Brochure 3

Brochure Covers

Seasonal Tokens an Ethical & Non-Speculative Wealth Creation system

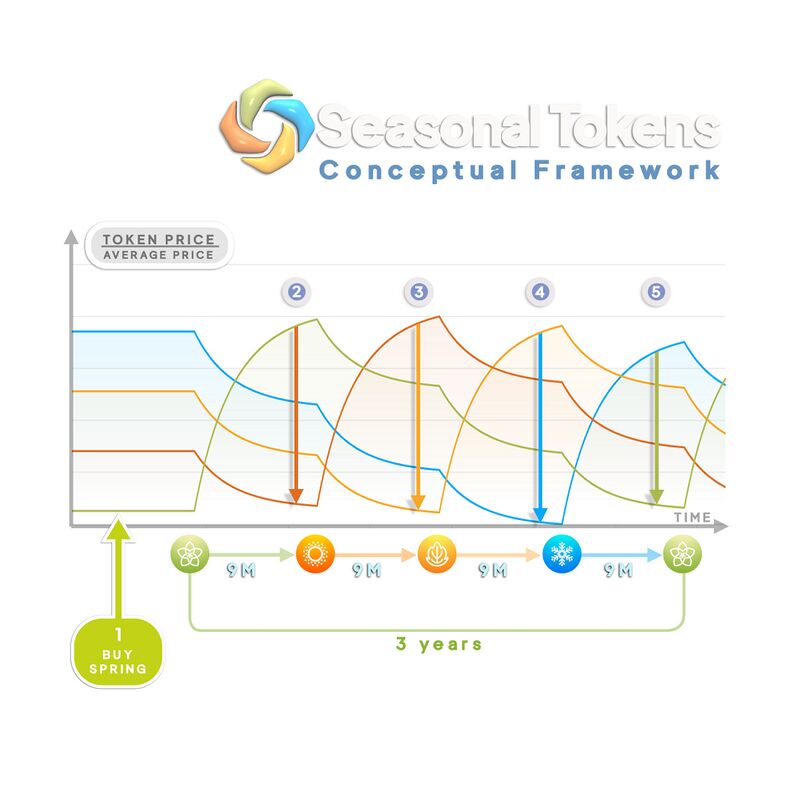

Conceptual Framework

The following picture illustrates the concept:

1) Buy Spring, and wait for it to become the most expensive of the four tokens.

2) Trade Spring for a larger number of Summer tokens. And wait for Summer to become the most expensive token.

3) Trade Summer for a larger number of Autumn tokens. And wait for Autumn to become the most expensive.

4) Trade Autumn for a larger number of Winter tokens. And when Winter becomes the most expensive token:

5) Trade Winter for Spring.

At this point you would have more Spring than if you only buy and hold the tokens. Regardless of the dollar prices of the tokens, having more Spring is better.

The Seasonal Tokens system outperforms the simple buy and hold strategy.

Let us explain how this works, and in the last section we will show you how to use Seasonal Tokens to get Bitcoin.

Risk

By following the rule: always trade tokens for more tokens of a different type, a trader can guarantee that the total number of tokens owned will increase with every trade. This makes it possible to accumulate tokens over time without risking a loss measured in tokens.

They do not eliminate the risk of making a loss measured in dollars or any other government backed fiat currencies, as the dollar prices of cryptocurrencies are subject to overall market cycles. But they allow the user to accumulate tokens over time by trading, even during bear markets, waiting for a favorable situation in the cryptocurrency markets to make profits. You can keep your earned tokens in any form: Stable coins, wrapped bitcoin, etc.

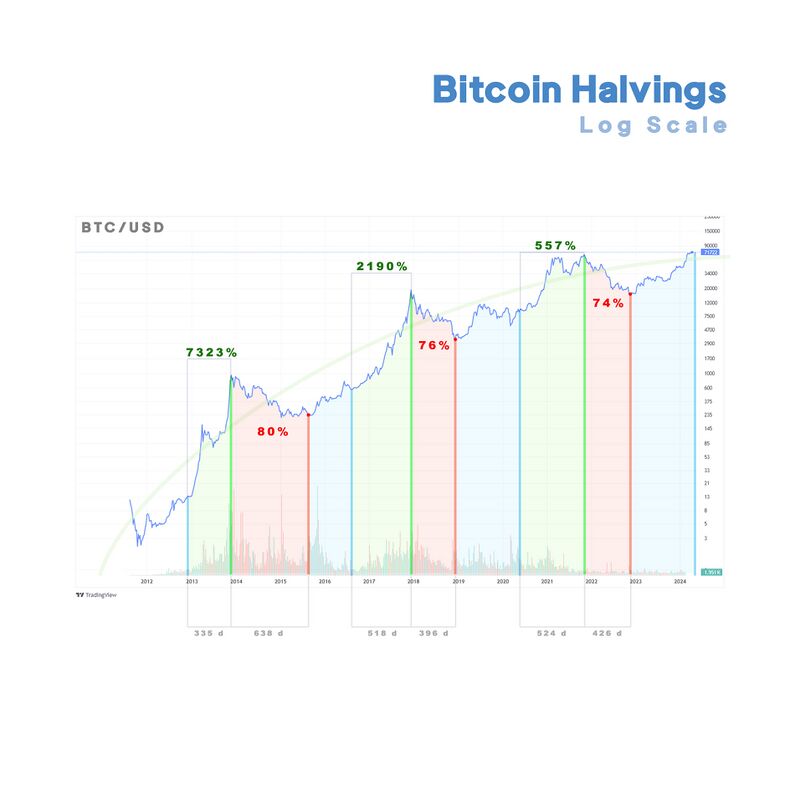

Bitcoin Halving

A key observation in cryptocurrency is that the Bitcoin halving of mining supply every 210.000 blocks has introduced a periodic behavior in cryptocurrency markets.

The following chart shows the historical Bitcoin's price. The blue vertical lines mark the dates when the mining supply of bitcoin was cut in half.

It is hard to see the effect of the halving of the mining supply. The price changes are so large that the information is lost in the details of price fluctuations. But if we look at the graph on a logarithmic scale, then a pattern emerges...

Bitcoin Halvings Log Scale

If we look at the price data on a logarithmic scale, we can concentrate on the order of magnitude changes paying less attention to the random fluctuations in the price.

Every 4 years on average, the mining supply is cut in half. Months after the halving of the mining supply a bull market sends the Bitcoin price to all-time highs, this bull market sends the price way above its cost of production and the whole thing ends up with a price bubble leading to a bear market that may last more than a year until the next halving occurs.

As the Bitcoin price skyrockets, people starts looking for alternative investments leading to the so called "Altcoin Season", where other major cryptocurrencies experiment a rise in price due to the Bitcoin bull market.

QR with link to live BTC chart

What Problems are Seasonal Tokens Designed to Solve?

In the long term there is no problem. Bitcoin is the best investment of all times. But in the short and mid terms some problems arise. The ideal situation would be if there were other cryptocurrencies whose prices are rising while Bitcoin's price is falling.

Imagine if there were other cryptocurrencies like Bitcoin, but their mining supply is not reduced at the same time, but arranged so that their bull markets happen in successive way. When the first crypto reaches an all time high on it's price you could trade it for the crypto whose mining supply will be cut in half next.

Then when the second crypto experiences a bull market, you could trade it for another crypto whose mining supply is going to be reduced next, producing a bull market and so on.

The problem is that the price of other major cryptocurrencies is highly correlated to Bitcoin's price, and when Bitcoin price falls, it brings all the markets with it.

Innovation

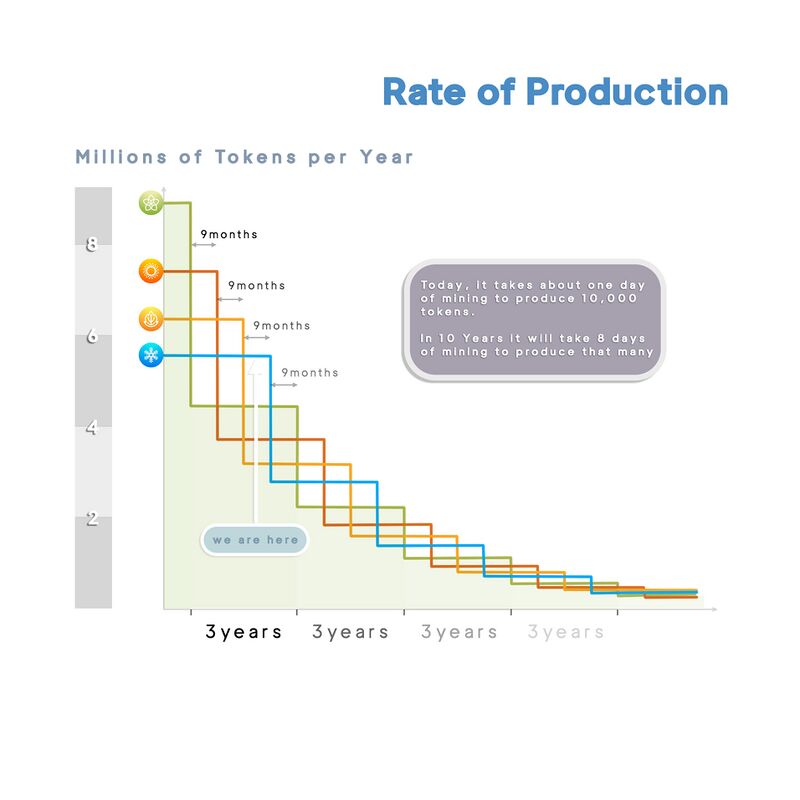

The key feature of Seasonal Tokens is that the rates of production have been arranged in time in such a way that every nine months the mining supply of the cheapest token is cut in half.

Scheduled halvings cause oscillations in relative price of the tokens. These predictable price oscillations can be used by traders to increase the total number of tokens they have.

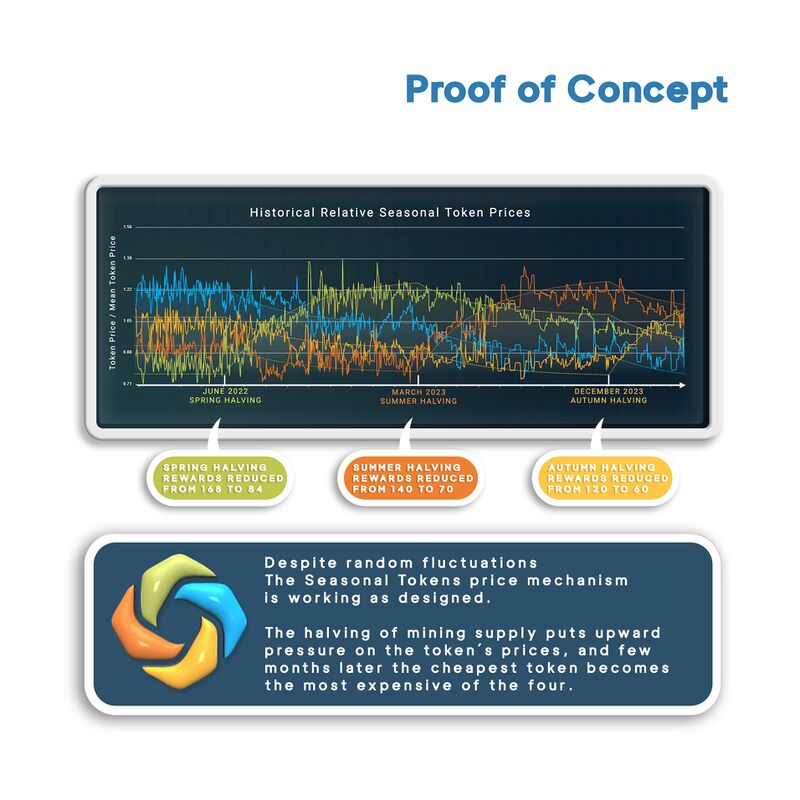

Proof of Concept

The next chart shows the historical relative prices of the four tokens. Notice that despite random fluctuations the real prices fluctuate around a well-defined pattern. (Dotted lines in the chart)

In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens.

In March 2023 the rate of supply of Summer tokens was cut in half, and few months later Summer became the most expensive of the four tokens.

In December 2023 the rate of supply of Autumn tokens was cut in half, and you can see that its price is rising relative to the other tokens.

Not only this proves that the Seasonal Tokens system is working as designed, but it is also a technological accomplishment because it proves that mining supply does affect the price.

It is hard to see this periodical signal in other proof of work cryptocurrencies because the fluctuations in the dollar prices blur the effects of the halving of mining supply.

By focusing on the relative prices of the four tokens, the effects of fluctuations in the dollar prices are factored out.

QR to Relative Price Chart video

Designed for Investment

Creating another blockchain comparable to Bitcoin but with a different halving schedule is practically impossible due to the amount of resources needed, both in hardware, energy consumption, and widespread adoption.

But thanks to Ethereum it is not necessary. The ERC20 technology allows the creation of digital assets with the economic principles embedded in Bitcoin's design, but they don't need their own blockchain. Decentralization and Security are handled by the Ethereum network.

- BTC was designed to be money.

- Ethereum is a Decentralized Virtual Computer

- Seasonal Tokens is designed for investment.

The Seasonal Tokens system is an investment instrument to mitigate risk, allowing miners, farmers and traders to participate in the creation of the asset, sharing the risks and profits.

Inspired on Bitcoin

- Issued by Proof of Work to ensure a fair initial distribution of the assets.

- Decreasing rate of production for a limited supply. About 37 million tokens of each type will be produced in total.

- Scheduled Halvings of mining supply.

- No governance, once deployed the tokens are only subject to supply and demand.

- No ICO, all investors are on equal footing.

- No Fund rising. All expenses have been paid for. No one is owed anything.

Implemented on Ethereum

- Four ERC-20 Tokens.

- Proof of Work mined on the Ethereum network.

- Maximum Supply: 37 million tokens of each type.

- Halving of Mining Supply every 3 years. (Scheduled in time, not number of blocks)

There were no pre-mining or initial coin offerings.

The four tokens smart contracts are independent (don’t interact with each other), and identical except by two things: The initial rate of supply and the halving schedule, arranged in time so that every nine months the fastest token to produce becomes the slowest to produce.

The smart contracts have been audited by three independent entities. Check out the smart contracts, audits, markets and other relevant technical data here:

Operating on Polygon

Seasonal Tokens are mined on the Ethereum network. The cost of electricity, equipment and gas fees establish a connection to the real world economy giving the tokens a basic cost of production. However the operation in the Ethereum blockchain is very expensive. For this reason the Polygon bridge was implemented so that trading can be done at a minimal cost.

This opens up new opportunities to profit when the token prices on the Ethereum and Polygon networks are different.

How to Use Seasonal Tokens to get Bitcoin

Trade Tokens for More Tokens

Let’s suppose that we’ve bought 51 MATIC (worth about $60) from an exchange, and swapped 50 MATIC for 10,000 Autumn tokens. The next step is to trade those Autumn tokens for more tokens of a different type. The exchange rates between the tokens change over time as the prices cycle around each other. You can check the exchange rates by going to seasonaltokens.org/trade and looking in the Trade Tokens for More Tokens section.

In order to get as many bitcoins as possible, we need to make a trade that gives us significantly more tokens than we started with. We want an exchange rate that’s around 1.1 or higher. A rate of 1.05 would give us just a 5% increase in the total number of tokens, so if the rates are all close to 1, then it’s better to wait and do the trade later, when the rates are better.

Let’s suppose that we have an opportunity to swap Autumn tokens for Summer at an exchange rate of 1.1. We can go ahead with that swap inside MetaMask, and afterwards, we’ll have approximately 11,000 Summer tokens.

Swap the Excess Tokens for Wrapped Bitcoin

With 11,000 Summer tokens, we have 1,000 more Seasonal Tokens than we started with, but we want to use the tokens to get bitcoins, not more tokens. So we can swap 1,000 Summer tokens for Wrapped Bitcoin inside MetaMask. This will give us about $5 in Wrapped Bitcoin.

So we started with 10,000 Seasonal Tokens and no bitcoins, and now we have 10,000 Seasonal Tokens and about $5 worth of bitcoin.

Repeat

When the Summer/Spring exchange rate looks good, we can repeat the process. Let’s suppose that, after a bit of waiting, the Summer/Spring rate is 1.1, and we can swap the 10,000 Summer tokens for 11,000 Spring tokens.

After that, we can swap 1,000 Spring tokens for Wrapped Bitcoin, and we’ll get a little less than $5 worth of Wrapped Bitcoin, and our wallet will then contain 10,000 Spring tokens and around $10 worth of Wrapped Bitcoin.

Then we can do the same thing again when the exchange rate is favorable. If the Spring/Winter rate is 1.1, we can swap the 10,000 Spring tokens for 11,000 Winter tokens, and then swap 1,000 Winter tokens for Wrapped Bitcoin.

By following this procedure, we’ll always have 10,000 Seasonal Tokens in the wallet, and the Wrapped Bitcoin balance will increase with every trade, providing an ongoing income in bitcoins.

QR to Use Seasonal Tokens to get BTC video

Left Over:

Trading Simulator

The Seasonal Tokens Trading Simulator allows users to practice trading tokens for more tokens over time as the prices cycle around each other, without putting any real money at risk. Use the simulator to see how many tokens you can acquire over the course of ten years by trading tokens for more tokens, as the prices cycle around each other.

- QR with link to the trading simulator

- QR with link to explainer video

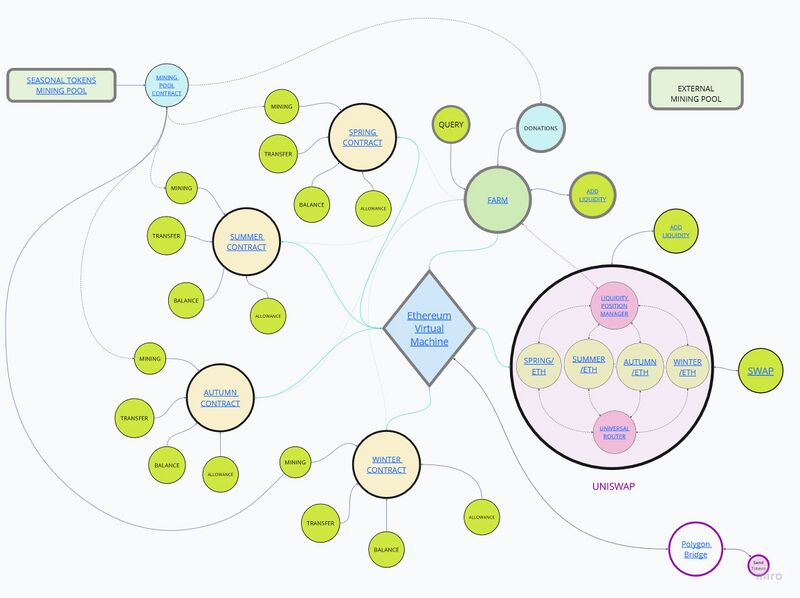

Seasonal Tokens Ecosystem

Overview of the system.

Ways of making profits in the system:

- Mining

- Farming

- Trading

- Arbitrage

- Participating in the promotion of the project.