Benzinga 03: Difference between revisions

No edit summary |

No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 16: | Line 16: | ||

The short answer is: It doesn’t look like it. | The short answer is: It doesn’t look like it. | ||

In particular, note that in March 2017 and March 2021, there were significant increases in the altcoin market cap that coincided with Bitcoin bull runs following Bitcoin’s halving events. | In particular, note that in March 2017 and March 2021, there were significant increases in the altcoin market cap that coincided with Bitcoin bull runs following Bitcoin’s halving events. | ||

As Bitcoin becomes more expensive, investors look for alternatives, expanding the altcoin market cap. | As Bitcoin becomes more expensive, investors look for alternatives, expanding the altcoin market cap. | ||

Therefore, we may ask ourselves if the percentage of the total crypto market cap represented by altcoins will increase in the future. | Therefore, we may ask ourselves if the percentage of the total crypto market cap represented by altcoins will increase in the future. | ||

Roughly, the total crypto market cap consists of 50% Bitcoin, 25% for the next top 7 altcoins, and 25% for hundreds or even thousands of other cryptocurrencies. | Roughly, the total crypto market cap consists of 50% Bitcoin, 25% for the next top 7 altcoins, and 25% for hundreds or even thousands of other cryptocurrencies. | ||

Of the top 8 cryptocurrencies, 7 are blockchains; however, they are very different. Only Bitcoin was designed to be money. All other blockchains are similar to Ethereum in that they are decentralized virtual computers. This crucial difference is reflected in the price of the underlying digital assets. | Of the top 8 cryptocurrencies, 7 are blockchains; however, they are very different. Only Bitcoin was designed to be money. All other blockchains are similar to Ethereum in that they are decentralized virtual computers. This crucial difference is reflected in the price of the underlying digital assets. | ||

Let’s look at the reasons why the altcoin market cap might increase: | Let’s look at the reasons why the altcoin market cap might increase: | ||

Bitcoin was designed to be digital cash, but limitations in the number of transactions per block, the capped supply of 21 million bitcoins, and the substantial energy and infrastructure required to maintain the network make it an excellent choice as a store of value. | Bitcoin was designed to be digital cash, but limitations in the number of transactions per block, the capped supply of 21 million bitcoins, and the substantial energy and infrastructure required to maintain the network make it an excellent choice as a store of value. | ||

On the other hand, Ethereum was designed as a decentralized virtual computer, and most other major blockchains also function as virtual computers in that they can perform decentralized computations or smart contracts. | On the other hand, Ethereum was designed as a decentralized virtual computer, and most other major blockchains also function as virtual computers in that they can perform decentralized computations or smart contracts. | ||

Smart contracts are very useful, and when something is very useful, it generally becomes cheaper over time. Think of automobiles, computers, cellphones, etc. Their utility has not made them more expensive; quite the opposite. | Smart contracts are very useful, and when something is very useful, it generally becomes cheaper over time. Think of automobiles, computers, cellphones, etc. Their utility has not made them more expensive; quite the opposite. | ||

As a result, other major cryptocurrencies face downward pressure on their prices. We can see this with Ethereum, where gas fees create opportunities for “layer 2” blockchains to capture part of the market by offering services at a lower cost. | As a result, other major cryptocurrencies face downward pressure on their prices. We can see this with Ethereum, where gas fees create opportunities for “layer 2” blockchains to capture part of the market by offering services at a lower cost. | ||

It is quite remarkable that the third-largest cryptocurrency by market cap, USDT, is not a blockchain but an ERC-20 token on the Ethereum network. Its only “utility” is to be money and a stable crypto to avoid market volatility. | It is quite remarkable that the third-largest cryptocurrency by market cap, USDT, is not a blockchain but an ERC-20 token on the Ethereum network. Its only “utility” is to be money and a stable crypto to avoid market volatility. | ||

This highlights the fact that decentralized virtual computer technology allows for the separation of blockchain infrastructure from the digital assets operating on it, which can be independent decentralized entities. | This highlights the fact that decentralized virtual computer technology allows for the separation of blockchain infrastructure from the digital assets operating on it, which can be independent decentralized entities. | ||

Moreover, proof-of-work technology can be integrated within decentralized virtual computers, effectively converting energy into currency. The digital assets produced by this method have a direct connection to a physical underlying economy, giving them intrinsic value based on production costs. | Moreover, proof-of-work technology can be integrated within decentralized virtual computers, effectively converting energy into currency. The digital assets produced by this method have a direct connection to a physical underlying economy, giving them intrinsic value based on production costs. | ||

In this context, there is no limit to the value that altcoins can contribute to the total crypto market cap. A single blockchain like Ethereum may hold assets with a value greater than Ethereum’s market cap, just as a bank can hold assets that exceed its own value. | In this context, there is no limit to the value that altcoins can contribute to the total crypto market cap. A single blockchain like Ethereum may hold assets with a value greater than Ethereum’s market cap, just as a bank can hold assets that exceed its own value. | ||

This connection with the real-world economy can be used to further expand the applications of cryptocurrency technology. For example, Seasonal Tokens are a set of four proof-of-work tokens on the Ethereum network, with their relative prices engineered to oscillate around each other over time. | This connection with the real-world economy can be used to further expand the applications of cryptocurrency technology. For example, Seasonal Tokens are a set of four proof-of-work tokens on the Ethereum network, with their relative prices engineered to oscillate around each other over time. | ||

If Bitcoin was designed to be money, and Ethereum a Decentralized Virtual Machine, Seasonal Tokens were designed as an investment. | If Bitcoin was designed to be money, and Ethereum a Decentralized Virtual Machine, Seasonal Tokens were designed as an investment. | ||

They function in the crypto world similarly to how agricultural products function in the traditional economy. | They function in the crypto world similarly to how agricultural products function in the traditional economy. | ||

The idea is straightforward: just as knowledge of seasons has been used to mitigate risk and plan agricultural activities, understanding the cycles in the relative prices of the four Seasonal Tokens allows traders and investors to plan ahead and profit from predictable price oscillations. | The idea is straightforward: just as knowledge of seasons has been used to mitigate risk and plan agricultural activities, understanding the cycles in the relative prices of the four Seasonal Tokens allows traders and investors to plan ahead and profit from predictable price oscillations. | ||

Similar to agricultural commodities, where traders pay in advance to help farmers mitigate price volatility risk, traders and investors in Seasonal Tokens support the mining economy by investing in tokens that are less profitable to mine. This is because the token supply is arranged so that the cheapest tokens become the most expensive of the four within a nine-month period. | Similar to agricultural commodities, where traders pay in advance to help farmers mitigate price volatility risk, traders and investors in Seasonal Tokens support the mining economy by investing in tokens that are less profitable to mine. This is because the token supply is arranged so that the cheapest tokens become the most expensive of the four within a nine-month period. | ||

(Note that the seasons in this cryptocurrency system last nine months, not four like in nature.) | (Note that the seasons in this cryptocurrency system last nine months, not four like in nature.) | ||

Therefore, while Bitcoin has become the most trusted store of value cryptocurrency, other cryptocurrencies do not necessarily compete for this role. Instead, they complement it by providing different opportunities and use cases. | Therefore, while Bitcoin has become the most trusted store of value cryptocurrency, other cryptocurrencies do not necessarily compete for this role. Instead, they complement it by providing different opportunities and use cases. | ||

Proof-of-work technology is also a transitional phase in the lifespan of cryptocurrencies. It serves its purpose during the “inflationary” phase when the asset is being created and rewards early investors for supporting its development. | Proof-of-work technology is also a transitional phase in the lifespan of cryptocurrencies. It serves its purpose during the “inflationary” phase when the asset is being created and rewards early investors for supporting its development. | ||

As mining supply decreases with each halving, economic incentives for market participants will shift from mining to other activities. In Bitcoin’s case, network node operators will eventually rely solely on transaction fees for revenue. Given the limited number of transactions per second, Bitcoin is expected to be used primarily by major players or not for everyday small transactions. | As mining supply decreases with each halving, economic incentives for market participants will shift from mining to other activities. In Bitcoin’s case, network node operators will eventually rely solely on transaction fees for revenue. Given the limited number of transactions per second, Bitcoin is expected to be used primarily by major players or not for everyday small transactions. | ||

In the case of Seasonal Tokens, price oscillations will provide economic incentives for several years until mining supply becomes less relevant. At that stage, market participants will be rewarded for providing liquidity to decentralized markets, arbitraging between different blockchains like Ethereum and Polygon, and trading price fluctuations among the four tokens. | In the case of Seasonal Tokens, price oscillations will provide economic incentives for several years until mining supply becomes less relevant. At that stage, market participants will be rewarded for providing liquidity to decentralized markets, arbitraging between different blockchains like Ethereum and Polygon, and trading price fluctuations among the four tokens. | ||

On September 4, 2024, the mining supply of the Winter token will be cut in half, marking the end of the first full period of halvings in Seasonal Tokens. The historical relative price chart shows that the price oscillations are working as designed, and it is expected that the Winter token, which has been the cheapest over the last few months, will become the most expensive at the beginning of the next year. | On September 4, 2024, the mining supply of the Winter token will be cut in half, marking the end of the first full period of halvings in Seasonal Tokens. The historical relative price chart shows that the price oscillations are working as designed, and it is expected that the Winter token, which has been the cheapest over the last few months, will become the most expensive at the beginning of the next year. | ||

Click here to grab a special Winter Halving gift for our Benzinga readers. | Click here to grab a special Winter Halving gift for our Benzinga readers. | ||

[[File:RelpriceAugust13.png|950px]] | |||

Image credits: CoinGecko | |||

Relative Price Chart www.seasonaltokens.org | |||

Latest revision as of 00:33, 23 August 2024

Will Bitcoin become the only trustless digital store of value?

Is there room for others?

Bitcoin maximalists claim that Bitcoin will be the only cryptocurrency needed in the future, and that all other altcoins will not survive long-term.

Let’s examine:

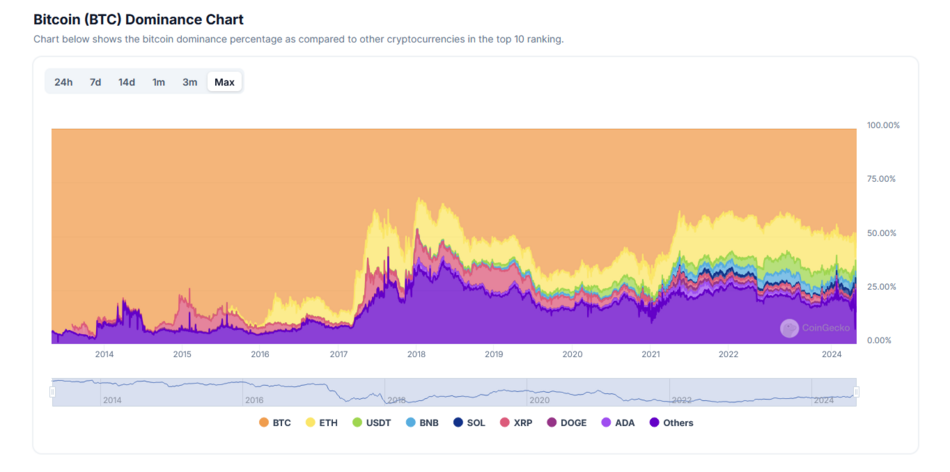

The total crypto market cap has been growing, largely due to Bitcoin’s market cap. However, in August 2024, Bitcoin represents only 50% of the total crypto market cap, valued at $2.2 trillion.

The Bitcoin dominance chart below shows that the altcoin market cap has been growing in the past. The question is: will BTC dominance increase, shrinking the percentage of altcoins in the total market cap?

The short answer is: It doesn’t look like it.

In particular, note that in March 2017 and March 2021, there were significant increases in the altcoin market cap that coincided with Bitcoin bull runs following Bitcoin’s halving events.

As Bitcoin becomes more expensive, investors look for alternatives, expanding the altcoin market cap.

Therefore, we may ask ourselves if the percentage of the total crypto market cap represented by altcoins will increase in the future.

Roughly, the total crypto market cap consists of 50% Bitcoin, 25% for the next top 7 altcoins, and 25% for hundreds or even thousands of other cryptocurrencies.

Of the top 8 cryptocurrencies, 7 are blockchains; however, they are very different. Only Bitcoin was designed to be money. All other blockchains are similar to Ethereum in that they are decentralized virtual computers. This crucial difference is reflected in the price of the underlying digital assets.

Let’s look at the reasons why the altcoin market cap might increase:

Bitcoin was designed to be digital cash, but limitations in the number of transactions per block, the capped supply of 21 million bitcoins, and the substantial energy and infrastructure required to maintain the network make it an excellent choice as a store of value.

On the other hand, Ethereum was designed as a decentralized virtual computer, and most other major blockchains also function as virtual computers in that they can perform decentralized computations or smart contracts.

Smart contracts are very useful, and when something is very useful, it generally becomes cheaper over time. Think of automobiles, computers, cellphones, etc. Their utility has not made them more expensive; quite the opposite.

As a result, other major cryptocurrencies face downward pressure on their prices. We can see this with Ethereum, where gas fees create opportunities for “layer 2” blockchains to capture part of the market by offering services at a lower cost.

It is quite remarkable that the third-largest cryptocurrency by market cap, USDT, is not a blockchain but an ERC-20 token on the Ethereum network. Its only “utility” is to be money and a stable crypto to avoid market volatility.

This highlights the fact that decentralized virtual computer technology allows for the separation of blockchain infrastructure from the digital assets operating on it, which can be independent decentralized entities.

Moreover, proof-of-work technology can be integrated within decentralized virtual computers, effectively converting energy into currency. The digital assets produced by this method have a direct connection to a physical underlying economy, giving them intrinsic value based on production costs.

In this context, there is no limit to the value that altcoins can contribute to the total crypto market cap. A single blockchain like Ethereum may hold assets with a value greater than Ethereum’s market cap, just as a bank can hold assets that exceed its own value.

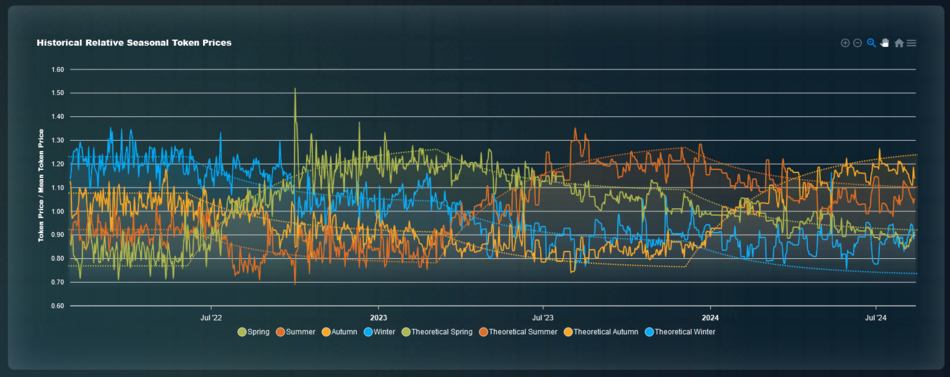

This connection with the real-world economy can be used to further expand the applications of cryptocurrency technology. For example, Seasonal Tokens are a set of four proof-of-work tokens on the Ethereum network, with their relative prices engineered to oscillate around each other over time.

If Bitcoin was designed to be money, and Ethereum a Decentralized Virtual Machine, Seasonal Tokens were designed as an investment.

They function in the crypto world similarly to how agricultural products function in the traditional economy.

The idea is straightforward: just as knowledge of seasons has been used to mitigate risk and plan agricultural activities, understanding the cycles in the relative prices of the four Seasonal Tokens allows traders and investors to plan ahead and profit from predictable price oscillations.

Similar to agricultural commodities, where traders pay in advance to help farmers mitigate price volatility risk, traders and investors in Seasonal Tokens support the mining economy by investing in tokens that are less profitable to mine. This is because the token supply is arranged so that the cheapest tokens become the most expensive of the four within a nine-month period.

(Note that the seasons in this cryptocurrency system last nine months, not four like in nature.)

Therefore, while Bitcoin has become the most trusted store of value cryptocurrency, other cryptocurrencies do not necessarily compete for this role. Instead, they complement it by providing different opportunities and use cases.

Proof-of-work technology is also a transitional phase in the lifespan of cryptocurrencies. It serves its purpose during the “inflationary” phase when the asset is being created and rewards early investors for supporting its development.

As mining supply decreases with each halving, economic incentives for market participants will shift from mining to other activities. In Bitcoin’s case, network node operators will eventually rely solely on transaction fees for revenue. Given the limited number of transactions per second, Bitcoin is expected to be used primarily by major players or not for everyday small transactions.

In the case of Seasonal Tokens, price oscillations will provide economic incentives for several years until mining supply becomes less relevant. At that stage, market participants will be rewarded for providing liquidity to decentralized markets, arbitraging between different blockchains like Ethereum and Polygon, and trading price fluctuations among the four tokens.

On September 4, 2024, the mining supply of the Winter token will be cut in half, marking the end of the first full period of halvings in Seasonal Tokens. The historical relative price chart shows that the price oscillations are working as designed, and it is expected that the Winter token, which has been the cheapest over the last few months, will become the most expensive at the beginning of the next year.

Click here to grab a special Winter Halving gift for our Benzinga readers.

Image credits: CoinGecko Relative Price Chart www.seasonaltokens.org