Pitch Deck: Difference between revisions

No edit summary |

No edit summary |

||

| Line 44: | Line 44: | ||

* It is expected that, before September 2024, it will be possible to trade 27 Autumn tokens for about 35 Winter tokens. | * It is expected that, before September 2024, it will be possible to trade 27 Autumn tokens for about 35 Winter tokens. | ||

* By turning 10 Winter tokens into 35 Winter tokens, an investor can make a profit without relying on an increase in the dollar prices of the tokens. | * By turning 10 Winter tokens into 35 Winter tokens, an investor can make a profit without relying on an increase in the dollar prices of the tokens. | ||

=The Main Difference Between Seasonal Tokens and Bitcoin= | |||

* If you have bitcoins, and you want more, you have to gamble. | |||

* You have to sell the bitcoins when you think the price is going to go down, and then buy more bitcoins after the price has fallen. | |||

* The price could go up instead of down. You could end up with fewer bitcoins. | |||

* Investors who hold Seasonal Tokens can gain more tokens over time without gambling. | |||

* They don’t need to speculate about the future when they trade tokens for more tokens. They don’t risk ending up with fewer tokens. | |||

=More Similarities Between Bitcoin and Seasonal Tokens= | |||

* There is no Seasonal Tokens corporation. | |||

* The founders of the project need to buy and mine the tokens to acquire them, like everyone else. | |||

* There was no ICO and no fundraising. The costs of developing the project have been fully covered by the founders. No one is owed anything. | |||

* Nobody is in control of the tokens. There is no governance. | |||

* Every investor is on an equal footing. | |||

=Differences Between Bitcoin and Seasonal Tokens= | |||

* Bitcoin has its own blockchain, peer-to-peer network, wallet software and block explorers. | |||

* Seasonal Tokens run on the Ethereum blockchain as smart contracts, and they do not need any supporting infrastructure or software. | |||

* As ERC-20 tokens, Seasonal Tokens can be stored in existing wallet software, mined using existing mining software, and traded on decentralized exchanges. | |||

* Bitcoin’s software can be upgraded. | |||

* The Seasonal Tokens smart contracts are set in stone and will continue to run in their current form for as long as Ethereum exists. | |||

* Bitcoin needs massive mining power to secure the blockchain. | |||

* Seasonal Tokens can survive indefinitely with only a single miner using a single GPU. | |||

Revision as of 21:52, 2 October 2023

Designed for Investment.

- Bitcoin was designed to be money.

- Ethereum was designed to be a public computer.

- Seasonal Tokens were designed to be an investment.

Similarities with Bitcoin

- Proof-of-work mining

- Decreasing rates of production

- Regular halvings

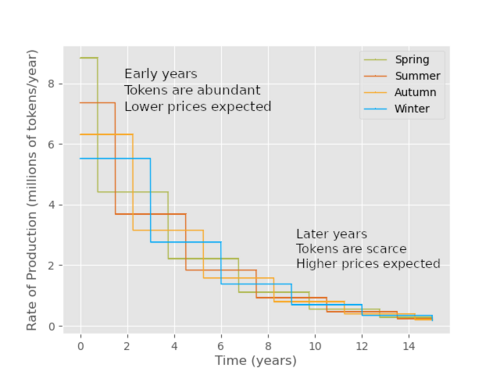

Once every nine months, the rate of production of one of the tokens is cut in half. The token that was produced at the fastest rate becomes the slowest.

In 10 years, the tokens will be produced at about 10% of their current rate. In 20 years, they’ll be produced at about 1% of their current rate.

If demand stays constant (dollars invested per day), the prices will rise as the supply decreases.

Innovation

The changes in the rates of production cause the token prices to cycle around each other.

In June 2022, the rate of production of Spring tokens was halved. Over the following months, Spring went from being the cheapest token to the most expensive. In March 2023, the Summer halving took place. Since then, Summer has gone from the cheapest token to the most expensive.

Trade Tokens for More Tokens

- Investors can trade the more expensive tokens for the cheaper ones, which will become the most expensive later on, allowing the investors to trade again.

- The total number of tokens owned increases with every trade, because the investor always trades tokens for more tokens of a different type.

- This eliminates the risk of making a loss measured in tokens.

- The risk of making a loss measured in dollars cannot be eliminated.

- An investor who turns 10 Spring tokens into 30 Spring tokens by trading will have more wealth than an investor who simply holds the 10 Spring tokens.

- “Trade tokens for more tokens” outperforms the buy-and-hold strategy.

Example

- An investor who started with 10 Winter tokens before June 2022 could have traded them for about 15 Spring tokens.

- Those 15 Spring tokens could have been traded for about 21 Summer tokens before March 2023.

- 21 Summer tokens can be traded for about 27 Autumn tokens today.

- It is expected that, before September 2024, it will be possible to trade 27 Autumn tokens for about 35 Winter tokens.

- By turning 10 Winter tokens into 35 Winter tokens, an investor can make a profit without relying on an increase in the dollar prices of the tokens.

The Main Difference Between Seasonal Tokens and Bitcoin

- If you have bitcoins, and you want more, you have to gamble.

- You have to sell the bitcoins when you think the price is going to go down, and then buy more bitcoins after the price has fallen.

- The price could go up instead of down. You could end up with fewer bitcoins.

- Investors who hold Seasonal Tokens can gain more tokens over time without gambling.

- They don’t need to speculate about the future when they trade tokens for more tokens. They don’t risk ending up with fewer tokens.

More Similarities Between Bitcoin and Seasonal Tokens

- There is no Seasonal Tokens corporation.

- The founders of the project need to buy and mine the tokens to acquire them, like everyone else.

- There was no ICO and no fundraising. The costs of developing the project have been fully covered by the founders. No one is owed anything.

- Nobody is in control of the tokens. There is no governance.

- Every investor is on an equal footing.

Differences Between Bitcoin and Seasonal Tokens

- Bitcoin has its own blockchain, peer-to-peer network, wallet software and block explorers.

- Seasonal Tokens run on the Ethereum blockchain as smart contracts, and they do not need any supporting infrastructure or software.

- As ERC-20 tokens, Seasonal Tokens can be stored in existing wallet software, mined using existing mining software, and traded on decentralized exchanges.

- Bitcoin’s software can be upgraded.

- The Seasonal Tokens smart contracts are set in stone and will continue to run in their current form for as long as Ethereum exists.

- Bitcoin needs massive mining power to secure the blockchain.

- Seasonal Tokens can survive indefinitely with only a single miner using a single GPU.