Autumn Halving: Difference between revisions

No edit summary |

|||

| Line 57: | Line 57: | ||

[[File:StDollarPricesZoom.png|600px]] | [[File:StDollarPricesZoom.png|600px]] | ||

In this zoomed out graph you can see that after September 2023 the tokens prices begin to recover. This is due to the introduction of a new technology to solve the problem of price slippage that was preventing people from investing relatively larger sums of money. Let us finish this discussion about the Autumn halving by recapitulating the first two years of operation, and the future developments of the system. | |||

=Seasonal Tokens Ecosystem= | =Seasonal Tokens Ecosystem= | ||

p | |||

Revision as of 00:51, 26 October 2023

Autumn Halving Facts

- On December 05 2023 the mining supply of Autumn tokens is cut in half.

- Instead of 120 tokens every ten minutes, only 60 Autumn tokens will be produced every ten minutes.

- This effectively doubles the cost of production of Autumn tokens.

- As a result, mining Autumn tokens will become unprofitable overnight.

- This puts upward pressure on the price of Autumn tokens relative to the other 3.

What do We Expect After the Halving?

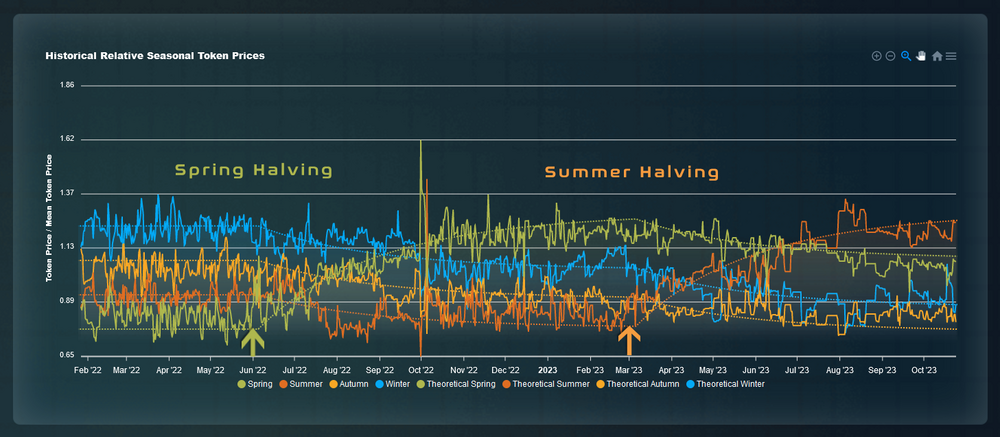

The halving of mining supply has happened already twice in seasonal tokens. On June 2022 the mining supply of Spring tokens was cut in half. Spring was the cheapest token of the four, and few months later it was the most expensive of the four. Similarly, on March 2023 the mining supply of Summer tokens was reduced from 140 to only 70 Summer tokens every ten minutes. Summer was the cheapest token, and few months later it became the most expensive of the four.

Therefore, we expect that few months after the Autumn halving Autumn will go from being the cheapest of the four tokens to be the most expensive.

Bitcoin Economic Design Running on the Ethereum network

Seasonal Tokens design is based on key observations about the way Bitcoin evolved over time. Basically, the mean feature borrowed from Bitcoin's design is the use of proof of work. In Bitcoin, PoW is used in the consensus mechanism for keeping the distributed database. But Proof of Work goes beyond that, it solves many problems at once:

# Self Sufficient, no management involved. # Decentralized, the smart contracts run autonomously on the Ethereum blockchain. # Scarce, there is a finite maximum number of coins. # Fair Initial Distribution of coins.

Proof of Work mining is necessary for Seasonal Tokens design, because it gives a real cost of production for the tokens (together with ETH minting fees). This is what anchors the token's prices to the real economy, and it is the handle that allows the relative token's prices to oscillate around each other. But the decentralization and security is the same as Ethereum's, because Seasonal Tokens are parts of the Ethereum blockchain.

The halving of mining supply every 3 years in Seasonal Tokens (every 4 years in Bitcoin) also is a way to have an absolute maximum number of tokens produced.

The fact that there is a finite number of coins is a necessary condition to make it valuable. Once all the coins are produced these digital assets are not subject to inflation. Nobody can produce them out of thin air de-valuating the asset.

Seasonal Tokens Relative Price Mechanism is Independent of Dollar prices

Seasonal Tokens were launched at the highest point of Bitcoin's bull market, shortly after that the bear market started, and the dollar prices of most altcoins have been falling for over two years at the time of this writing. As the 2024 Bitcoin halving approaches, the Bitcoin and Ethereum markets begin to show some signs of recovery.

The relative price graph shows clearly that the price mechanism is working as designed, but you can see it working in the dollar prices as well. In the following chart, notice how Spring became the most expensive of the four tokens months after the halving of mining supply. And then Summer's price started to rise relative to the other 3 tokens after the Summer halving. (The chart shows the prices in Matic not in dollars)

If we zoom into the last portion of the graph you can see that few months after the halving of Summer mining supply, Summer went from being the cheapest of the four tokens, to be the most expensive of the four.

In this zoomed out graph you can see that after September 2023 the tokens prices begin to recover. This is due to the introduction of a new technology to solve the problem of price slippage that was preventing people from investing relatively larger sums of money. Let us finish this discussion about the Autumn halving by recapitulating the first two years of operation, and the future developments of the system.

Seasonal Tokens Ecosystem

p