Seasonal Tokens Tribe: Difference between revisions

No edit summary |

|||

| (27 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

''The Seasonal Tokens Tribe is a group of community members who want to participate directly in the promotion of Seasonal Tokens. '' | ''The Seasonal Tokens Tribe is a group of community members who want to participate directly in the promotion of Seasonal Tokens. '' | ||

| Line 6: | Line 4: | ||

''With their time, knowledge, and contacts they provide a very valuable service to the project, and in return, they are eligible for special rewards.'' | ''With their time, knowledge, and contacts they provide a very valuable service to the project, and in return, they are eligible for special rewards.'' | ||

[https://zealy.io/c/promotion/invite/tjDZ13xY9iukVf_0L3h6I Seasonal Tokens Tribe on Zealy.io] | |||

[[File: | [[File:SpacePoster01.jpg |500px]] | ||

= | =Tribe Manifesto:= | ||

We want money. | |||

We want Seasonal Tokens prices to rise, but not before we accumulate a stockpile of tokens. | |||

At the present time, the price of the tokens is very close to the cost of production. In fact, it is below the cost of production in most countries. It is cheaper to buy the tokens than to mine them. | |||

The tokens are not going to be this cheap in the future. | |||

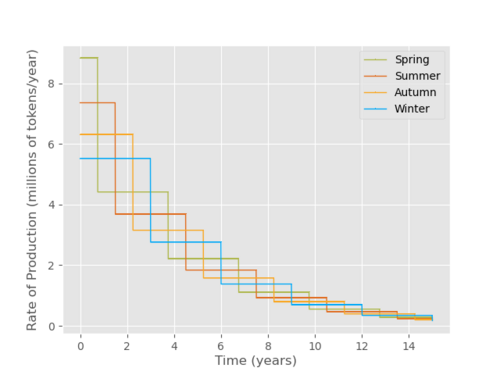

During the first six years of the project the rate of production will be reduced by 80% | |||

Approximately 75% of the total supply of tokens will be mined by then. | |||

[[File:Production curves correct colors.png |500px]] | |||

This is going to put upward pressure on the tokens prices. | |||

But we don’t need the tokens prices to rise in order to profit from the system. | |||

Liquidity positions benefit from fluctuations around stable values. And prices that oscillate about each other are as good as prices that rise, as you can see with the trading simulator. | |||

The trading simulator shows the potential of S.T in the limit of very large liquidity pools. In practice, trading will cause the price to change. Buying tokens rises the price, and selling tokens lower the price, so that the potential profits get reduced by this price slippage. | |||

Seasonal Tokens | =Maximize profits from Seasonal Tokens= | ||

In order to maximize our profit from the system we want: | |||

1. Collect cheap tokens. | |||

2. Large liquidity pools to maximize profits in seasonal trading. | |||

3. Large number of transactions to profit from Liquidity Positions. | |||

4. A steady rise in the tokens dollar prices. | |||

= | =How do We Get There?= | ||

The standard analysis of a cryptocurrency project shows 3 factors that undermine investors confidence in the project: | |||

State 1 | |||

1. Low number of holders. | |||

2. Low market cap. | |||

3. Small Liquidity Pools. | |||

Obviously what is needed for the success of the project is to address these three issues. The ideal situation of the project in the future is: | |||

State 2 | |||

• Large number of holders with significant amounts of tokens. | |||

• Larger Liquidity Pools. | |||

• Large volume of transactions for better ROI of Liquidity Positions. | |||

• Greater market cap. | |||

==Road Map:== | |||

# Increase the number of holders. | |||

# Get holders to increase their tokens by seasonal trading, or providing liquidity. | |||

# Promote DCA among holders. | |||

==Observations:== | |||

* In July 2023 there are about 400,000 tokens of each type produced every month. At an average price of half a cent, this represents $2000. Therefore, if the total investment in tokens every month is around $8000 the prices won’t have pressure to rise. If there is more demand the price will rise. | |||

* Due to the reduced liquidity trying to buy or sell a large number of tokens has a big price impact. But the new price is not sustainable. | |||

* The Seasonal Tokens system is more efficient for relatively small transactions. | |||

* This is an advantage for small investors because it makes it more difficult for big whales to buy a large number of tokens forcing them to DCA into the tokens to participate. | |||

* The ideal situation is a steady increase in those 3 factors, resulting in a steady and sustainable price rise. | |||

[[File:STLogoFicha 02.png |200px |right]] | |||

Latest revision as of 03:05, 16 July 2023

The Seasonal Tokens Tribe is a group of community members who want to participate directly in the promotion of Seasonal Tokens.

With their time, knowledge, and contacts they provide a very valuable service to the project, and in return, they are eligible for special rewards.

Seasonal Tokens Tribe on Zealy.io

Tribe Manifesto:

We want money.

We want Seasonal Tokens prices to rise, but not before we accumulate a stockpile of tokens.

At the present time, the price of the tokens is very close to the cost of production. In fact, it is below the cost of production in most countries. It is cheaper to buy the tokens than to mine them.

The tokens are not going to be this cheap in the future.

During the first six years of the project the rate of production will be reduced by 80% Approximately 75% of the total supply of tokens will be mined by then.

This is going to put upward pressure on the tokens prices.

But we don’t need the tokens prices to rise in order to profit from the system.

Liquidity positions benefit from fluctuations around stable values. And prices that oscillate about each other are as good as prices that rise, as you can see with the trading simulator.

The trading simulator shows the potential of S.T in the limit of very large liquidity pools. In practice, trading will cause the price to change. Buying tokens rises the price, and selling tokens lower the price, so that the potential profits get reduced by this price slippage.

Maximize profits from Seasonal Tokens

In order to maximize our profit from the system we want:

1. Collect cheap tokens. 2. Large liquidity pools to maximize profits in seasonal trading. 3. Large number of transactions to profit from Liquidity Positions. 4. A steady rise in the tokens dollar prices.

How do We Get There?

The standard analysis of a cryptocurrency project shows 3 factors that undermine investors confidence in the project:

State 1

1. Low number of holders. 2. Low market cap. 3. Small Liquidity Pools.

Obviously what is needed for the success of the project is to address these three issues. The ideal situation of the project in the future is:

State 2

• Large number of holders with significant amounts of tokens. • Larger Liquidity Pools. • Large volume of transactions for better ROI of Liquidity Positions. • Greater market cap.

Road Map:

- Increase the number of holders.

- Get holders to increase their tokens by seasonal trading, or providing liquidity.

- Promote DCA among holders.

Observations:

- In July 2023 there are about 400,000 tokens of each type produced every month. At an average price of half a cent, this represents $2000. Therefore, if the total investment in tokens every month is around $8000 the prices won’t have pressure to rise. If there is more demand the price will rise.

- Due to the reduced liquidity trying to buy or sell a large number of tokens has a big price impact. But the new price is not sustainable.

- The Seasonal Tokens system is more efficient for relatively small transactions.

- This is an advantage for small investors because it makes it more difficult for big whales to buy a large number of tokens forcing them to DCA into the tokens to participate.

- The ideal situation is a steady increase in those 3 factors, resulting in a steady and sustainable price rise.