Brochure 3: Difference between revisions

Jump to navigation

Jump to search

(Created page with "=Brochure Covers= 800px =Seasonal Tokens an Ethical & Non-Speculative Wealth Creation system= Seasonal Tokens can be described as an ethical and non-speculative tool for building wealth in the form of digital assets (tokens). There are four trustless, decentralized tokens, mined using Proof-of-Work. Spring, Summer, Autumn and Winter. They’ve been designed so that their prices will cycle around each other over the course of years, all...") |

No edit summary |

||

| (18 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

[[File: | [[File:Spacer white.jpg |800px|left]] | ||

[[File:Cover10.jpg |800px|right]] | |||

[[File:Spacer black.jpg |800px|left]] | |||

[[File:Ethical non Spec.jpg |800px|right]] | |||

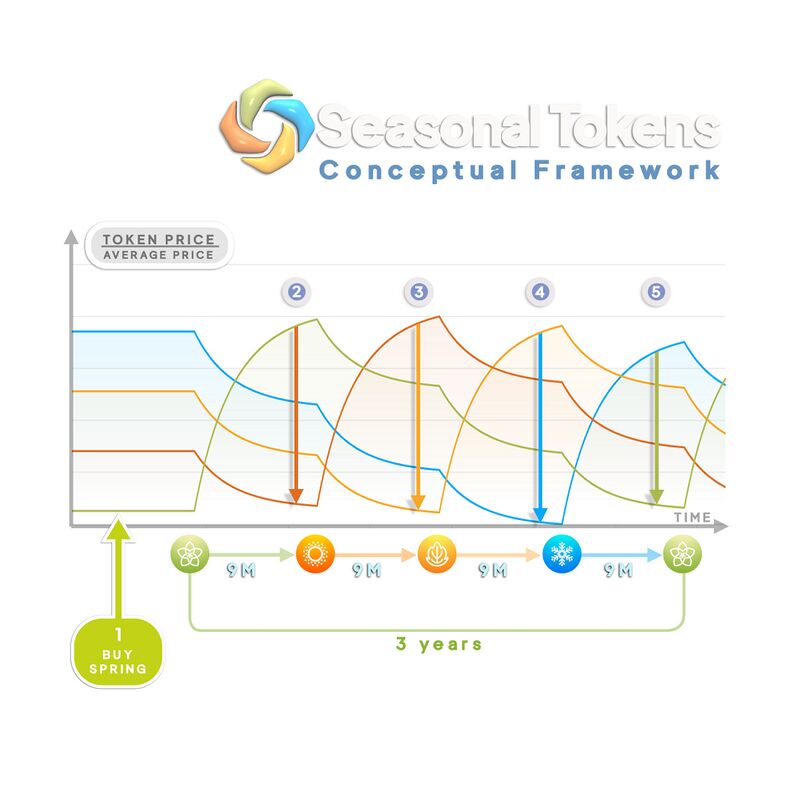

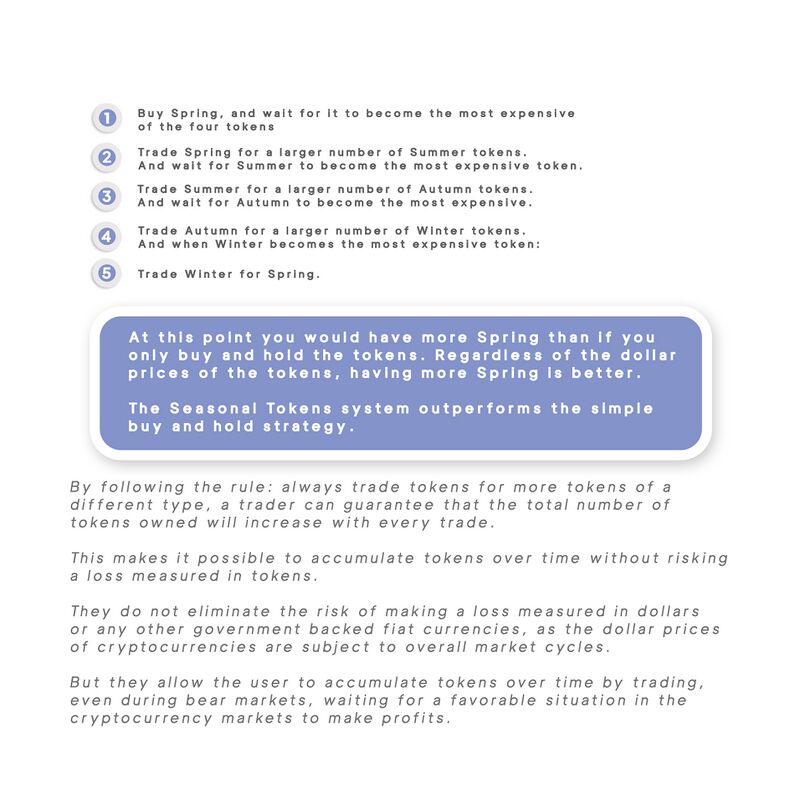

[[File:Conceptual framework.jpg |800px|left]] | |||

[[File:Conceptual Framework 2.jpg |800px|right]] | |||

[[File:Halvings.jpg |800px|left]] | |||

[[File:Halvings 2.jpg |800px|right]] | |||

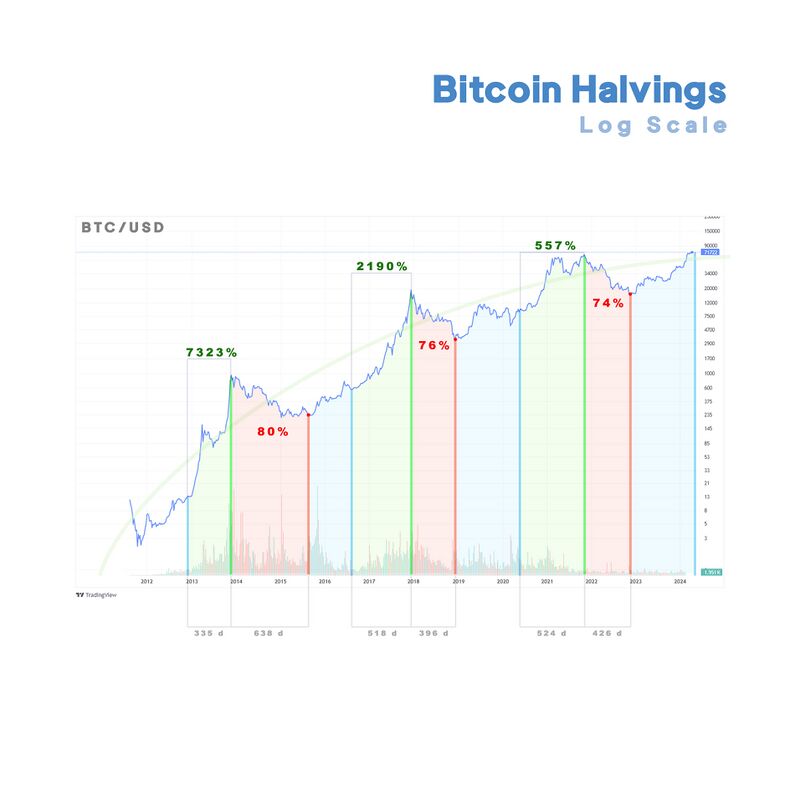

[[File:Halvings Log.jpg |800px|left]] | |||

[[File:Halvings log 2.jpg |800px|right]] | |||

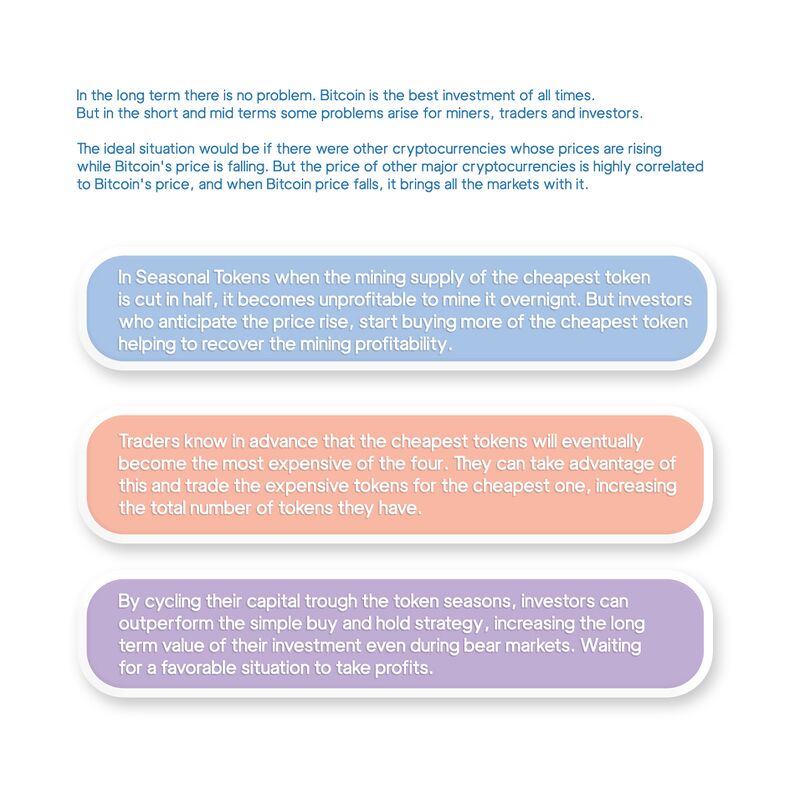

[[File:What problems.jpg |800px |left]] | |||

[[File:What problems 2.jpg |800px |right]] | |||

[[File:Innovation.jpg |800px |left]] | |||

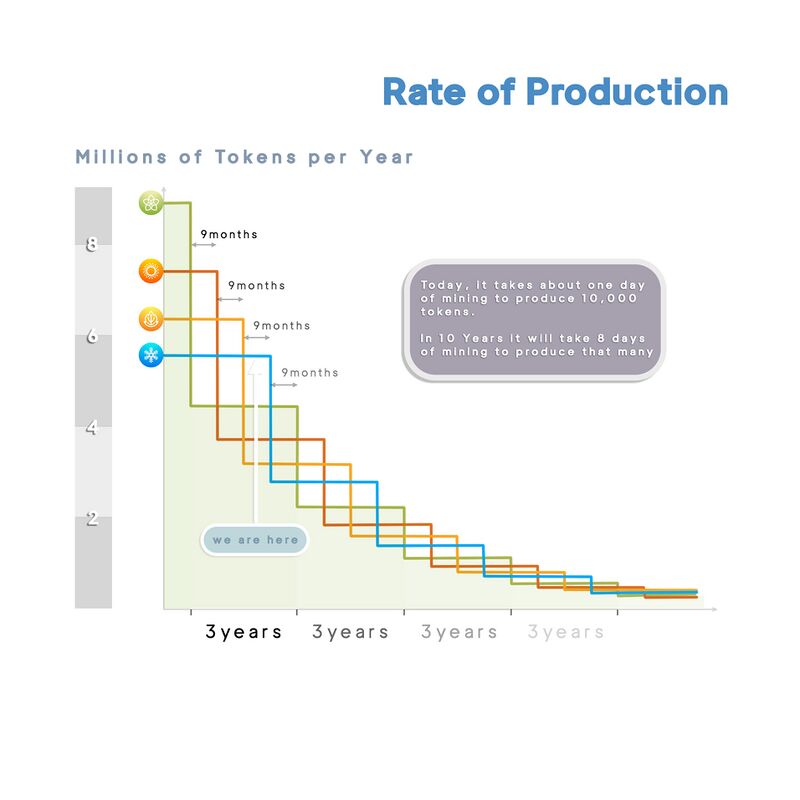

[[File:Rate of Production 2.jpg |800px |right]] | |||

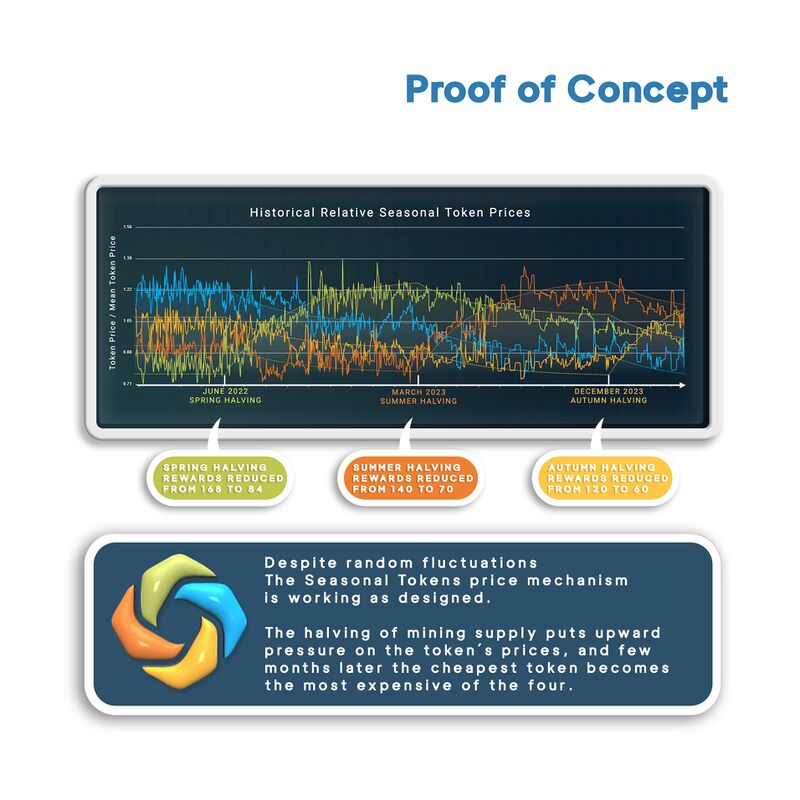

[[File:Proof of Concept.jpg |800px|left]] | |||

[[File:Proof of Concept 2.jpg |800px|right]] | |||

[[File:Inspired on BTC.jpg |800px|left]] | |||

[[File:Inspired on BTC2 .jpg |800px|right]] | |||

[[File:Implemented ETH.jpg |800px |left]] | |||

[[File:Implemented on 2.jpg |800px |right]] | |||

[[File:Designed for Investiment 2.jpg |800px|left]] | |||

[[File:Operating on Polygon 2.jpg |800px|right ]] | |||

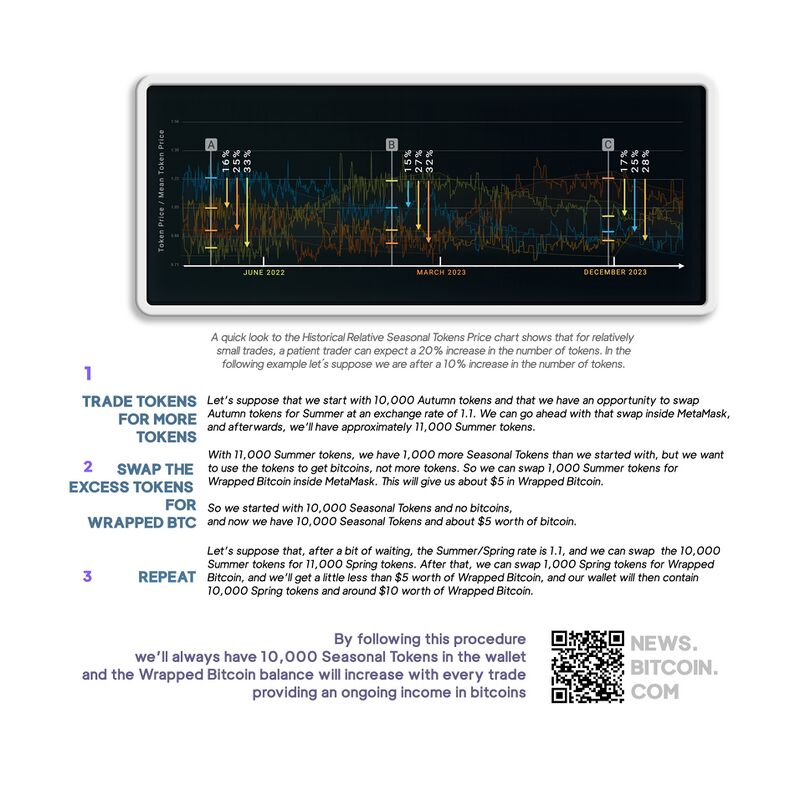

[[File: | [[File:Use ST to BTC.jpg |800px |left]] | ||

[[File:Use ST to BTC 2.jpg |800px |right]] | |||

[[File:Spacer white.jpg |800px|left]] | |||

[[File:Spacer black.jpg |800px|right]] | |||

[[File:Brochure Covers.jpg |800px|left]] | |||

[[File:Spacer white.jpg |800px|right]] | |||

[[File: | |||

[[File: | |||