Brochure 2: Difference between revisions

Jump to navigation

Jump to search

No edit summary |

No edit summary |

||

| (17 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

[[File:Spacer white.jpg |800px|left]] | |||

[[File:Coverandsite.jpg |800px|right]] | |||

[[File:Spacer black.jpg |800px|left]] | |||

[[File:Ethical non Spec.jpg |800px|right]] | |||

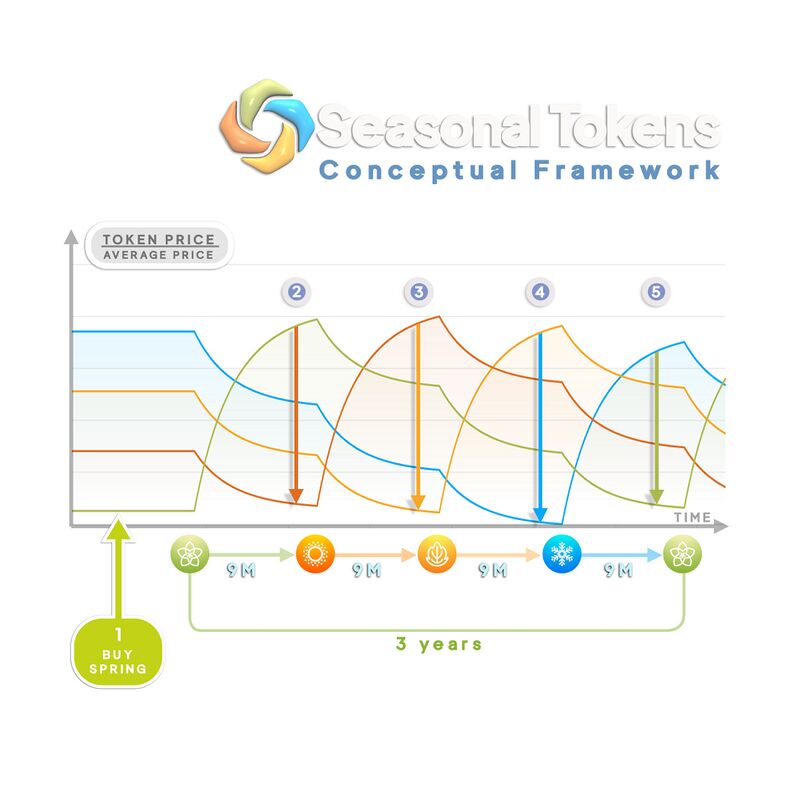

[[File:Conceptual framework.jpg |800px |left]] | [[File:Conceptual framework.jpg |800px|left]] | ||

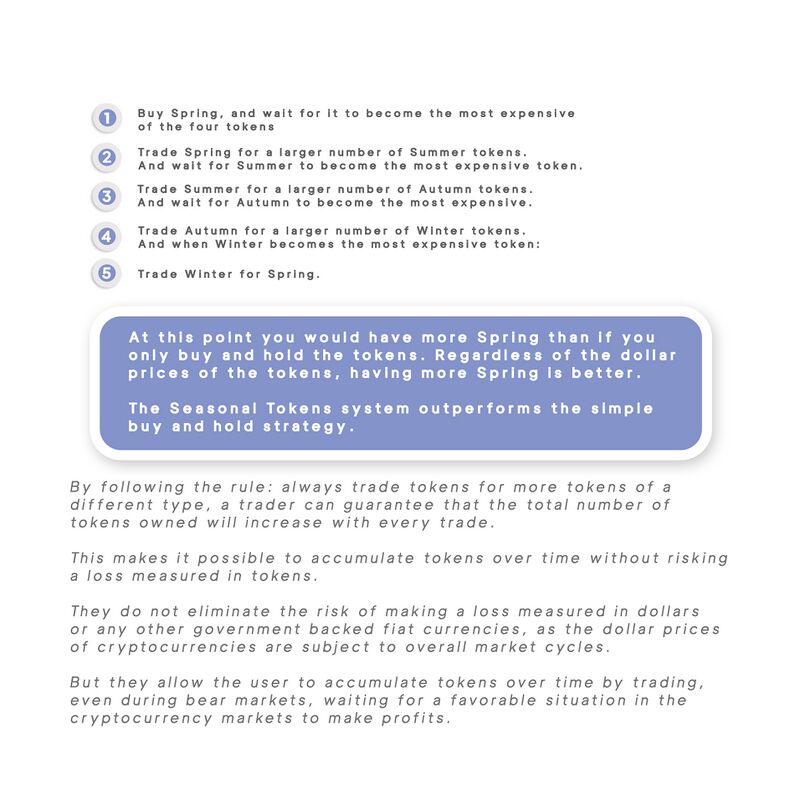

[[File:Conceptual Framework 2.jpg |800px|right]] | |||

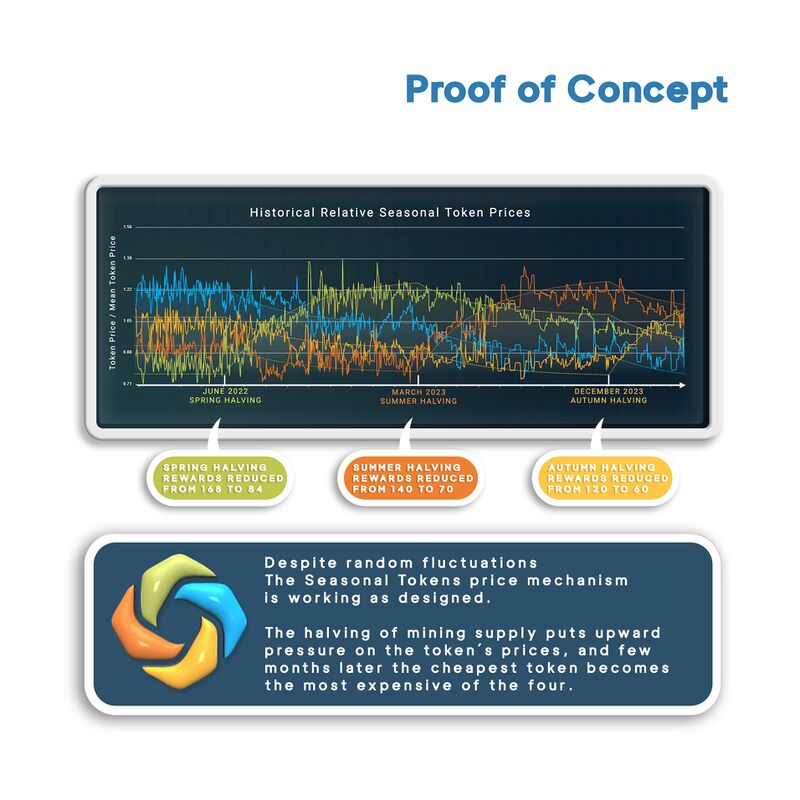

[[File:Proof of Concept.jpg |800px|left]] | |||

[[File:Proof of Concept 2.jpg |800px|right]] | |||

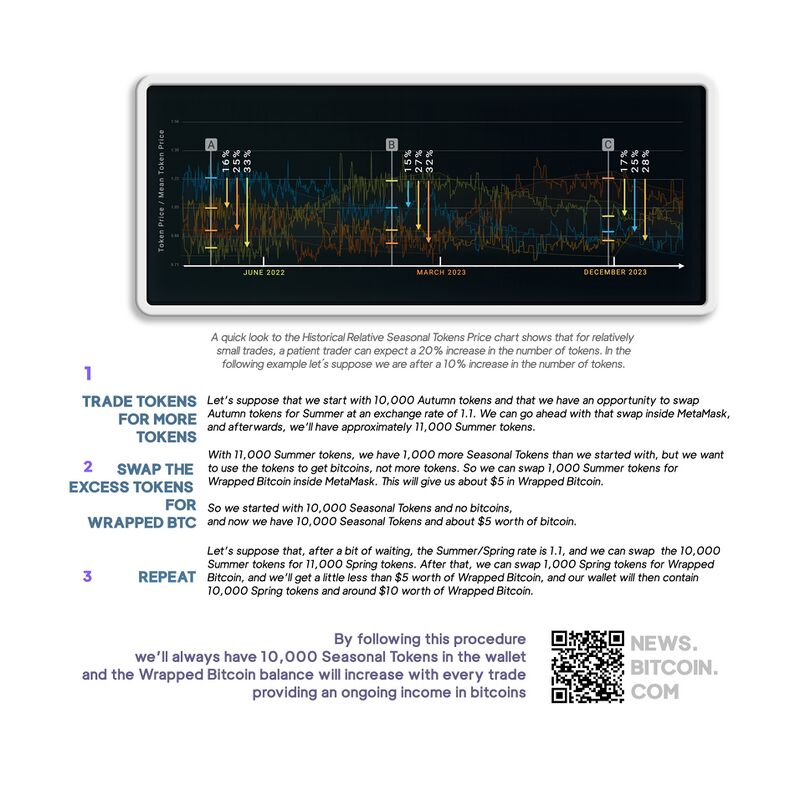

[[File:Use ST to BTC.jpg |800px |left]] | |||

[[File:Use ST to BTC 2.jpg |800px |right]] | |||

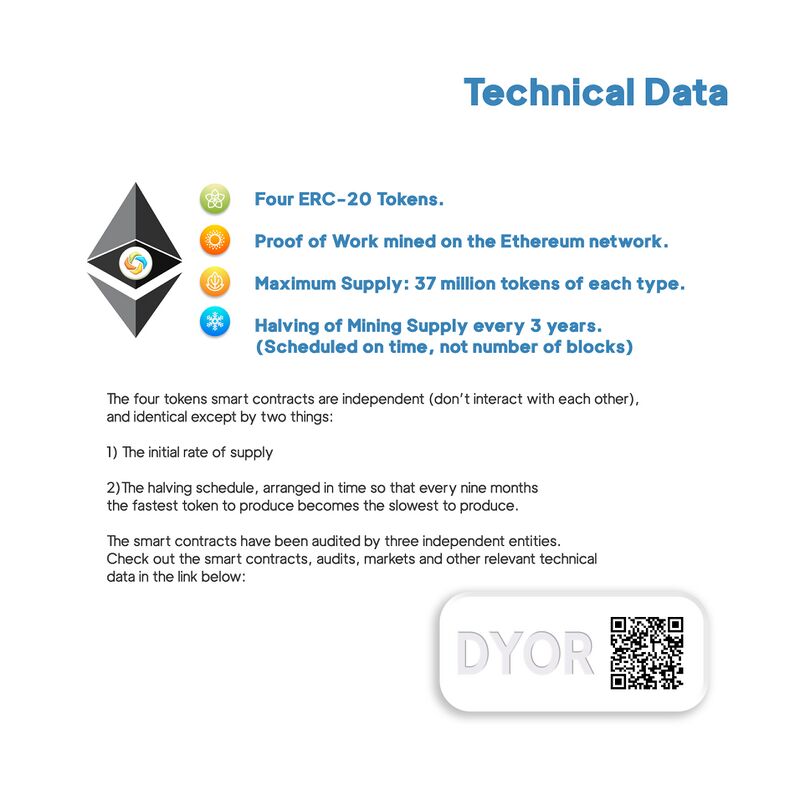

[[File:TechData.jpg |800px|left]] | |||

[[File:Spacer black.jpg |800px|right]] | |||

[[File:BackCover.jpg |800px|left]] | |||

[[File:Spacer white.jpg |800px|right]] | |||

[[File: | |||

[[File: | |||