Farming: Difference between revisions

| Line 121: | Line 121: | ||

And similarly for the 777 Autumns, and 581 Winters. | And similarly for the 777 Autumns, and 581 Winters. | ||

[[File:Tokens Donated Each Pool Per Day Polygon Farm.png |500px | [[File:Tokens Donated Each Pool Per Day Polygon Farm.png |500px]] | ||

| Line 128: | Line 128: | ||

Invested in the Pool. | Invested in the Pool. | ||

[[File:TokensPerPoolPerDayPerMatic.png |500px | [[File:TokensPerPoolPerDayPerMatic.png |500px]] | ||

| Line 138: | Line 138: | ||

[[File:ProjectedROIperYearPerMatic.png |1000px | [[File:ProjectedROIperYearPerMatic.png |1000px]] | ||

Revision as of 19:03, 20 October 2023

Decentralized exchanges like Uniswap V3 are fundamental parts of the Web3 ecosystem, allowing the exchange of tokens. They work differently from traditional exchanges where people put buy and sell orders that the operators of the exchange match with each other allowing people to buy and sell cryptocurrencies. But decentralized markets must operate automatically without intervention of third parties. This problem has been solved by introducing the concept of Liquidity Pools where users deposit or withdraw cryptocurrencies from a stockpile called liquidity pool.

Users are incentivized to provide liquidity to the decentralized markets by taking a share of the trades made by other users. The more transactions the more rewards you get by providing liquidity to the market.

However, if there are few transactions there is not a lot of incentive to keep your money in the liquidity pool. This is why Seasonal Tokens implemented Liquidity Farms, to provide an extra incentive for Liquidity providers.

Nine percent of all tokens mined by the Seasonal Tokens Mining Pool are donated to the Farms. There are two farms, one in Ethereum network and another in Polygon network. There is one Uniswap V3 in the Ethereum network, and another Uniswap V3 in the Polygon network. Both farms receive 4.5% of all mined tokens.

Investors and miners can receive a regular income of tokens by providing liquidity at Uniswap V3 and then depositing the Uniswap liquidity position into the farm. Farming helps to ensure that there is sufficient liquidity available for trades, and it generates a rotating demand for the tokens that complements the rotating scarcity.

Here is a tutorial on how to create a liquidity position and deposit it into the farm: Farming Tutorial on Reddit

In this page we will dive into the details about how profitable it is to farm the tokens.

Farming Rewards Correlate with Mining Supply

The 9% donation to the farm is distributed among the 4 liquidity pools in such a way that complements the changes in mining supply, adding a rotating demand that acts together with the mining supply to produce the oscillations in the relative price of the tokens.

Four months after the mining supply of a token is cut in half, the farming reward for that token is increased, creating a combination of reduced supply and increased demand helping the price oscillations.

Number of Tokens per Reward

Every ten minutes on average a miner finds a solution to the proof of work challenge and receives a reward in tokens. There are 144 rewards per day.

| Month | Year | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|---|

| September | 2021 | 168 | 140 | 120 | 105 |

| June | 2022 | 84 | 140 | 120 | 105 |

| March | 2023 | 84 | 70 | 120 | 105 |

| December | 2023 | 84 | 70 | 60 | 105 |

| September | 2024 | 84 | 70 | 60 | 52.5 |

Farming Rewards

Nine percent of the tokens mined by the Seasonal Tokens liquidity pool are donated to the farms. Notice that there may be other liquidity pools and solo miners outside the Seasonal Tokens pool. Specially when the token prices make it profitable.

For example, in June 2022 the mining supply of Spring was cut in half, four months later, on October 2022 the farming rewards changed and Spring receives more rewards than the other 3 tokens. In March 2023 the Summer mining supply was cut in half, four months later, on July 2023 the farming rewards changed and Summer receives more rewards than the other 3 tokens. In December 2023 Autumn mining supply is cut in half, and on April 2024 the farming rewards will give Autumn the larger fraction of rewards.

| Month | Year | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|---|

| Initially | 2021 | 0.19 | 0.23 | 0.27 | 0.31 |

| October | 2022 | 0.32 | 0.19 | 0.23 | 0.26 |

| July | 2023 | 0.27 | 0.32 | 0.19 | 0.22 |

| April | 2024 | 0.23 | 0.27 | 0.32 | 0.18 |

| January | 2025 | 0.19 | 0.23 | 0.27 | 0.31 |

Profitability of Farming

Number of Tokens donated to the Farm

Each farm receives 4.5% of the mined tokens, therefore the number of tokens donated every day is:

(144 rewards per day)*(Number of tokens per reward)*(Pool HashRate/Total HashRate)*(4.5/100)

The (Pool HR / Total HR) factor takes into account that only the Seasonal Tokens mining pool donates tokens to the farms. Independent miners do not provide tokens to the farm.

For example, at the time of this writing the number of Spring Tokens per reward is 84, the Spring pool hashrate is 219 GH/s, and the total Spring hashrate is 221 GH/s:

Seasonal Tokens Mining Pool Page

therefore the number of tokens donated per day to each farm is: 539.4 Spring

Token distribution among the four Liquidity Pools

Those 539.4 Spring tokens are distributed among the four liquidity pools in the proportion given by the Farming Rewards (Fraction) table above. At the time of this writing the fraction of tokens distributed to each Liquidity Pool is: (0.27,0.32,0.19,0.22) for Srping, Summer, Autumn and Winter Liquidity Pools respectively.

Therefore the 539.4 Spring tokens will be distributed in this way:

145.64 tokens to the Spring liquidity pool. 172.61 tokens to the Summer liquidity pool. 102.49 tokens to the Autumn liquidity pool. 118.67 tokens to the Winter liquidity pool.

Token distribution among the Liquidity Providers

Finally the last factor in the calculation of the token rewards is the fraction of the tokens each liquidity provider receives. The tokens are distributed according to the fraction of liquidity provided. A person holding 10% of the liquidity will receive 10% of the rewarded tokens.

We can calculate the amount of tokens received per ETH or Matic invested. Let's suppose we are talking about a Spring Liquidity position in the Polygon Farm, then in order to know how many Spring tokens you receive per Matic invested you have to multiply by 1/Total Matic in the Spring Liquidity Pool:

145.64*(1/2597.18)= 0.0561 Spring tokens per Matic invested in the Spring Liquidity pool every day.

One Matic invested in the Spring liquidity pool receives also Summer, Autumn, and Winter. So to calculate the total rewards per matic per day we have to add the other rewards.

Example Calculation October 20 2023

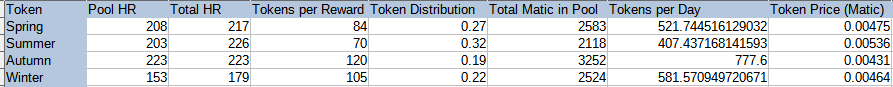

Mining and Farming data. Tokens donated per day to the farms. Token price in Matic.

The next table shows how are the tokens distributed to each pool in the Polygon Farm.

For example, the 521 Spring tokens will be distributed according to the fraction given in the Farming Rewards (Fraction) table above.

27% of the 521 Spring will be given to the Spring Pool, 32% of the 521 Spring will be given to the Summer Pool, 19% of the 521 Spring to the Autumn Pool, and 22% to the Winter Pool.

Then from the 407 Summer donated per day to the farm, 27% will be given to the Spring Pool, 32% to the Summer Pool, 19% to the Autumn Pool and 22% to the Winter Pool.

And similarly for the 777 Autumns, and 581 Winters.

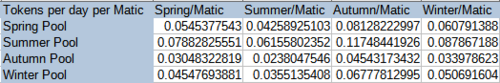

These tokens are given to each Liquidity Pool, but in order to calculate how much every Farmer will get we have to multiply by the fraction of the total liquidity each Farmer is providing.

In order to make an estimate, let us calculate how much rewards per Matic invested a Farmer gets per day. So that to calculate how much you will get per day you have to multiply by the amount of Matic

Invested in the Pool.

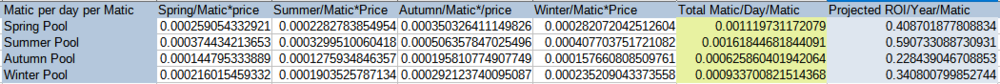

The above table shows how many tokens you get per day per Matic invested. In order to get an idea of how much this represents in more familiar terms,

let us calculate the Return of Investment per year of 1 Matic invested on each pool.

In the table below we multiply the amount of tokens by the price in Matic to obtain how much matic per day you get per Matic invested in each Pool. And finally multiply it by 365 to visualize the ROI per year.