Pitch Deck

Designed for Investment.

- Bitcoin was designed to be money.

- Ethereum was designed to be a public computer.

- Seasonal Tokens were designed to be an investment.

Similarities with Bitcoin

- Proof-of-work mining

- Decreasing rates of production

- Regular halvings

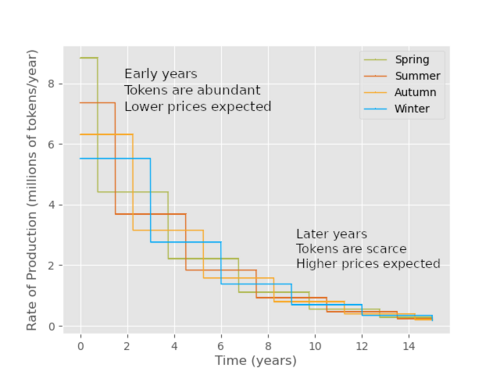

Once every nine months, the rate of production of one of the tokens is cut in half. The token that was produced at the fastest rate becomes the slowest.

In 10 years, the tokens will be produced at about 10% of their current rate. In 20 years, they’ll be produced at about 1% of their current rate.

If demand stays constant (dollars invested per day), the prices will rise as the supply decreases.

Innovation

The changes in the rates of production cause the token prices to cycle around each other.

In June 2022, the rate of production of Spring tokens was halved. Over the following months, Spring went from being the cheapest token to the most expensive. In March 2023, the Summer halving took place. Since then, Summer has gone from the cheapest token to the most expensive.