How to Make Money With Seasonal Tokens: Difference between revisions

No edit summary |

No edit summary |

||

| Line 10: | Line 10: | ||

=Six Ways to Benefit from Seasonal Tokens= | =Six Ways to Benefit from Seasonal Tokens= | ||

= Buy and Hold = | |||

This is the simplest strategy, the idea is to buy tokens and wait for the prices to rise to make profits selling them again. | This is the simplest strategy, the idea is to buy tokens and wait for the prices to rise to make profits selling them again. | ||

| Line 30: | Line 23: | ||

the tokens prices. If the demand of the tokens remains as it is now, the token prices will rise naturally. | the tokens prices. If the demand of the tokens remains as it is now, the token prices will rise naturally. | ||

= Farming = | |||

Providing liquidity to the markets is essential to the Token economics. Decentralized markets like Uniswap reward liquidity providers in proportion to the | Providing liquidity to the markets is essential to the Token economics. Decentralized markets like Uniswap reward liquidity providers in proportion to the | ||

| Line 48: | Line 41: | ||

The donations to the farm are covered by a investment fund and nobody has to pay for it. | The donations to the farm are covered by a investment fund and nobody has to pay for it. | ||

= Mining = | |||

Mining is the core of the Seasonal Tokens ecosystem. The mining supply of tokens is the driving force behind the price oscillations that are the main feature of the system. | Mining is the core of the Seasonal Tokens ecosystem. The mining supply of tokens is the driving force behind the price oscillations that are the main feature of the system. | ||

| Line 57: | Line 50: | ||

At the time of this writing, the token prices are below the cost of production in most countries. And these BlackMiners are dominating the token economics. | At the time of this writing, the token prices are below the cost of production in most countries. And these BlackMiners are dominating the token economics. | ||

= Trading = | |||

= Arbitrage = | |||

= Free Tokens = | |||

Revision as of 00:09, 26 July 2024

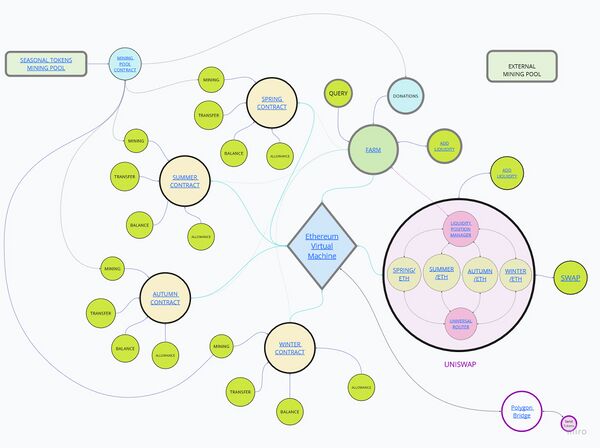

The Seasonal Tokens ecosystem operates autonomously, governed solely by the token's supply and demand. For the system to work, it needs human participation: miners, farmers, traders, and investors. These human actors may join or leave the system at any time, there is no need for coordination among them.

All necessary actions for the system to function are executed by somebody when there is profit to make. The system evolves purely from economic principles in a completely trust-less environment, without the need for governance or management.

Six Ways to Benefit from Seasonal Tokens

Buy and Hold

This is the simplest strategy, the idea is to buy tokens and wait for the prices to rise to make profits selling them again. In general this is a long term strategy since Seasonal Tokens is a very young project and it is still on the inflationary phase. This means that lots of tokens are being produced every day. When these tokens reach the Liquidity Pools in Uniswap they push the prices down. An equal value of Matic should be invested every day to keep the price stable.

This is something natural and it is an opportunity for new investors to enter the world of crypto. Early investors are taking more risk but they are going to catch the largest rewards when the token´s prices rise.

There are only 37 million tokens of each type, and every 3 years the mining supply of tokens is cut in half. This scarcity will put an upward pressure on the tokens prices. If the demand of the tokens remains as it is now, the token prices will rise naturally.

Farming

Providing liquidity to the markets is essential to the Token economics. Decentralized markets like Uniswap reward liquidity providers in proportion to the number of transactions occurring in the market.

For providing liquidity to be economically feasible, the rewards have to overcome the problem of so called "Impermanent Loss". Basically means that a liquidity position loses value, if the token´s prices go down, and also if the price goes up!

This is a mathematical feature of the way the automated market works, and the transaction fees are the way to solve this problem.

However for new projects with a low number of transactions the fees may not be sufficient to counter this loss.

For this reason Seasonal Tokens has a solution in place: Farming.

Basically, a portion of the tokens mined by the Seasonal Tokens mining pool is donated to the four farms. Liquidity providers in Uniswap can deposit their liquidity positions in the farms, and receive additional income from the mining pool.

The donations to the farm are covered by a investment fund and nobody has to pay for it.

Mining

Mining is the core of the Seasonal Tokens ecosystem. The mining supply of tokens is the driving force behind the price oscillations that are the main feature of the system.

The original price of the tokens at the beginning of the project was estimated by the cost of production of the tokens using graphic cards GPU, but after few months of operation the project was discovered by miners using the F1 BlackMiner ASIC designed to mine Ethereum, and these machines can produce tokens at a much lower cost. This, together with the beginning of the worst bear market in Bitcoin history made a big impact on the token prices.

At the time of this writing, the token prices are below the cost of production in most countries. And these BlackMiners are dominating the token economics.