Benzinga 01 old

Bitcoin-Inspired Hard Digital Assets on the Ethereum Network: A New Frontier

Seasonal Tokens are a set of four trust-less, decentralized digital assets issued by proof of work.They use the same economic principles embedded in Bitcoin's design but running on the Ethereum network. Their mining supply has been engineered to produce predictable price oscillations. Traders can use this built-in seasonality to make money.

Bitcoin Halving and Seasonality

Bitcoin is the first hard digital asset in history, the proof of work mechanism effectively converts energy into currency by a process referred to as "mining". It's cost of production connects it to the real world economy and provides a fundamental value thus behaving like a physical commodity.

Mining is a way to create new coins without a central mint of trusted parties. In order to make sure that only a finite number of bitcoins will be created, the mining supply of new coins is cut in half approximately every four years, an event called Bitcoin Halving.

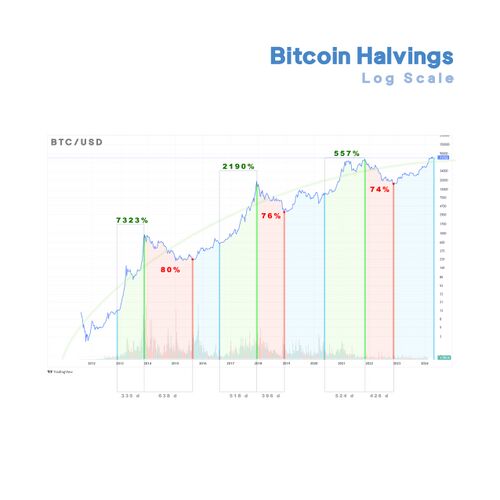

A key observation in crypto is that the Bitcoin Halving has introduced seasonality in the cryptocurrency markets. This is difficult to see due to the large price fluctuations, but if we look at the Bitcoin price history on a logarithmic scale, a pattern emerges:

Ever four years on average, the Bitcoin mining supply is cut in half. The blue vertical lines mark the halving, months after the halving of mining supply a bull market (marked in green) sends the Bitcoin price to all time highs, reaching prices well above the cost of production, and the whole thing ends up with a price bubble leading to a bear market (in red) that may last for more than a year, followed by a period of recovery until the next halving occurs.

As the Bitcoin price skyrockets, people starts looking for alternative investments leading to the so called "altcoin season" when other major cryptocurrencies experiment a rise in price due to Bitcoin's bull run.

There are many other proof of work cryptocurrencies. If some of them would experiment a bull run when Bitcoin is experimenting a bear market, traders could exploit this seasonality trading Bitcoin for the cryptocurrencies that will rise in price. Unfortunately, technical analysis of other major proof of work cryptocurrencies price action does not reveal the desired seasonal patterns.

Ethereum and Innovation

Creating another blockchain comparable to Bitcoin but with a different halving schedule is practically impossible due to the amount of resources needed, both in hardware, energy consumption, and widespread adoption.

But thanks to Ethereum it is not necessary. the ERC20 technology allow the creation of digital assets with the economic principles embedded in Bitcoin's design, but they don't need their own blockchain.

Decentralization and security are handled by the Ethereum network.

Designed for Investment

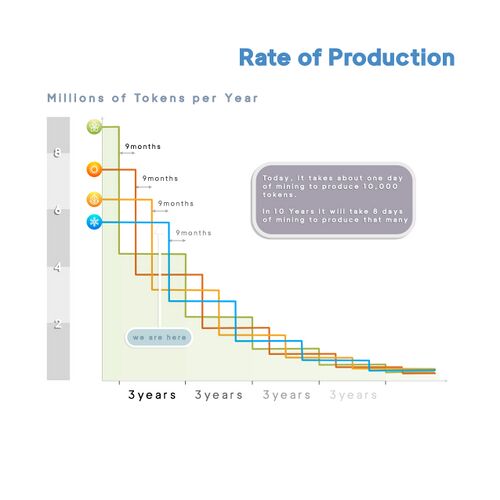

There are four Seasonal Tokens: Spring, Summer, Autumn and Winter. Their mining supply is cut in half every 3 years. But the key feature of Seasonal Tokens is that the rates of production have been arranged in time in such a way that every nine months the mining supply of the token being produced at the fastest rate is cut in half, becoming the token produced at the slowest rate.

Scheduled halvings cause oscillations in the relative price of the tokens. These predictable oscillations can be used by traders for profit.

By concentrating on the relative prices of the four tokens, the effects of fluctuations in the dollar value of the assets can be factored out.

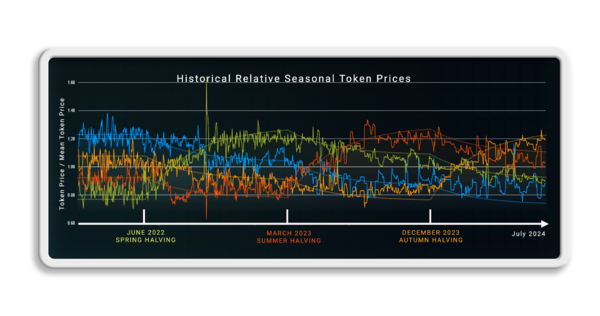

On Septermber 4 2024 the mining supply of Winter tokens will be cut in half. This will close a full cycle of halvings. The historical relative price graph shows that the system is working as designed. The mining supply causes predictable oscillations in the relative prices of the four tokens.

This closed ecosystem is completely autonomous, only subject to supply and demand, and it is a technical achievement which proves that a complex organization can emerge from economic principles only, in a completely trust-less manner without any governance or management involved.

GPT Title Variations

"Exploring Hard Digital Assets: How Bitcoin-Inspired Innovations Thrive on Ethereum" "Bridging Blockchains: The Rise of Bitcoin-Inspired Digital Assets on Ethereum" "From Bitcoin to Ethereum: The Evolution of Hard Digital Assets" "Hard Digital Assets: Harnessing Bitcoin’s Principles on the Ethereum Blockchain"