you only buy and hold the tokens. | |||

Regardless of the Dollar price of the tokens, having more Spring is better. | |||

'''Seasonal Tokens outperforms the simple buy and hold strategy.''' | |||

This brings the power of compounding returns to your portfolio, and the results are amazing. | This brings the power of compounding returns to your portfolio, and the results are amazing. | ||

| Line 43: | Line 51: | ||

The picture above represents a theoretical model for the response of the relative prices to the changes in mining supply. | The picture above represents a theoretical model for the response of the relative prices to the changes in mining supply. | ||

The next chart shows the historical relative prices of the four tokens. Notice that despite random fluctuations the real prices fluctuate around a well-defined pattern. (Dotted lines in the chart) | The next chart shows the historical relative prices of the four tokens. Notice that despite random fluctuations the real prices fluctuate around a well-defined pattern. (Dotted lines in the chart) | ||

[[File: | [[File:HistoricalRelPrice.png|800px |left]] | ||

In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens. | In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens. | ||

Latest revision as of 21:31, 15 July 2024

Welcome to Seasonal Tokens:

A tool for building wealth, a financial innovation, an accessible investment option, a risk management tool, and a long-term investment strategy.

Seasonal Tokens is the first cryptocurrency system in the world with built in seasonality in their relative prices.

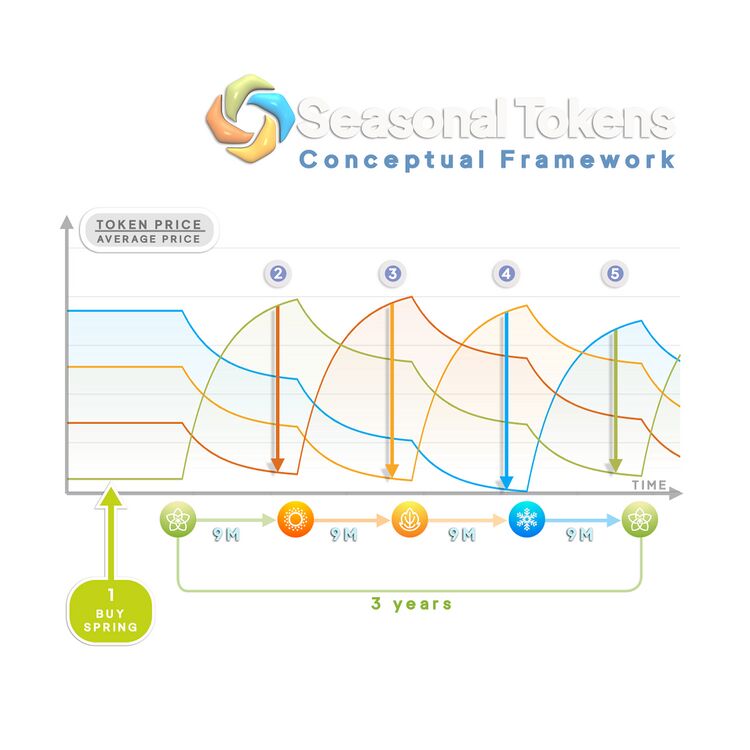

The essence of the system can be appreciated in one picture:

Traders can profit from the predictable price changes. There is a winning trading strategy in the system:

- Buy Spring (Or the cheapest token). Wait until it becomes the most expensive of the four.

- Trade Spring for a larger number of Summer tokens.

- Trade Summer for Autumn, and wait for Autumn to become the most expensive.

- Trade Autumn for Winter, and when Winter becomes the most expensive:

- Trade Winter for Spring.

At this point you will have more Spring than if you only buy and hold the tokens.

Regardless of the Dollar price of the tokens, having more Spring is better.

Seasonal Tokens outperforms the simple buy and hold strategy.

This brings the power of compounding returns to your portfolio, and the results are amazing. You can see it for yourself using our seasonal trading simulator.

Traders can use these clear, transparent, and public signals to decide how and when to buy and sell the tokens. This is an innovative, ethical and fair approach to cryptocurrency trading.

Warning! A token is said to be "in season" when it is produced at the fastest rate, and it goes out of season when its mining supply is cut in half. These Token seasons last nine months each, and do not coincide with the actual seasons in nature lasting 4 months.

Relative Prices Chart Explained

Understanding Seasonal Tokens equals: Understanding the Normalized Relative Price Graph This page explains the dimensionless variable used to analyze the relative prices of the four tokens.

Check out this video explaining the Relative Tokens Price Chart.

Proof of Concept:

The picture above represents a theoretical model for the response of the relative prices to the changes in mining supply.

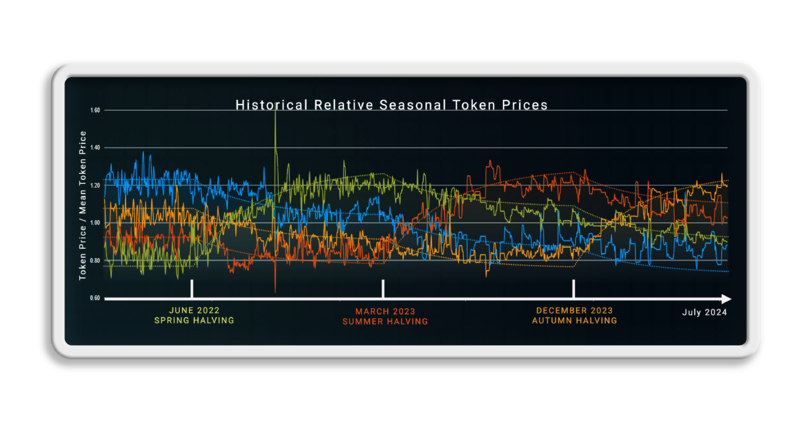

The next chart shows the historical relative prices of the four tokens. Notice that despite random fluctuations the real prices fluctuate around a well-defined pattern. (Dotted lines in the chart)

In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens.

In March 2023 the rate of supply of Summer tokens was cut in half, and few months later Summer became the most expensive of the four tokens.

In December 2023 the rate of supply of Autumn tokens was cut in half, and you can see that its price is rising relative to the other tokens.

Not only this proves that the Seasonal Tokens system is working as designed, but it is also a technological accomplishment because it proves that mining supply does affect the price.

It is hard to see this periodical signal in other proof of work cryptocurrencies because the fluctuations in the dollar prices blur the effects of the halving of mining supply.

By focusing on the relative prices of the four tokens, the effects of fluctuations in the dollar prices are factored out.

Do you Want to Be Part of This Financial Innovation in Web3 Technology?

Read our Due Diligence article .

Chat with team members of the project. We have a friendly community of people who trust this project and are happy to clear out any doubts or questions you may have. And help you to find an easy entry point according to your special needs.

How to Guides and Tutorials: this is where you find step by step instructions on how to operate all features in Seasonal Tokens, how to buy tokens, do seasonal trading, mine tokens, and farm tokens to earn passive income providing liquidity to the markets.

If you are new to crypto, or want to learn more about Web3 technology, these tutorials can help you a lot with real world examples, using Seasonal Tokens to illustrate the potential of decentralized finance.

And off course: Read the white paper!

Don't have time for reading? Watch the video version of the documentation

No time at all? OK. Try this: DYOR in less than 60 seconds Playlist