Brochure

Brochure

Seasonal Tokens an Ethical & Non-Speculative Wealth Creation system

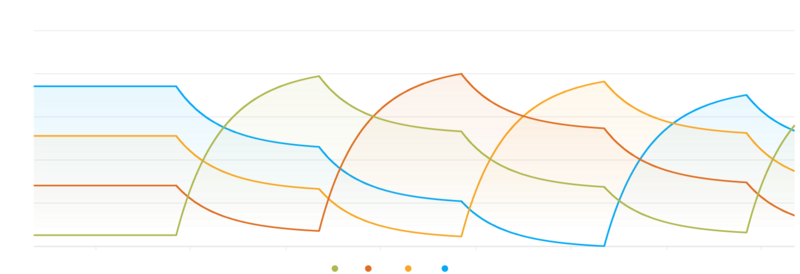

Seasonal Tokens can be described as an ethical and non-speculative tool for building wealth in the form of digital assets (tokens). There are four trustless, decentralized tokens, mined using Proof-of-Work. Spring, Summer, Autumn and Winter. They’ve been designed so that their prices will cycle around each other over the course of years, allowing users to gain more tokens over time by trading the more expensive tokens for the cheaper ones.

The following picture illustrates the concept: If you start with a number of Winter tokens you can trade them for a larger number of Spring tokens, then wait for Spring to become the most expensive token. Then you can trade it for a larger number of Summer tokens. When Summer becomes the most expensive tokens you can trade it for a larger number of Autumn tokens and so on.

By following the rule: always trade tokens for more tokens of a different type, a trader can guarantee that the total number of tokens owned will increase with every trade. This makes it possible to accumulate tokens over time without risking a loss measured in tokens.

They do not eliminate the risk of making a loss measured in dollars or any other government backed fiat currencies, as the dollar prices of cryptocurrencies are subject to overall market cycles. But they allow the user to accumulate tokens over time by trading, even during bear markets, waiting for a favorable situation in the cryptocurrency markets to make profits. You can keep your earned tokens in any form: Stable coins, wrapped bitcoin, etc.

Let us explain how this works, and in the last section we will show you how to use Seasonal Tokens to get Bitcoin.

BTC halving

Key observation in crypto: BTC halving introduces seasonality

A key observation in cryptocurrency is that the Bitcoin halving of mining supply every 210.000 blocks has introduced a periodic behavior in cryptocurrency markets.

The following chart shows the historical Bitcoin's price. The blue vertical lines mark the dates when the mining supply of bitcoin was cut in half.

(The following info will go in the graph itself --Infographic style)

| date | Reward change in BTC |

|---|---|

| 11/28/2012 | 50 to 25 |

| 07/09/2016 | 25 to 12.5 |

| 05/11/2020 | 12.5 to 6.25 |

| 04/19/2024 | 6.25 to 3.125 |

As you can appreciate, there is nothing particularly enlightening about this graph. It is hard to see the effect of the halving of the mining supply. The price changes are so large that the information is lost in the details of price fluctuations.

Analysis of the Log(Price) chart. Bull and Bear markets.

If we look at the graph on a logarithmic scale, we can concentrate on the order of magnitude changes, paying less attention to the random fluctuations in the price. Then a pattern emerges:

Every 4 years on average, the mining supply is cut in half. Months after the halving of the mining supply a bull market sends the Bitcoin price to all-time highs, this bull market sends the price way above its cost of production and the whole thing ends up with a price bubble leading to a bear market that may last more than a year until the next halving occurs.

As the Bitcoin price skyrockets, people starts looking for alternative investments leading to the so called "Altcoin Season", where other major cryptocurrencies experiment a rise in price due to the Bitcoin bull market.

Comment on Bull / Bear markets

The following information will go with the graph:

| date | BTC Price $ | Days after halving to Market Peak | Percent Gain | Days after peak to Market Bottom | Percent Loss |

|---|---|---|---|---|---|

| 11/28/2012 | 13 | 335d | 7323% | 638d | 80% |

| 07/09/2016 | 593 | 518d | 2190% | 396d | 76% |

| 05/11/2020 | 9265 | 518d | 557% | 426d | 74% |

| 04/19/2024 | 70000 | ? | ? | ? | ? |

QR with live chart for technical analysis

QR with link to live BTC chart

What Problem is Seasonal Tokens designed to Solve?

In the long term there is no problem. Bitcoin is the best investment of all times. But in the short and mid terms some problems arise.

- For miners: When the halving takes place, the cost of producing Bitcoin doubles overnight. This leaves many miners out of business.

- For Investors: After the bull market reaches it's peak, a bear market follows and typically lasts more than a year. During this time Bitcoin loses about 80% of the value at the peak leaving many investors on a bad situation.

- For Traders: If you have bitcoins, and you want more, you have to gamble. You have to sell the bitcoins when you think the price is going to go down, and then buy more bitcoins after the price has fallen. The price could go up instead of down. You could end up with fewer bitcoins.

The ideal situation would be if there were other cryptocurrencies whose prices are rising while Bitcoin's price is falling.

Imagine if there were other cryptocurrencies like Bitcoin, but their mining supply is not reduced at the same time, but arranged so that their bull markets happen in successive way.

When the first crypto reaches an all time high on it's price you could trade it for the crypto whose mining supply will be cut in half next.

Then when the second crypto experiences a bull market, you could trade it for another crypto whose mining supply is going to be reduced next, producing a bull market and so on.

The problem is that the price of other major cryptocurrencies is highly correlated to Bitcoin's price, and when Bitcoin price falls, it brings all the markets with it.

Solution

Creating another blockchain comparable to Bitcoin but with a different halving schedule is practically impossible due to the amount of resources needed, both in hardware, energy consumption, and widespread adoption.

But thanks to Ethereum it is not necessary. The ERC20 technology allows the creation of digital assets with the economic principles embedded in Bitcoin's design, but they don't need their own blockchain. Decentralization and Security are handled by the Ethereum network.

The Seasonal Tokens System

Designed for Investment

- BTC was designed to be money.

- Ethereum is a Decentralized Virtual Computer

- Seasonal Tokens is designed for investment.

The Seasonal Tokens system is an investment instrument to mitigate risk, allowing miners, farmers and traders to participate in the creation of the asset, sharing the risks and profits.

Inspired on Bitcoin

- Issued by Proof of Work to ensure a fair initial distribution of the assets.

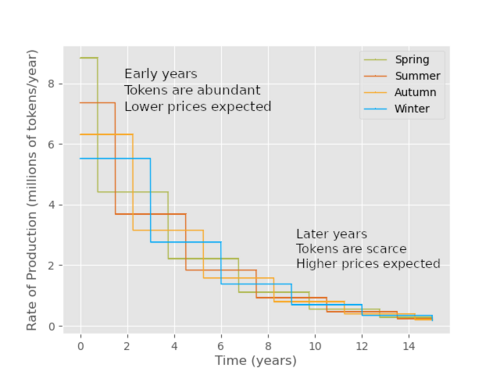

- Decreasing rate of production for a limited supply. About 37 million tokens of each type will be produced in total.

- Scheduled Halvings of mining supply.

- No governance, once deployed the tokens are only subject to supply and demand.

- No ICO, all investors are on equal footing.

- No Fund rising. All expenses have been paid for. No one is owed anything.

Implemented on Ethereum

Token technical data:

Innovation

The key feature of Seasonal Tokens is that the rates of production have been arranged in time in such a way that every nine months the mining supply of the cheapest token is cut in half.

Scheduled halvings cause oscillations in relative price of the tokens. These predictable price oscillations can be used by traders to increase the total number of tokens they have.

Technical Differences with Bitcoin

- Once the code was deployed it can't be changed. Bitcoin code is maintained by the Bitcoin foundation.

- Tokens don't need their own blockchain

- Halvings of mining supply scheduled in time, not in block numbers.

Proof of Concept

- The Relative price chart

- Halvings

- Comments

- QR to proof of concept video

- QR to relative price chart explained

What is the Utility?

The utility of Seasonal Tokens is to generate wealth. The ecosystem promotes the interaction of miners, farmers, traders to cooperate in the production of the digital asset, reducing the risks associated.

why don't add more utility?

Water diamond paradox. Ethereum loosing market to other chains. (leads to Polygon section)

Operating on Polygon

- Cost of creation is good for establishing a price

- Operation in ETH is very expensive

- Polygon network solves the problem

- new Opportunities of profit arise from arbitrage

DYOR QR to Article with links

Don't Trust, verify!!

Technical data sheet, with QR code to live data page

Seasonal Tokens Ecosystem

Overview of the system.

Ways of making profits in the system:

- Mining

- Farming

- Trading

- Arbitrage

- Participating in the promotion of the project.

How to Use Seasonal Tokens to get Bitcoin

Example use case like in the article.

QR to explainer video