Farming: Difference between revisions

No edit summary |

No edit summary |

||

| (50 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

=Introduction= | |||

A decentralized market like Uniswap is not operated by humans, it doesn't have buy-and-sell orders like normal markets. Instead, it has Liquidity Pools. | |||

For a token pair of A and B tokens, it has a repository of A and B tokens | |||

The number of A tokens has the same value as the number of B tokens. | |||

For example, the Spring-Matic liquidity pool has a number S of Spring tokens and a number M of Matic. So Spring's price is M/S | |||

Uniswap users are encouraged to provide liquidity by receiving a percentage of all trades done on Uniswap. | |||

But for small projects where there are not many transactions, this percentage may be very small. | |||

This is what happens in Seasonal Tokens. We don't get much income from Uniswap. | |||

That is the reason for creating the farms. Farms will provide extra income to liquidity providers to overcome this problem. | |||

=Seasonal Tokens Farms= | |||

* Nine percent of all Seasonal Tokens mined are donated to the Farms. | * Nine percent of all Seasonal Tokens mined are donated to the Farms. | ||

| Line 11: | Line 25: | ||

=Which Token is the Most Profitable to Farm? (UPDATED | =Which Token is the Most Profitable to Farm? (UPDATED NOVEMBER 2024)= | ||

Use the annual Percent Return on Investment as an indicator of which of the farms is the most profitable at the time of the update. Not as an indicator of future profits. | Use the annual Percent Return on Investment as an indicator of which of the farms is the most profitable at the time of the update. Not as an indicator of future profits. | ||

| Line 33: | Line 47: | ||

|+ Projected Anual Return on Investment in Polygon Farms | |+ Projected Anual Return on Investment in Polygon Farms | ||

|- | |- | ||

! | ! date!! Spring !! Summer !! Autumn !! Winter | ||

|- | |- | ||

| | | 10/10/2024|| 8.60% || 10.89% || 9.44% || 3.81% | ||

|- | |||

| 11/05/2024|| 7.44% || 09.43% || 8.52% || 3.11% | |||

|} | |||

==Ethereum Farm== | ==Ethereum Farm== | ||

| Line 44: | Line 61: | ||

|+ Projected Anual Return on Investment in Ethereum Farms | |+ Projected Anual Return on Investment in Ethereum Farms | ||

|- | |- | ||

! | ! date!! Spring !! Summer !! Autumn !! Winter | ||

|- | |||

| 10/10/2024|| 6.60% || 10.98% || 11.02% || 6.42% | |||

|- | |- | ||

| | | 11/05/2024|| 6.78% || 10.71% || 10.94% || 6.11% | ||

|} | |||

| | ==ROI in Polygon Farm== | ||

As you can see in the table above, farming in Polygon is more profitable than farming in the Ethereum network. This is because there is more liquidity in the Ethereum network. | |||

This opportunity will remain open for early farmers and it will reduce in time as more farming positions are added. | |||

We have created four test liquidity positions in Polygon to observe their Matic value as a percentage of the Matic invested. | |||

You can see that from July 2023 to June 2024 they have increased in Matic value by up to 30% | |||

[[File:Polygonfarmroi.png |1300px]] | |||

Click [http://84.46.244.52:8040/ HERE] for an updated graph. (It may take a while to build up the graph from current data) | |||

How to create a liquidity position and deposit it into the farm: [https://www.reddit.com/r/seasonaltokens/wiki/index/farming/ Farming Tutorial on Reddit] | How to create a liquidity position and deposit it into the farm: [https://www.reddit.com/r/seasonaltokens/wiki/index/farming/ Farming Tutorial on Reddit] | ||

| Line 89: | Line 118: | ||

Therefore, at the time of this writing, there are 144*84 Spring, 144*70 Summer, 144*60 Autumn, and 144*105 Winter mined every day. | Therefore, at the time of this writing, there are 144*84 Spring, 144*70 Summer, 144*60 Autumn, and 144*105 Winter mined every day. | ||

==Fraction of Tokens donated to the Farm== | ==2. Fraction of Tokens donated to the Farm== | ||

Multiply the above number of tokens mined per day by 4.5/100 to obtain the number of tokens of each type donated to the ETH, or Polygon farm. | Multiply the above number of tokens mined per day by 4.5/100 to obtain the number of tokens of each type donated to the ETH, or Polygon farm. | ||

==Distribution of Tokens among the 4 Liquidity Pools== | ==3. Distribution of Tokens among the 4 Liquidity Pools== | ||

To contribute to the relative price oscillations, the farming rewards are organized in such a way that the demand for tokens for farming complements the scarcity produced by the mining supply. | To contribute to the relative price oscillations, the farming rewards are organized in such a way that the demand for tokens for farming complements the scarcity produced by the mining supply. | ||

| Line 124: | Line 153: | ||

[[File:FarmRewardsCROP.png |500px]] | [[File:FarmRewardsCROP.png |500px]] | ||

== | ==4. Token distribution among the Liquidity Providers== | ||

Finally, the last factor in the calculation of the token rewards is the fraction of the tokens each liquidity provider receives. | |||

The tokens are distributed according to the fraction of liquidity provided. A person holding 10% of the liquidity will receive 10% of the rewarded tokens. | |||

You obtain this fraction by taking the amount of Matic or ETH in your liquidity position, divided by the total amount of Matic or ETH in the Liquidity Pool. | |||

Your Liquidity Position in the Spring liquidity pool receives also Summer, Autumn, and Winter. So to calculate the total rewards per day we have to add the other rewards. | |||

==5. Percent Anual Return of Investment == | |||

* | * The annual ROI is calculated by adding the Matic value of the Spring, Summer, Autumn, and Winter rewards times 365 | ||

* The Percent annual ROI is calculated by taking the above result for the annual ROI and dividing it by the amount of Matic in your Liquidity Position times 100 | |||

=Example= | |||

Suppose you have a Spring liquidity position. You will receive every day some number of Spring, Summer, Autumn, and Winter tokens, as described above. | |||

Then we can calculate the Matic value of the daily rewards by multiplying the number of tokens by their respective price in Matic and adding the result. | |||

Now we have the value in Matic of our daily reward. To visualize the ROI in a more familiar form we multiply this by 365, to obtain the annual ROI (In Matic) of our Liquidity Position. | |||

To obtain the percentage ROI we divide this number by the number of Matic in our Liquidity Position. | |||

This annual percent ROI does not depend on the dollar price of Matic. | |||

If the annual percent ROI is 10% (for example) it means that if we invest 1 Matic in the Liquidity Pool, we will have 1.1 Matic by the end of the year. | |||

Warning: Use this ROI only to decide which liquidity pool is giving the best returns at the moment you are providing liquidity. The projected annual ROI may change a lot during the year, and so it is not a good indicator of future profits. It is only a metric used to decide where to add liquidity at a given moment. | |||

=Farming Technical Data= | |||

== | ==Seasonal Tokens Ethereum Farm Contract:== | ||

https://etherscan.io/address/0xe8adb0111ccb570e366c73ee799242effc319404 | |||

==Polygon Farm smart contract:== | |||

https://polygonscan.com/address/0x27114Bb43Ca5B3fc13bf51284aa036Ed5869B371 | |||

==Checking Your Liquidity Position on Uniswap== | |||

Your liquidity position in Uniswap V3 is represented by an NFT. You can view your account in Etherscan or Polygonscan. On the Overview category find the Token Holdings tab. | |||

Then find the NFT assets page to find it. You may also find some trash NFT's sent by you by some advertising promotions or scammers! | |||

You can check the initial Token/ETH amounts by clicking on the NFT icon, and review the mint transaction at the bottom of the page. | |||

Notice that after you deposit the liquidity in the farm, you will no longer have the Uniswap V3 NFT liquidity position in your account. | |||

( | You can see your unclaimed fees in Uniswap by using the (Liquidity Position Number) located in the first column of Your Farm Stats on the Farming page. | ||

https://app.uniswap.org/#/pools/ (Liquidity Position Number) | |||

You have to be connected to the appropriate network to see it. | |||

You can see how much fees are collected in Uniswap by visiting: | |||

https://app.uniswap.org/#/pools/LP# | |||

Where LP# is the liquidity position number given in Your Farming Stats on the website's farming page. | |||

== | ==Liquidity Positions on The Farm== | ||

Liquidity positions on the Farm are identified by the liquidity position number located in the first column in Your Farm Stats on the Seasonal Toekens website Farming page. | |||

Then you have the Trading Pair, the percentage of total liquidity you have, the number of tokens and Matic (or ETH) you have. And finally the Harvestable tokens columns. | |||

These are the tokens you have earned by providing liquidity to the Farm. Liquidity positions are locked for a period of 30 days, then they are unlocked for 7 days if you want to withdraw your liquidity. | |||

If you "Harvest" the tokens you will withdraw the earned tokens but not the liquidity position. | |||

Latest revision as of 02:50, 6 November 2024

Introduction

A decentralized market like Uniswap is not operated by humans, it doesn't have buy-and-sell orders like normal markets. Instead, it has Liquidity Pools.

For a token pair of A and B tokens, it has a repository of A and B tokens The number of A tokens has the same value as the number of B tokens.

For example, the Spring-Matic liquidity pool has a number S of Spring tokens and a number M of Matic. So Spring's price is M/S

Uniswap users are encouraged to provide liquidity by receiving a percentage of all trades done on Uniswap. But for small projects where there are not many transactions, this percentage may be very small. This is what happens in Seasonal Tokens. We don't get much income from Uniswap.

That is the reason for creating the farms. Farms will provide extra income to liquidity providers to overcome this problem.

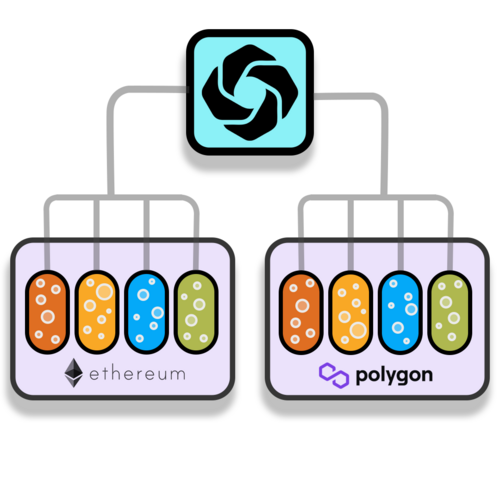

Seasonal Tokens Farms

- Nine percent of all Seasonal Tokens mined are donated to the Farms.

- There are two farms, one in Ethereum network and another in Polygon network, Each farm receives 4.5% of all mined tokens.

- The 4.5% is then distributed among the four Liquidity Pools, but not in the same proportion. It is arranged in such a way that it complements the Mining supply, see Farming Rewards section below.

- Finally, farmers receive rewards in proportion to the percentage of liquidity they have on each farm.

Which Token is the Most Profitable to Farm? (UPDATED NOVEMBER 2024)

Use the annual Percent Return on Investment as an indicator of which of the farms is the most profitable at the time of the update. Not as an indicator of future profits.

The numbers will vary if:

- The number of tokens in the liquidity pools changes. (This happens when a farmer adds or retires liquidity from the farm)

- The Fraction of Farming Rewards given to each pool changes. (This happens every 9 months and correlates with mining supply)

Since the yearly ROI is a percent of the total Matic/ETH invested, it is not dependent on the dollar price of Matic or Ether. In other words: This ROI is given on Matic or ETH, and it is not calculated as a return in dollars.

For example, if you invested 10 Matic in the Polygon Spring Liquidity Pool, and the annual ROI is 40%, it means that in one year your 10 Matic will turn into 14 Matic.

Warning: Use this ROI only to decide which token is more profitable to farm at the given date of the update. It is not guaranteed that you will get this return on investment over a year, because the numbers vary with the above mentioned factors.

Polygon Farm

| date | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|

| 10/10/2024 | 8.60% | 10.89% | 9.44% | 3.81% |

| 11/05/2024 | 7.44% | 09.43% | 8.52% | 3.11% |

Ethereum Farm

| date | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|

| 10/10/2024 | 6.60% | 10.98% | 11.02% | 6.42% |

| 11/05/2024 | 6.78% | 10.71% | 10.94% | 6.11% |

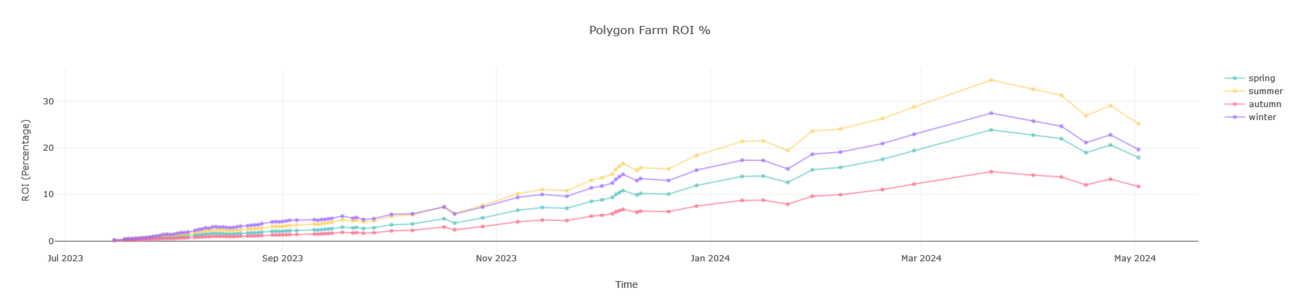

ROI in Polygon Farm

As you can see in the table above, farming in Polygon is more profitable than farming in the Ethereum network. This is because there is more liquidity in the Ethereum network. This opportunity will remain open for early farmers and it will reduce in time as more farming positions are added.

We have created four test liquidity positions in Polygon to observe their Matic value as a percentage of the Matic invested. You can see that from July 2023 to June 2024 they have increased in Matic value by up to 30%

Click HERE for an updated graph. (It may take a while to build up the graph from current data)

How to create a liquidity position and deposit it into the farm: Farming Tutorial on Reddit Adding a liquidity position in the farm is far more expensive in the Ethereum network than in Polygon.

ROI Calculation Explained

In the next section, we will dive into the details of how to compute the above ROI.

- First we calculate how many tokens are mined every day

- Then take 4.5% of that for one farm

- Then distribute those tokens among the 4 liquidity pools

- Then multiply by the fraction of the total liquidity we have

- Divide by the size of our liquidity position to obtain a percentage ROI

It is very important to notice that the tokens are not distributed equally among the four liquidity pools. Some receive more tokens than others. It is arranged in such a way that the farming demand complements the mining supply contributing to the relative price oscillations.

1. Tokens mined per day

There are on average 144 mining rewards per day on each token mining pool. So the total number of tokens mined is 144 times the number of tokens per reward.

| Month | Year | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|---|

| September | 2021 | 168 | 140 | 120 | 105 |

| June | 2022 | 84 | 140 | 120 | 105 |

| March | 2023 | 84 | 70 | 120 | 105 |

| December | 2023 | 84 | 70 | 60 | 105 |

| September | 2024 | 84 | 70 | 60 | 52.5 |

Therefore, at the time of this writing, there are 144*84 Spring, 144*70 Summer, 144*60 Autumn, and 144*105 Winter mined every day.

2. Fraction of Tokens donated to the Farm

Multiply the above number of tokens mined per day by 4.5/100 to obtain the number of tokens of each type donated to the ETH, or Polygon farm.

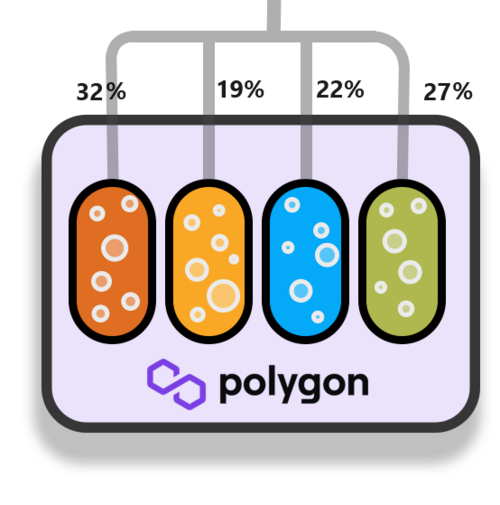

3. Distribution of Tokens among the 4 Liquidity Pools

To contribute to the relative price oscillations, the farming rewards are organized in such a way that the demand for tokens for farming complements the scarcity produced by the mining supply. Four months after the halving of the mining supply of the token produced at the fastest rate, the farming rewards for that token increase.

The idea here is that the token whose mining supply was cut in half will start rising in price relative to the other tokens, and it makes sense to trade it for cheaper tokens. To motivate users to keep them in the liquidity pools the reward increases to compensate for the possible loss of opportunity in trading the tokens for cheaper tokens.

| Month | Year | Spring | Summer | Autumn | Winter |

|---|---|---|---|---|---|

| Initially | 2021 | 0.19 | 0.23 | 0.27 | 0.31 |

| October | 2022 | 0.32 | 0.19 | 0.23 | 0.26 |

| July | 2023 | 0.27 | 0.32 | 0.19 | 0.22 |

| April | 2024 | 0.23 | 0.27 | 0.32 | 0.18 |

| January | 2025 | 0.19 | 0.23 | 0.27 | 0.31 |

Therefore, (at the time of this writing) from the 144*84*4.5/100 Spring tokens donated to the farm, 27% will go to the Spring liquidity pool. 32% will go to the Summer liquidity pool. 19% for Autumn pool and 22% for the Winter pool.

And similarly for the Summer, Autumn, and Winter tokens donated to the farm. They will be distributed in the same proportion among the four liquidity pools.

4. Token distribution among the Liquidity Providers

Finally, the last factor in the calculation of the token rewards is the fraction of the tokens each liquidity provider receives. The tokens are distributed according to the fraction of liquidity provided. A person holding 10% of the liquidity will receive 10% of the rewarded tokens.

You obtain this fraction by taking the amount of Matic or ETH in your liquidity position, divided by the total amount of Matic or ETH in the Liquidity Pool.

Your Liquidity Position in the Spring liquidity pool receives also Summer, Autumn, and Winter. So to calculate the total rewards per day we have to add the other rewards.

5. Percent Anual Return of Investment

- The annual ROI is calculated by adding the Matic value of the Spring, Summer, Autumn, and Winter rewards times 365

- The Percent annual ROI is calculated by taking the above result for the annual ROI and dividing it by the amount of Matic in your Liquidity Position times 100

Example

Suppose you have a Spring liquidity position. You will receive every day some number of Spring, Summer, Autumn, and Winter tokens, as described above.

Then we can calculate the Matic value of the daily rewards by multiplying the number of tokens by their respective price in Matic and adding the result.

Now we have the value in Matic of our daily reward. To visualize the ROI in a more familiar form we multiply this by 365, to obtain the annual ROI (In Matic) of our Liquidity Position.

To obtain the percentage ROI we divide this number by the number of Matic in our Liquidity Position.

This annual percent ROI does not depend on the dollar price of Matic.

If the annual percent ROI is 10% (for example) it means that if we invest 1 Matic in the Liquidity Pool, we will have 1.1 Matic by the end of the year.

Warning: Use this ROI only to decide which liquidity pool is giving the best returns at the moment you are providing liquidity. The projected annual ROI may change a lot during the year, and so it is not a good indicator of future profits. It is only a metric used to decide where to add liquidity at a given moment.

Farming Technical Data

Seasonal Tokens Ethereum Farm Contract:

https://etherscan.io/address/0xe8adb0111ccb570e366c73ee799242effc319404

Polygon Farm smart contract:

https://polygonscan.com/address/0x27114Bb43Ca5B3fc13bf51284aa036Ed5869B371

Checking Your Liquidity Position on Uniswap

Your liquidity position in Uniswap V3 is represented by an NFT. You can view your account in Etherscan or Polygonscan. On the Overview category find the Token Holdings tab. Then find the NFT assets page to find it. You may also find some trash NFT's sent by you by some advertising promotions or scammers!

You can check the initial Token/ETH amounts by clicking on the NFT icon, and review the mint transaction at the bottom of the page.

Notice that after you deposit the liquidity in the farm, you will no longer have the Uniswap V3 NFT liquidity position in your account.

You can see your unclaimed fees in Uniswap by using the (Liquidity Position Number) located in the first column of Your Farm Stats on the Farming page.

https://app.uniswap.org/#/pools/ (Liquidity Position Number)

You have to be connected to the appropriate network to see it.

You can see how much fees are collected in Uniswap by visiting:

https://app.uniswap.org/#/pools/LP#

Where LP# is the liquidity position number given in Your Farming Stats on the website's farming page.

Liquidity Positions on The Farm

Liquidity positions on the Farm are identified by the liquidity position number located in the first column in Your Farm Stats on the Seasonal Toekens website Farming page. Then you have the Trading Pair, the percentage of total liquidity you have, the number of tokens and Matic (or ETH) you have. And finally the Harvestable tokens columns.

These are the tokens you have earned by providing liquidity to the Farm. Liquidity positions are locked for a period of 30 days, then they are unlocked for 7 days if you want to withdraw your liquidity.

If you "Harvest" the tokens you will withdraw the earned tokens but not the liquidity position.