Relative Prices: Difference between revisions

Jump to navigation

Jump to search

No edit summary |

No edit summary |

||

| Line 17: | Line 17: | ||

Any change in the price of the tokens due to external factors would affect the numerator and denominator of this fraction in the same proportion. Canceling out its effect on this graph. | Any change in the price of the tokens due to external factors would affect the numerator and denominator of this fraction in the same proportion. Canceling out its effect on this graph. | ||

[[File:PtDIVpAVandXF 9.1.2.jpg|60px | | [[File:PtDIVpAVandXF 9.1.2.jpg|60px |right]] | ||

This way of presenting the price data concentrates only on changes in the relative value of the tokens. Leaving out the effects of external factors affecting all token prices in the same way. | This way of presenting the price data concentrates only on changes in the relative value of the tokens. Leaving out the effects of external factors affecting all token prices in the same way. | ||

Revision as of 20:11, 13 June 2023

Proof of Concept. Historical Relative Price Data.

This graph represents the Relative Prices of the four tokens.

On the vertical axis, we have the token’s price divided by the average value of the four token's prices.

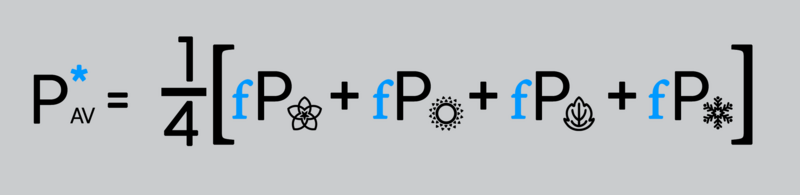

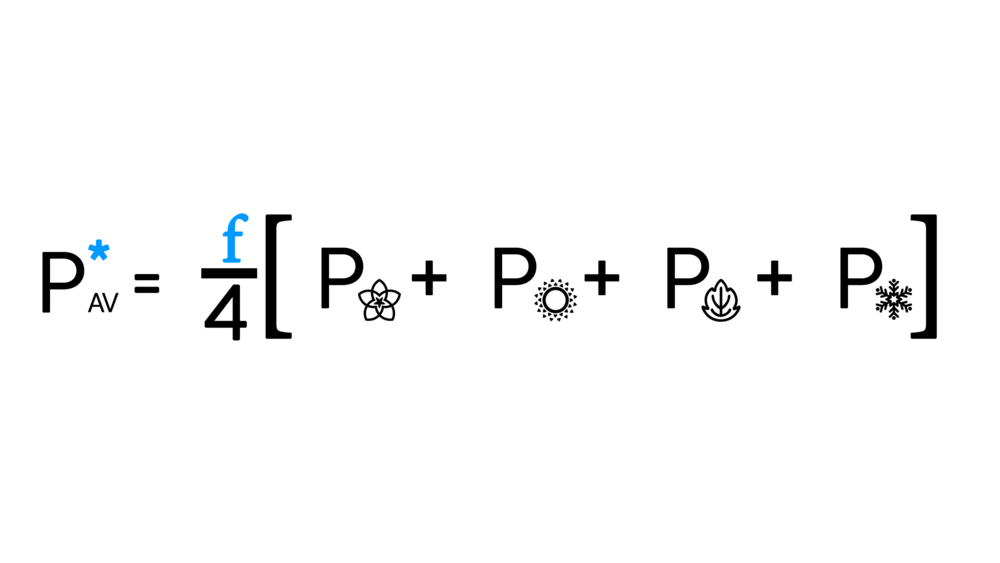

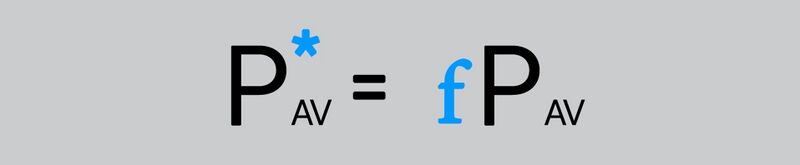

Where the average price is given by:

This way of presenting the price data is independent of external factors affecting all four tokens' prices. In particular, this chart is independent of the dollar prices of the tokens.

Any change in the price of the tokens due to external factors would affect the numerator and denominator of this fraction in the same proportion. Canceling out its effect on this graph.

This way of presenting the price data concentrates only on changes in the relative value of the tokens. Leaving out the effects of external factors affecting all token prices in the same way.

Traders profit from oscillations in the relative prices of the four tokens.

And those are independent of the dollar price of the tokens.