GenerateWealth

Seasonal Tokens are designed for investment. They can be used to generate wealth. The Seasonal Tokens system rewards the economy participants with tokens, but you can keep your earnings on any currency. In the following section we explain how to use Seasonal Tokens to get Bitcoin.

Use Seasonal Tokens to Get Bitcoin.

Trade Tokens for More Tokens

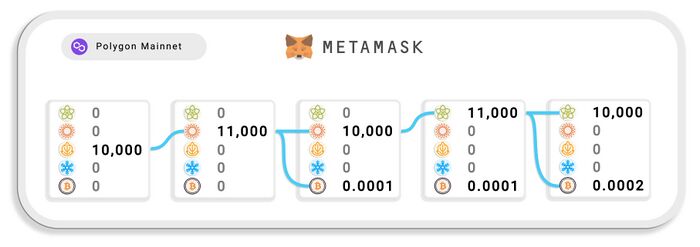

Let’s suppose that we’ve bought 51 MATIC (worth about $60) from an exchange, and swapped 50 MATIC for 10,000 Autumn tokens. The next step is to trade those Autumn tokens for more tokens of a different type. The exchange rates between the tokens change over time as the prices cycle around each other. You can check the exchange rates by going to seasonaltokens.org/trade and looking in the Trade Tokens for More Tokens section.

In order to get as many bitcoins as possible, we need to make a trade that gives us significantly more tokens than we started with. We want an exchange rate that’s around 1.1 or higher. A rate of 1.05 would give us just a 5% increase in the total number of tokens, so if the rates are all close to 1, then it’s better to wait and do the trade later, when the rates are better.

Let’s suppose that we have an opportunity to swap Autumn tokens for Summer at an exchange rate of 1.1. We can go ahead with that swap inside MetaMask, and afterwards, we’ll have approximately 11,000 Summer tokens.

Swap the Excess Tokens for Wrapped Bitcoin

With 11,000 Summer tokens, we have 1,000 more Seasonal Tokens than we started with, but we want to use the tokens to get bitcoins, not more tokens. So we can swap 1,000 Summer tokens for Wrapped Bitcoin inside MetaMask. This will give us about $5 in Wrapped Bitcoin.

So we started with 10,000 Seasonal Tokens and no bitcoins, and now we have 10,000 Seasonal Tokens and about $5 worth of bitcoin.

Repeat

When the Summer/Spring exchange rate looks good, we can repeat the process. Let’s suppose that, after a bit of waiting, the Summer/Spring rate is 1.1, and we can swap the 10,000 Summer tokens for 11,000 Spring tokens.

After that, we can swap 1,000 Spring tokens for Wrapped Bitcoin, and we’ll get a little less than $5 worth of Wrapped Bitcoin, and our wallet will then contain 10,000 Spring tokens and around $10 worth of Wrapped Bitcoin.

Then we can do the same thing again when the exchange rate is favorable. If the Spring/Winter rate is 1.1, we can swap the 10,000 Spring tokens for 11,000 Winter tokens, and then swap 1,000 Winter tokens for Wrapped Bitcoin.

By following this procedure, we’ll always have 10,000 Seasonal Tokens in the wallet, and the Wrapped Bitcoin balance will increase with every trade, providing an ongoing income in bitcoins.

The image shows an Example Sequence of Trades. By trading 10,000 tokens for more than 10,000 tokens of a different type, the total number of tokens owned increases. The excess above 10,000 can then be swapped for Wrapped Bitcoin inside the MetaMask wallet. By repeating this procedure, the total number of Seasonal Tokens in the wallet remains fixed at 10,000, but the amount of Wrapped Bitcoin in the wallet increases with every trade

The Downsides

Winter is currently the cheapest token, and is expected to remain the cheapest until after September this year. In September, the Winter halving will take place, and Winter will go from being produced at the fastest rate of the four tokens to the slowest. In the following months, Winter is expected to become the most expensive token, as the market adjusts to the new scarcity. The big downside is that it’s necessary to wait until that happens before you can trade again, and get more bitcoins.

Another downside is that this can only be done with small numbers of tokens. A trade of 10,000 tokens won’t move the market much, but if you try to trade a million tokens, you’ll find that you always get fewer tokens in return. This is because there will only be about 37 million tokens of each type produced in total. A trade of a million tokens will have a big price impact, reducing the number of tokens you get in return.

The Upsides

Like Bitcoin, the tokens go through regular halvings and will become scarcer in the future. This makes them suitable as a store of value, so, even though you would always have 10,000 tokens if you use this procedure, the amount of mining time needed to produce that many tokens will keep increasing as time goes on. This means that you can use the tokens to get an ongoing income in bitcoins, and also hold an asset that’s becoming scarcer over time.

Additionally, while nine months is a long time to wait to perform the next trade, the long interval between halvings makes it possible to break a large trade up into many small trades. Instead of trading 100,000 tokens in a single trade, and getting a bad deal because of the price impact, it’s possible to make 10 trades of 10,000 tokens each, spread out over months.

Risks

Investing in any cryptocurrency is risky, and nobody should invest more than they can afford to lose. Seasonal Tokens provide a way to manage that risk. By following the rule: Always trade tokens for more tokens, and never trade for fewer tokens, it’s possible to guarantee that the number of tokens owned never decreases. Just like Bitcoin, the tokens could fall in price, leading to a loss measured in dollars, but by following this rule, the possibility of making a loss measured in tokens can be eliminated, while the number of bitcoins owned increases over time.

Finally, nobody can guarantee future prices. The rates of production of the tokens are guaranteed to cycle around each other, and the prices consequently tend to cycle around each other because of the influence of supply on the market. The future behavior of the prices is not absolutely guaranteed. The tokens have been around for two and a half years, and three halvings have taken place so far, with the token prices cycling around each other as expected. There is no absolute guarantee that the prices will continue to behave as expected in the future.

The chart shows the historical behavior of the token prices relative to each other. After each halving, the rate of production of one of the tokens is cut in half. The token that was produced at the fastest rate becomes the slowest. As the market adjusts to the change in supply, that token tends to go from the cheapest of the four to the most expensive, making the prices cycle around each other over the long term.

The procedure above ensures that neither the number of tokens owned nor the number of bitcoins owned will decrease, although their value measured in dollars could certainly decrease. In the worst case, there would be no opportunities to trade. This would require the prices to be exactly equal to each other permanently, which could only happen if the rates of production had no influence at all on the market prices.

For as long as the supply from mining affects the market prices, we can expect that there will be some difference in the prices of the tokens, and therefore some opportunities to trade and gain bitcoins. How many bitcoins can be achieved depends on future market conditions, which can’t be predicted with certainty.