Brochure 3

Brochure Covers

Seasonal Tokens an Ethical & Non-Speculative Wealth Creation system

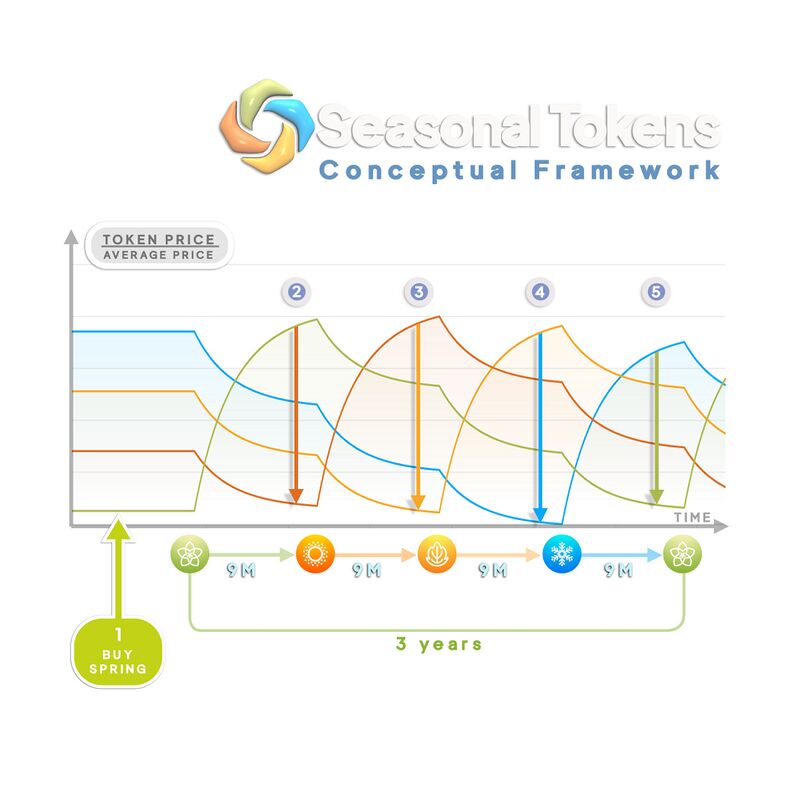

Conceptual Framework

Bitcoin Halving

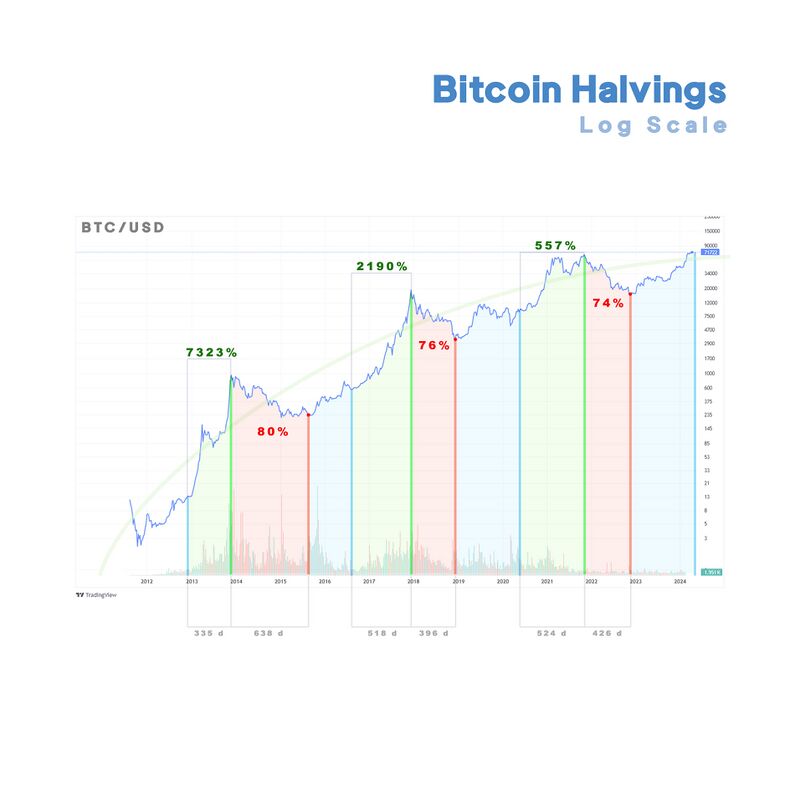

Bitcoin Halvings Log Scale

What Problems are Seasonal Tokens Designed to Solve?

Innovation

Creating another blockchain comparable to Bitcoin but with a different halving schedule is practically impossible due to the amount of resources needed, both in hardware, energy consumption, and widespread adoption.

But thanks to Ethereum it is not necessary. The ERC20 technology allows the creation of digital assets with the economic principles embedded in Bitcoin's design, but they don't need their own blockchain. Decentralization and Security are handled by the Ethereum network.

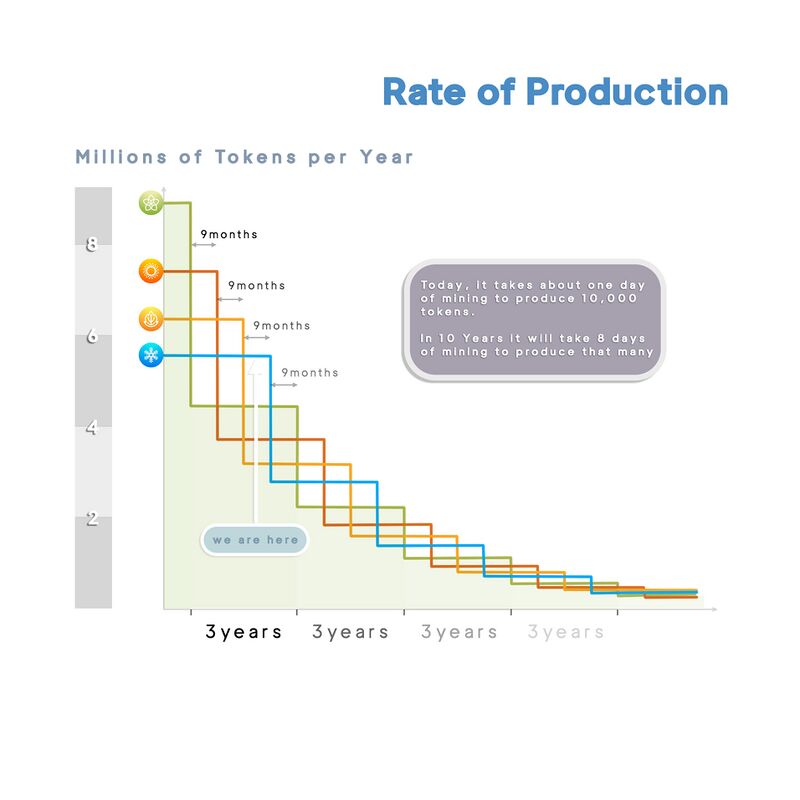

The key feature of Seasonal Tokens is that the rates of production have been arranged in time in such a way that every nine months the mining supply of the cheapest token is cut in half.

Scheduled halvings cause oscillations in relative price of the tokens. These predictable price oscillations can be used by traders to increase the total number of tokens they have.

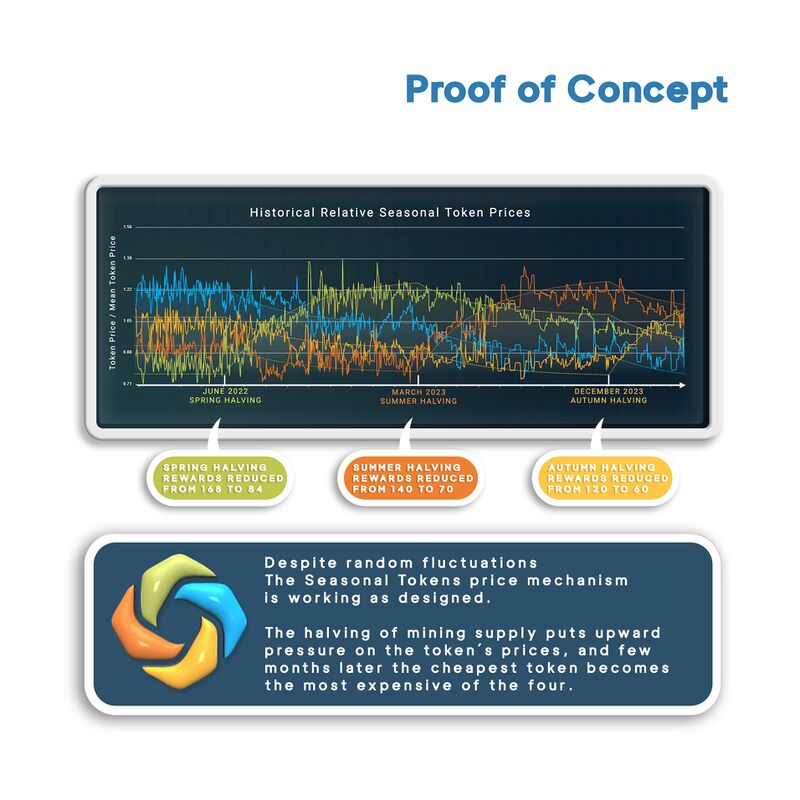

Proof of Concept

The Historical Relative Seasonal Tokens Prices chart shows that despite random fluctuations the toiken prices fluctuate around a well-defined pattern. (Dotted lines in the chart)

In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens.

In March 2023 the rate of supply of Summer tokens was cut in half, and few months later Summer became the most expensive of the four tokens.

In December 2023 the rate of supply of Autumn tokens was cut in half, and you can see that its price is rising relative to the other tokens.

Not only this proves that the Seasonal Tokens system is working as designed, but it is also a technological accomplishment because it proves that mining supply does affect the price.

It is hard to see this periodical signal in other proof of work cryptocurrencies because the fluctuations in the dollar prices blur the effects of the halving of mining supply. By focusing on the relative prices of the four tokens, the effects of fluctuations in the dollar prices are factored out.

QR to Relative Price Chart video

Designed for Investment

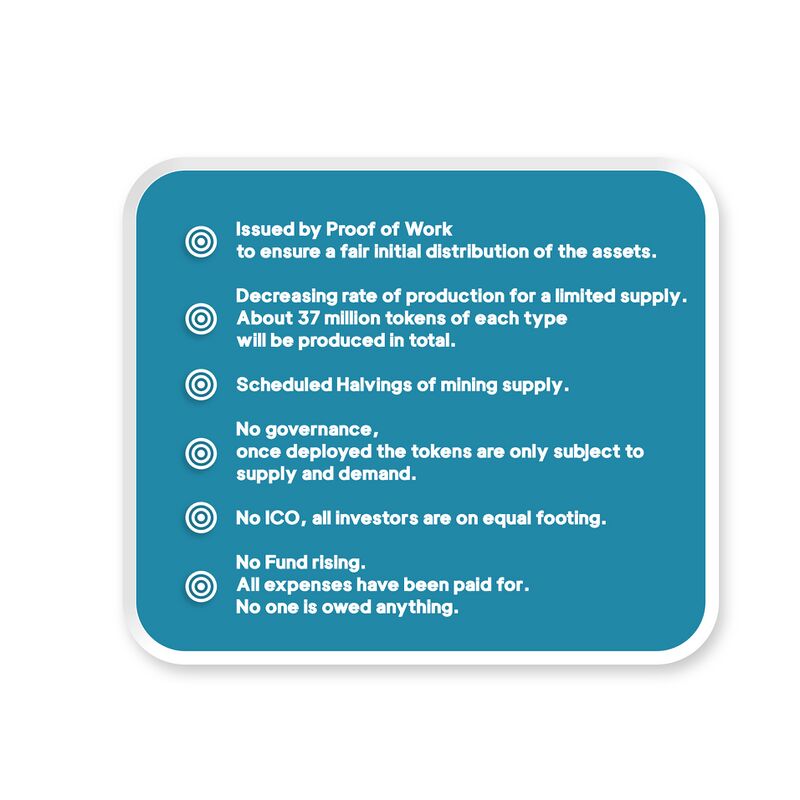

Inspired on Bitcoin

Implemented on Ethereum

- Four ERC-20 Tokens.

- Proof of Work mined on the Ethereum network.

- Maximum Supply: 37 million tokens of each type.

- Halving of Mining Supply every 3 years. (Scheduled in time, not number of blocks)

There were no pre-mining or initial coin offerings.

The four tokens smart contracts are independent (don’t interact with each other), and identical except by two things: The initial rate of supply and the halving schedule, arranged in time so that every nine months the fastest token to produce becomes the slowest to produce.

The smart contracts have been audited by three independent entities. Check out the smart contracts, audits, markets and other relevant technical data here:

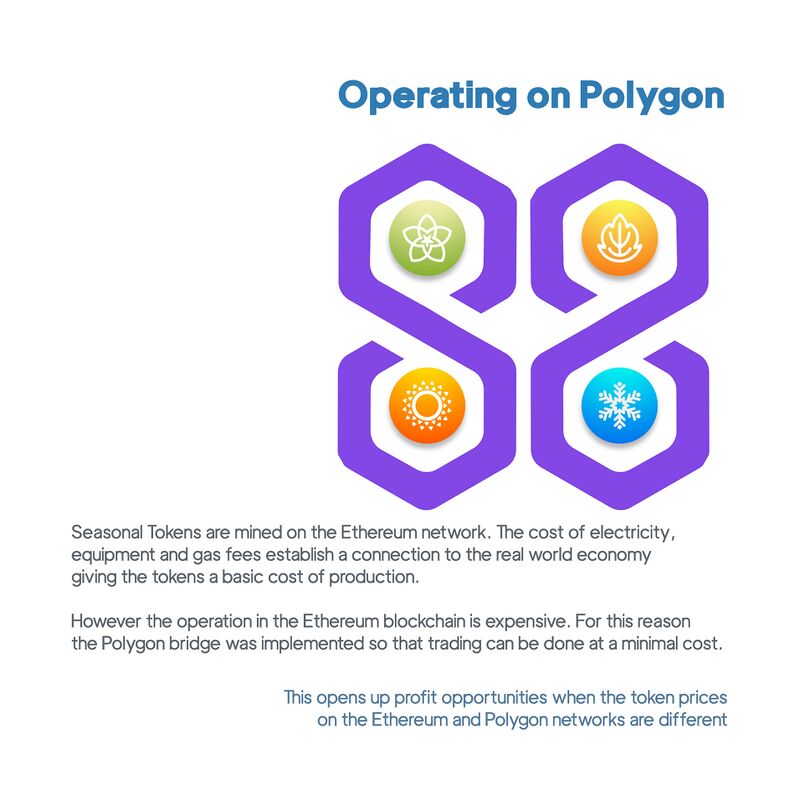

Operating on Polygon

How to Use Seasonal Tokens to get Bitcoin

Trade Tokens for More Tokens

Let’s suppose that we start with 10,000 Autumn tokens. The next step is to trade those Autumn tokens for more tokens of a different type.

In order to get as many bitcoins as possible, we need to make a trade that gives us significantly more tokens than we started with.

Let’s suppose that we have an opportunity to swap Autumn tokens for Summer at an exchange rate of 1.1. We can go ahead with that swap inside MetaMask, and afterwards, we’ll have approximately 11,000 Summer tokens.

Swap the Excess Tokens for Wrapped Bitcoin

With 11,000 Summer tokens, we have 1,000 more Seasonal Tokens than we started with, but we want to use the tokens to get bitcoins, not more tokens. So we can swap 1,000 Summer tokens for Wrapped Bitcoin inside MetaMask. This will give us about $5 in Wrapped Bitcoin.

So we started with 10,000 Seasonal Tokens and no bitcoins, and now we have 10,000 Seasonal Tokens and about $5 worth of bitcoin.

Repeat

When the Summer/Spring exchange rate looks good, we can repeat the process. Let’s suppose that, after a bit of waiting, the Summer/Spring rate is 1.1, and we can swap the 10,000 Summer tokens for 11,000 Spring tokens.

After that, we can swap 1,000 Spring tokens for Wrapped Bitcoin, and we’ll get a little less than $5 worth of Wrapped Bitcoin, and our wallet will then contain 10,000 Spring tokens and around $10 worth of Wrapped Bitcoin.

Then we can do the same thing again when the exchange rate is favorable. If the Spring/Winter rate is 1.1, we can swap the 10,000 Spring tokens for 11,000 Winter tokens, and then swap 1,000 Winter tokens for Wrapped Bitcoin.

By following this procedure, we’ll always have 10,000 Seasonal Tokens in the wallet, and the Wrapped Bitcoin balance will increase with every trade, providing an ongoing income in bitcoins.

QR to Use Seasonal Tokens to get BTC video

Left Over:

Trading Simulator

The Seasonal Tokens Trading Simulator allows users to practice trading tokens for more tokens over time as the prices cycle around each other, without putting any real money at risk. Use the simulator to see how many tokens you can acquire over the course of ten years by trading tokens for more tokens, as the prices cycle around each other.

- QR with link to the trading simulator

- QR with link to explainer video

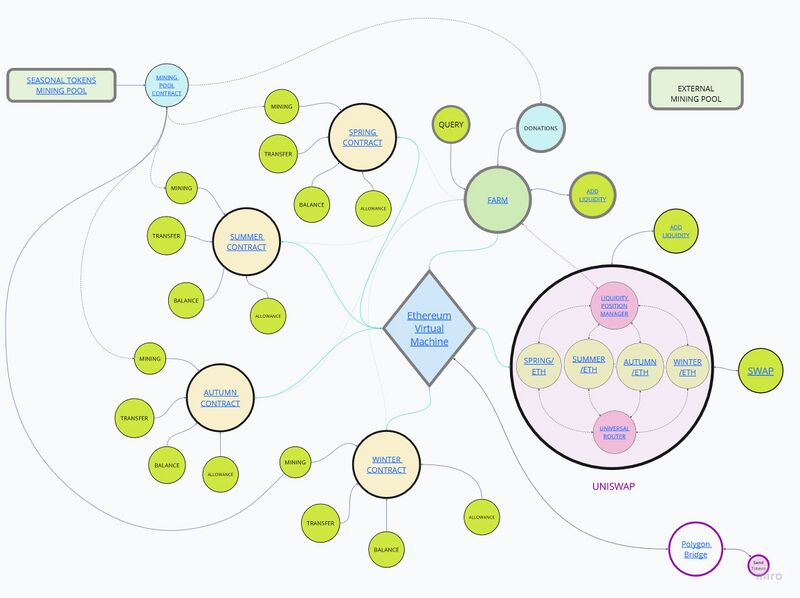

Seasonal Tokens Ecosystem

Overview of the system.

Ways of making profits in the system:

- Mining

- Farming

- Trading

- Arbitrage

- Participating in the promotion of the project.