Due Diligence: Difference between revisions

No edit summary |

|||

| (5 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

[[File:SeasonalTokens Banner XI 01SM.png | | [[File:SeasonalTokens Banner XI 01SM.png |1000px]] | ||

=Seasonal Tokens Due Diligence:= | =Seasonal Tokens Due Diligence:= | ||

| Line 9: | Line 9: | ||

# No initial coin distribution or pre-mining. | # No initial coin distribution or pre-mining. | ||

# Everybody, including the contract creators, has to buy or mine the tokens. | # Everybody, including the contract creators, has to buy or mine the tokens. | ||

# Maximum Supply: 33.1128 million of each token. | # Maximum Supply: 33.1128 million of each token. | ||

# Halving of Mining Supply for each token every 3 years. | # Halving of Mining Supply for each token every 3 years. | ||

| Line 42: | Line 41: | ||

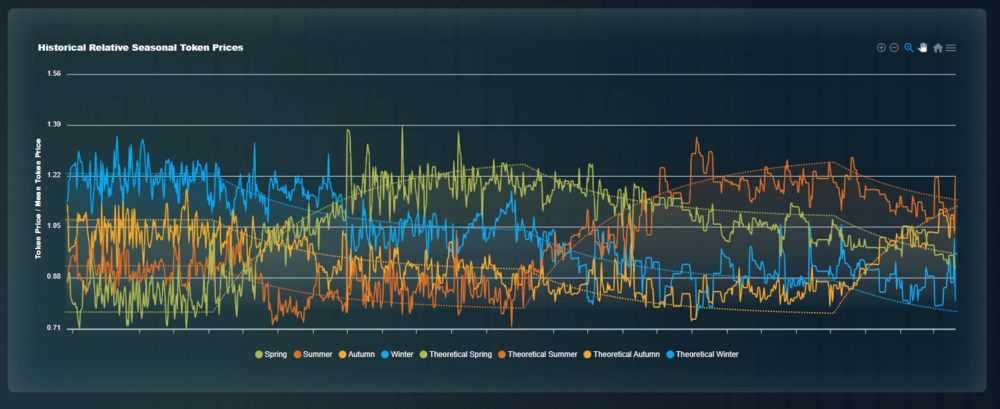

The next chart shows the historical relative prices of the four tokens. Notice that despite random fluctuations the real prices fluctuate around the theoretical values. (Dotted lines) | The next chart shows the historical relative prices of the four tokens. Notice that despite random fluctuations the real prices fluctuate around the theoretical values. (Dotted lines) | ||

[[File: | [[File:Chart March 2024.png|1000px |left]] | ||

In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens. | In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens. | ||

In March 2023 the rate of supply of Summer tokens was cut in half, and you can see that its price is rising relative to the other tokens. | In March 2023 the rate of supply of Summer tokens was cut in half, and few months later Summer became the most expensive of the four tokens. | ||

In December 2023 the rate of supply of Autumn tokens was cut in half, and you can see that its price is rising relative to the other tokens. | |||

==Governance:== | ==Governance:== | ||

| Line 91: | Line 92: | ||

At the moment the system works as intended for relatively small-volume trades. Large trades are not as profitable due to price slippage. This will improve in the future as the liquidity pools grow in size. | At the moment the system works as intended for relatively small-volume trades. Large trades are not as profitable due to price slippage. This will improve in the future as the liquidity pools grow in size. | ||

[[Road Map | Read the Full Road Map]] | |||

==Facts you don’t want overlooked:== | ==Facts you don’t want overlooked:== | ||

Latest revision as of 20:14, 25 March 2024

Seasonal Tokens Due Diligence:

Token Economics:

- Price anchored in reality by the cost of Proof of Work mining and Ethereum mint transaction.

- No initial coin distribution or pre-mining.

- Everybody, including the contract creators, has to buy or mine the tokens.

- Maximum Supply: 33.1128 million of each token.

- Halving of Mining Supply for each token every 3 years.

- Every nine months, the mining supply of the fastest-to-produce token is cut in half, making it the slowest to produce.

What Problem Does it Solve?

It converts a problem for miners into a solution for traders.

The problem with cryptocurrency trading is that it is mostly a gamble. Seasonal Tokens mining supply has been engineered to produce predictable oscillations in the relative prices of the four tokens. In this way, traders know in advance which token is going to go up in price next.

The problem for miners is that when the mining supply of the cheapest token is cut in half, it becomes unprofitable to mine the token overnight.

This causes miners to mine the other 3 tokens, and this results in reducing the profitability of mining the other tokens as well since there are more miners sharing the rewards.

The problem for traders is to buy low and sell high. In seasonal trading, you know in advance which token will go up in relative price next.

Because traders start buying the cheapest token anticipating that it will rise in price relative to the other tokens due to the reduced supply, they create a demand for the cheapest token, and this puts upward pressure on the token's price.

The relative price will rise until it becomes profitable to mine it again. In this way, traders help the mining economy to recover the mining profitability.

Unique Value Proposition:

Seasonal Tokens are the first digital commodities with built-in seasonality in their relative prices. This provides an open, transparent and low-risk environment for people to decide how to administrate their digital assets without speculation and gambling.

Proof of Concept:

The next chart shows the historical relative prices of the four tokens. Notice that despite random fluctuations the real prices fluctuate around the theoretical values. (Dotted lines)

In particular, notice that on June 2022 the rate of production of Spring token was cut in half, creating upward pressure on its price, and five months later Spring was the most expensive of the four tokens.

In March 2023 the rate of supply of Summer tokens was cut in half, and few months later Summer became the most expensive of the four tokens.

In December 2023 the rate of supply of Autumn tokens was cut in half, and you can see that its price is rising relative to the other tokens.

Governance:

Seasonal Tokens is a decentralized and trust less Web3 ecosystem. The tokens are subject only to the laws of supply and demand. No enterprise or corporation, no management behind the tokens.

Community:

Reddit and Discord, very friendly environment, with technical and moral support for all your crypto related needs. It’s goal is to help new users to understand the system.

It is in the best interest of all participants to bring in more users, because it increases the efficiency of the S.T system. There is no need for S.T prices to rise for the system to work.

Technology:

4 proof of work ERC-20 smart contracts. Same economic principles behind Bitcoin’s design, but running on the Ethereum Virtual Computer.

The contracts have been audited by three independent companies to reduce as much as possible the risk of technical failures.

Read the Full Technical Data Sheet

Utility:

The first cryptocurrency system in the world with built-in alpha.

Seasonal Trading increases the total number of tokens you have and outperforms the buy-and-hold strategy regardless of the dollar prices of the tokens.

The Utility of Seasonal Tokens is to increase the total number of tokens you have without investing more money.

This accessible investment option is a financial innovation, a tool for risk management, and a long-term investment strategy for building wealth.

Implementation, further development. Road map:

Seasonal Tokens system is fully developed. The historical relative price chart is a proof of concept that the system is working as designed.

Vision to the Future:

The Seasonal Tokens system doesn’t depend on the dollar prices of the tokens to rise. Prices that oscillate around each other are as good as prices that go up to make money, but they are lower risk.

To achieve its full potential it needs the size of the Liquidity Pools to increase to allow large volume traders.

At the moment the system works as intended for relatively small-volume trades. Large trades are not as profitable due to price slippage. This will improve in the future as the liquidity pools grow in size.

Facts you don’t want overlooked:

The tokens prices are close to their cost of production, and they are being produced at the fastest rate they will ever be produced.

The tokens are running out.