Farming

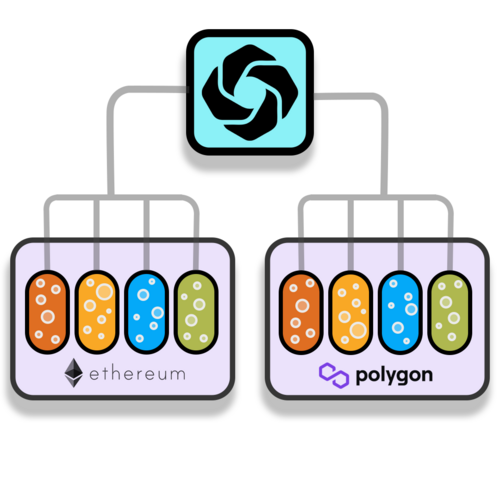

- Nine percent of all Seasonal Tokens mined are donated to the Farms.

- There are two farms, one in Ethereum network and another in Polygon network, Each farm receives 4.5% of all mined tokens.

- The 4.5% is then distributed among the four Liquidity Pools, but not in the same proportion. It is arranged in such a way that it complements the Mining supply, see Farming Rewards section below.

- Finally, farmers receive rewards in proportion to the percentage of liquidity they have on each farm.

Which Token is the Most Profitable to Farm? (UPDATED JAN 22 2024)

Use the annual Percent Return on Investment as an indicator of which of the farms is the most profitable at the time of the update. Not as an indicator of future profits.

The numbers will vary if:

- The number of tokens in the liquidity pools changes. (This happens when a farmer adds or retires liquidity from the farm)

- The Fraction of Farming Rewards given to each pool changes. (This happens every 9 months and correlates with mining supply)

Since the yearly ROI is a percent of the total Matic/ETH invested, it is not dependent on the dollar price of Matic or Ether. In other words: This ROI is given on Matic or ETH, and it is not calculated as a return in dollars.

For example, if you invested 10 Matic in the Polygon Spring Liquidity Pool, and the annual ROI is 40%, it means that in one year your 10 Matic will turn into 14 Matic.

Warning: Use this ROI only to decide which token is more profitable to farm at the given date of the update. It is not guaranteed that you will get this return on investment over a year, because the numbers vary with the above mentioned factors.

Polygon Farm

| Spring | Summer | Autumn | Winter |

|---|---|---|---|

| 40.7% | 63.9% | 22.7% | 38% |

Ethereum Farm

| Spring | Summer | Autumn | Winter |

|---|---|---|---|

| 9.63% | 15.29% | 8.86% | 11.11% |

How to create a liquidity position and deposit it into the farm: Farming Tutorial on Reddit

Adding a liquidity position in the farm is far more expensive in the Ethereum network than in Polygon.

ROI Calculation Explained

In the next section, we will dive into the details of how to compute the above ROI.

Example:

If you have a Spring Liquidity Position in the Polygon farm, you will receive rewards in the four tokens.

The amount of Spring per day received by the Spring Liquidity Pool is:

144 rewards per day (on average) times the number of Spring tokens on each reward (you can see this on the Mining Page)*(4.5/100)*(0.27)

Where 0.27 is the farming rewards given by the table below.

And finally, to obtain your share of Spring tokens you have to multiply the above result by the fraction of liquidity you provided. You can obtain this number by dividing the amount of Matic in your Liquidity Position, divided by the total amount of Matic in the Liquidity Pool.

To obtain all rewards you have to add the Summer, Autumn, and Winter rewards calculated similarly.

Farming Rewards Correlate with Mining Supply

The 9% donation to the farm is distributed among the 4 liquidity pools in such a way that complements the changes in mining supply, adding a rotating demand that acts together with the mining supply to produce the oscillations in the relative price of the tokens.

Four months after the mining supply of a token is cut in half, the farming reward for that token is increased, creating a combination of reduced supply and increased demand helping the price oscillations.

Number of Tokens per Reward

Every ten minutes on average a miner finds a solution to the proof of work challenge and receives a reward in tokens. There are 144 rewards per day.

| Month | Year | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|---|

| September | 2021 | 168 | 140 | 120 | 105 |

| June | 2022 | 84 | 140 | 120 | 105 |

| March | 2023 | 84 | 70 | 120 | 105 |

| December | 2023 | 84 | 70 | 60 | 105 |

| September | 2024 | 84 | 70 | 60 | 52.5 |

Farming Rewards

Nine percent of the tokens mined are donated to the farms.

For example, in June 2022 the mining supply of Spring was cut in half, four months later, on October 2022 the farming rewards changed and Spring received more rewards than the other 3 tokens.

In March 2023 the Summer mining supply was cut in half, four months later, in July 2023 the farming rewards changed and Summer receives more rewards than the other 3 tokens. In December 2023 Autumn mining supply is cut in half, and on April 2024 the farming rewards will give Autumn the larger fraction of rewards.

| Month | Year | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|---|

| Initially | 2021 | 0.19 | 0.23 | 0.27 | 0.31 |

| October | 2022 | 0.32 | 0.19 | 0.23 | 0.26 |

| July | 2023 | 0.27 | 0.32 | 0.19 | 0.22 |

| April | 2024 | 0.23 | 0.27 | 0.32 | 0.18 |

| January | 2025 | 0.19 | 0.23 | 0.27 | 0.31 |

Profitability of Farming

Number of Tokens donated to the Farm

Each farm receives 4.5% of the mined tokens, therefore the number of tokens donated every day is:

(144 rewards per day)*(Number of tokens per reward)*(4.5/100)

For example, at the time of this writing the number of Spring Tokens per reward is 84, therefore the number of tokens donated per day to each farm is: 544.32 Spring

Token distribution among the four Liquidity Pools

Those 544.32 Spring tokens are distributed among the four liquidity pools in the proportion given by the Farming Rewards (Fraction) table above. At the time of this writing the fraction of tokens distributed to each Liquidity Pool is: (0.27,0.32,0.19,0.22) for Spring, Summer, Autumn and Winter Liquidity Pools respectively.

Therefore the 544.32 Spring tokens will be distributed in this way:

146.97 tokens to the Spring liquidity pool. 174.18 tokens to the Summer liquidity pool. 103.42 tokens to the Autumn liquidity pool. 119.75 tokens to the Winter liquidity pool.

Token distribution among the Liquidity Providers

Finally the last factor in the calculation of the token rewards is the fraction of the tokens each liquidity provider receives. The tokens are distributed according to the fraction of liquidity provided. A person holding 10% of the liquidity will receive 10% of the rewarded tokens.

We can calculate the amount of tokens received per ETH or Matic invested. Let's suppose we are talking about a Spring Liquidity position in the Polygon Farm, then in order to know how many Spring tokens you receive per Matic invested you have to multiply by 1/Total Matic in the Spring Liquidity Pool:

146.97*(1/2597.18)= 0.0566 Spring tokens per Matic invested in the Spring Liquidity pool every day.

One Matic invested in the Spring liquidity pool receives also Summer, Autumn, and Winter. So to calculate the total rewards per matic per day we have to add the other rewards.