Benzinga 04 RevII: Difference between revisions

No edit summary |

|||

| (5 intermediate revisions by the same user not shown) | |||

| Line 7: | Line 7: | ||

DeFi has emerged as a significant sector within the cryptocurrency ecosystem, leveraging blockchain technology to provide financial services such as borrowing, lending, and trading without relying on traditional financial intermediaries. As of October 2024, the total value locked (TVL) in DeFi stood at $85.2 billion, reflecting the robust interest in decentralized finance platforms. | DeFi has emerged as a significant sector within the cryptocurrency ecosystem, leveraging blockchain technology to provide financial services such as borrowing, lending, and trading without relying on traditional financial intermediaries. As of October 2024, the total value locked (TVL) in DeFi stood at $85.2 billion, reflecting the robust interest in decentralized finance platforms. | ||

DeFi projects utilize blockchain technology to run smart contracts which automatically execute transactions based on the terms coded within, eliminating the need for middlemen or traditional financial institutions. | |||

But besides this coded behavior, platforms like the Ethereum Virtual Machine foster an environment where smart contracts can interact in ways '''not directly specified in their code.''' | |||

Seasonal Tokens is an example of such ''Emergent Phenomena'' within decentralized finance. The historical relative price | |||

Seasonal Tokens is an example of such ''Emergent Phenomena'' within decentralized finance. The following chart shows the historical relative price of the four tokens. | |||

Notice how prices oscillate in relation to each other, showcasing complex interactions within the ecosystem. | |||

[[File:RelPriceOct102024.png|800px]] | [[File:RelPriceOct102024.png|800px]] | ||

| Line 21: | Line 24: | ||

It's crucial to recognize that the price oscillations observed are not explicitly programmed into the smart contracts. | It's crucial to recognize that the price oscillations observed are not explicitly programmed into the smart contracts. | ||

The four smart contracts operate independently, and their mining supply is scheduled to halve every three years. | |||

The four smart contracts differ only in two respects: their names—Spring, Summer, Autumn, and | The four smart contracts differ only in two respects: their names—Spring, Summer, Autumn, and Winter, and the specific dates when their mining supplies halve. | ||

The schedule for mining supply is structured such that every nine months, the token currently being mined at the highest rate undergoes a halving event. | The schedule for mining supply is structured such that every nine months, the token currently being mined at the highest rate undergoes a halving event. | ||

Latest revision as of 23:18, 8 October 2024

Seasonal Tokens: A Case Study For Emergent Phenomena In Decentralized Finance

Bitcoin's technological breakthrough was its ability to facilitate cryptocurrency transactions without the need for trusted third parties or a central authority.

Building on this innovation, Ethereum introduced the concept of a Virtual Machine, enabling a variety of applications to operate in a trustless manner. This development paved the way for a new sector within financial services known as decentralized finance, or DeFi.

DeFi has emerged as a significant sector within the cryptocurrency ecosystem, leveraging blockchain technology to provide financial services such as borrowing, lending, and trading without relying on traditional financial intermediaries. As of October 2024, the total value locked (TVL) in DeFi stood at $85.2 billion, reflecting the robust interest in decentralized finance platforms.

DeFi projects utilize blockchain technology to run smart contracts which automatically execute transactions based on the terms coded within, eliminating the need for middlemen or traditional financial institutions.

But besides this coded behavior, platforms like the Ethereum Virtual Machine foster an environment where smart contracts can interact in ways not directly specified in their code.

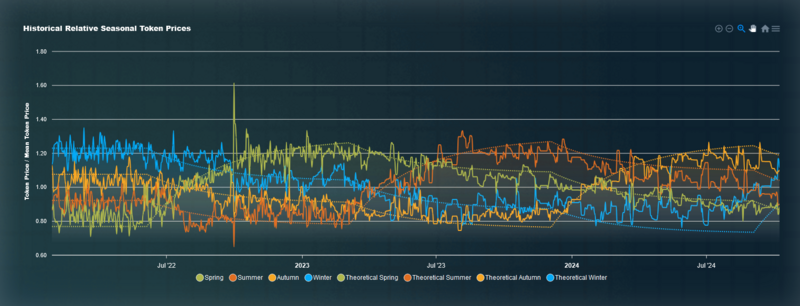

Seasonal Tokens is an example of such Emergent Phenomena within decentralized finance. The following chart shows the historical relative price of the four tokens.

Notice how prices oscillate in relation to each other, showcasing complex interactions within the ecosystem.

Image source: https://seasonaltokens.org/

It's crucial to recognize that the price oscillations observed are not explicitly programmed into the smart contracts.

The four smart contracts operate independently, and their mining supply is scheduled to halve every three years.

The four smart contracts differ only in two respects: their names—Spring, Summer, Autumn, and Winter, and the specific dates when their mining supplies halve.

The schedule for mining supply is structured such that every nine months, the token currently being mined at the highest rate undergoes a halving event.

The price dynamics of Seasonal Tokens are governed solely by supply and demand. Although the token supply is fixed over time, this alone does not explain the observed price oscillations. Let's delve deeper into how these dynamics play out.

An Emergent Collaboration:

In traditional proof of work cryptocurrencies, halving events often lead to significant challenges for miners, as the cost of production effectively doubles overnight, potentially driving many out of business. With Seasonal Tokens, however, the dynamics are quite different. When the mining supply of the least expensive token halves and it becomes less profitable to mine, miners quickly redirect their resources to the other three tokens. This sudden influx of mining activity reduces the profitability of these tokens as well, due to increased competition.

Traders, anticipating these shifts, often invest in the token that is currently the least expensive but expected to rise in price. This strategy is based on the knowledge that a reduction in its supply—due to the halving—combined with a spike in demand will likely drive its price up.

As a result, the token’s price increases, often surpassing the other three. This strategic investment not only yields profits due to predictable price oscillations but also supports the overall mining economy by redistributing resources and effort across the different tokens.

This phenomenon represents an unplanned yet effective collaboration among network participants, driven by economic principles within the four-token ecosystem.

Seasonal Tokens exemplify a decentralized, emergent system where independent actors unknowingly collaborate in the creation and maintenance of digital assets, without the need for a central organizing authority. Their autonomous and trust less nature highlights how decentralization extends beyond simple transaction verification and smart contract execution, influencing broader economic activities within the cryptocurrency space.

If Seasonal Tokens has piqued your interest, either for its dynamic trading opportunities across four cryptocurrencies, or for mining activities in which participants earn Seasonal Tokens as a reward, you can find your place in the project by visiting SeasonalTokens.org here.