How to Make Money With Seasonal Tokens: Difference between revisions

No edit summary |

|||

| (7 intermediate revisions by the same user not shown) | |||

| Line 10: | Line 10: | ||

=Six Ways to Benefit from Seasonal Tokens= | =Six Ways to Benefit from Seasonal Tokens= | ||

= Buy and Hold = | == Buy and Hold == | ||

This is the simplest strategy, the idea is to buy tokens and wait for the prices to rise to make profits selling them again. | This is the simplest strategy, the idea is to buy tokens and wait for the prices to rise to make profits selling them again. | ||

| Line 23: | Line 23: | ||

the tokens prices. If the demand of the tokens remains as it is now, the token prices will rise naturally. | the tokens prices. If the demand of the tokens remains as it is now, the token prices will rise naturally. | ||

= Farming = | == Farming == | ||

Providing liquidity to the markets is essential to the Token economics. Decentralized markets like Uniswap reward liquidity providers in proportion to the | Providing liquidity to the markets is essential to the Token economics. Decentralized markets like Uniswap reward liquidity providers in proportion to the | ||

| Line 41: | Line 41: | ||

The donations to the farm are covered by a investment fund and nobody has to pay for it. | The donations to the farm are covered by a investment fund and nobody has to pay for it. | ||

= Mining = | == Mining == | ||

Mining is the core of the Seasonal Tokens ecosystem. The mining supply of tokens is the driving force behind the price oscillations that are the main feature of the system. | Mining is the core of the Seasonal Tokens ecosystem. The mining supply of tokens is the driving force behind the price oscillations that are the main feature of the system. | ||

The original price of the tokens at the beginning of the project was estimated by the cost of production of the tokens using graphic cards GPU, but after few months of operation the project was | The original price of the tokens at the beginning of the project was estimated by the cost of production of the tokens using graphic cards GPU, but after few months of operation the project was | ||

discovered by miners using the F1 | discovered by miners using the BlackMiner F1 which can produce tokens at a much lower cost. This, together with the beginning of the worst bear market in Bitcoin history made a big impact on the token prices. | ||

At the time of this writing, the token prices are below the cost of production in most countries. And these BlackMiners are dominating the token economics. | At the time of this writing, the token prices are below the cost of production in most countries. And these BlackMiners are dominating the token economics. | ||

= Trading = | == Trading == | ||

Trading is the basic way of making money with assets whose price varies in time. The idea is you buy it when the price is low, and sell it when the price is higher. | |||

In Seasonal Tokens there are additional variants of this that traders can profit from: Seasonal Trading, and trading "mining time". This is a more advanced topic and needs some | |||

discussion. | |||

= | ===Trading Price Fluctuations=== | ||

This is the standard trading, buy low sell high. This is easier to say but not so easy to do.We will discuss a special variation of this unique to seasonal tokens at the end of the "trading" section. | |||

= Free Tokens = | ===Seasonal Trading=== | ||

Together with mining, this is the second ingredient in the unique Seasonal Tokens system. Here traders can profit from predictable price oscillations. | |||

Seasonal Tokens prices are engineered to oscillate around each other over time. The token produced at the fastest rate becomes the cheapest one. When its mining supply is cut in half, it becomes the slowest token to produce. This puts upward pressure on the token price and few months after the halving of mining supply it becomes the most expensive of the four tokens. | |||

Seasonal Traders make profits by helping the mining economy to recover after the halving of mining supply. | |||

With other proof of work assets, when the halving of mining supply occurs, miners have to absorb all the loses. This puts some miners out of business. | |||

In Seasonal Tokens, a collaboration between miners and investors occurs.The halving of mining supply makes the production of the cheapest token unprofitable overnight. | |||

But investors buy the cheapest token in expectation of the prices to rise, helping to recover the mining profitability of the token. | |||

===Trading Mining Time=== | |||

The relative prices of the tokens tend to show the differences in mining time of the four tokens. In other words, the tokens that take longer to mine tend to be the most expensive. | |||

Traders benefit from the token price differences and can increase the total number of tokens they have trading the most expensive tokens for the cheaper ones. | |||

However, sometimes it may happen that large volumes of trading activity tend to collapse the prices onto each other. | |||

If the two tokens have the same price, traders can decide to trade the token that is faster to produce for the token that takes longer to produce. | |||

When the token prices return to their natural values reflecting the mining time, their token holdings will rise in value. | |||

===Advanced Seasonal Trading=== | |||

The basic conceptual framework of the Seasonal Tokens system can be explained with a picture: Every nine months the token that is produced at the fastest rate becomes the one produced at the slowest rate. This is reflected on the token prices in such a way that every nine months the cheapest token begins to rise in price and few months later becomes the most expensive of the four. | |||

The mining supply of the tokens is cut in half every 3 years, but it is arranged in time so that every nine months the mining supply of the token produced at the fastest rate is cut in half. | |||

(Nine months times four tokens equals three years, and the cycle repeats) | |||

One way to profit from this is that you buy the cheapest token, then wait until it becomes the most expensive of the four and then you can trade it for the cheapest one, increasing the total number of tokens you have with each trade. Or you can choose to have always the same number of tokens and trade the excess number of tokens for any other currency like wrapped Bitcoin, or stable-coins for example. | |||

This process can be repeated every nine months. | |||

However, in Seasonal Tokens there is a Trading Simulator to teach users the basic principles of Seasonal Trading. And there are contest where participants earn tokens by playing with the simulator. | |||

It was discovered that some traders found a way to make a lot more profit than the simple strategy described above. | |||

Advanced traders do not trade the most expensive token for the cheapest tokens. Instead, they wait for price fluctuations to be favorable, and trade the most expensive token for the next most expensive. Then wait for another price fluctuation and trade the second most expensive for the third most expensive, then wait for another price fluctuation and trade the third most expensive for the cheapest of the four tokens. | |||

This procedure allows traders to trade three times in the nine month period. By following this procedure, by the time they get to the cheapest token they have more tokens than they would have if they just went for the cheapest token from the beginning. | |||

This trading strategy is described in the article: How to use Seasonal Tokens to get Bitcoin. And it is the result of the community experimenting with the trading simulator. | |||

== Arbitrage == | |||

Seasonal Tokens are produced by Proof of Work in the Ethereum network only. This process known as "mining" effectively converts energy into currency, and it gives the tokens a real cost of production, connecting it to the real world economy. In this way, the tokens are hard digital assets that behave like physical commodities. There will be only 37 million tokens of each type, and they have a non zero value given by their cost of production. | |||

Ethereum gas fees are high though. This is good for giving the tokens a real cost of production. But it is bad for the Seasonal Trading system, and trading in general. | |||

For this reason the Polygon bridge was implemented so that trading can be performed at a minimal cost on the Polygon network. A layer 2 solution on top of Ethereum. | |||

Therefore, there are tokens on Ethereum network, traded on the Uniswap DEX on Ethereum. And there are Polygon representations of the tokens, or "wrapped" tokens on the Polygon network, that can be traded on the Polygon Uniswap DEX. | |||

In other words, the Polygon tokens, (sometimes refered to as PoS tokens on price trackers) are representations of Ethereum tokens, for the convenience of moving them around at a lower gas fees. But they are really Ethereum tokens. | |||

It may happen that the token prices on the Polygon network are different than the prices on the Ethereum network. And some profit can be made by buying in one network and selling on the other network. This is called "Arbitrage". | |||

Moving tokens from one network to another across the Polygon bridge cost gas fees.Therefore, for arbitrage to be economically feasible, the price difference between networks has to be enough to cover the cost of using the bridge. | |||

== Free Tokens == | |||

And last bun not least, you can get tokens for free by joining the Seasonal Tokens community on Discord. Community members can earn tokens supporting the project on social media platforms such as Telegram, YouTube, LinkedIn, and Twitter, learning about the project, participating in trading contests, playing games, and receiving tips for helping other members and being active in the Discord server. | |||

Latest revision as of 20:01, 26 July 2024

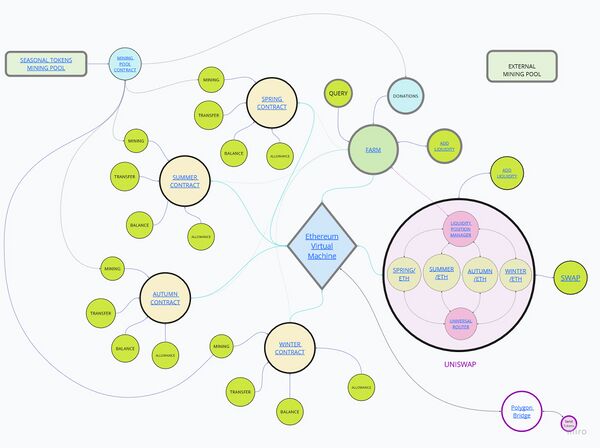

The Seasonal Tokens ecosystem operates autonomously, governed solely by the token's supply and demand. For the system to work, it needs human participation: miners, farmers, traders, and investors. These human actors may join or leave the system at any time, there is no need for coordination among them.

All necessary actions for the system to function are executed by somebody when there is profit to make. The system evolves purely from economic principles in a completely trust-less environment, without the need for governance or management.

Six Ways to Benefit from Seasonal Tokens

Buy and Hold

This is the simplest strategy, the idea is to buy tokens and wait for the prices to rise to make profits selling them again. In general this is a long term strategy since Seasonal Tokens is a very young project and it is still on the inflationary phase. This means that lots of tokens are being produced every day. When these tokens reach the Liquidity Pools in Uniswap they push the prices down. An equal value of Matic should be invested every day to keep the price stable.

This is something natural and it is an opportunity for new investors to enter the world of crypto. Early investors are taking more risk but they are going to catch the largest rewards when the token´s prices rise.

There are only 37 million tokens of each type, and every 3 years the mining supply of tokens is cut in half. This scarcity will put an upward pressure on the tokens prices. If the demand of the tokens remains as it is now, the token prices will rise naturally.

Farming

Providing liquidity to the markets is essential to the Token economics. Decentralized markets like Uniswap reward liquidity providers in proportion to the number of transactions occurring in the market.

For providing liquidity to be economically feasible, the rewards have to overcome the problem of so called "Impermanent Loss". Basically means that a liquidity position loses value, if the token´s prices go down, and also if the price goes up!

This is a mathematical feature of the way the automated market works, and the transaction fees are the way to solve this problem.

However for new projects with a low number of transactions the fees may not be sufficient to counter this loss.

For this reason Seasonal Tokens has a solution in place: Farming.

Basically, a portion of the tokens mined by the Seasonal Tokens mining pool is donated to the four farms. Liquidity providers in Uniswap can deposit their liquidity positions in the farms, and receive additional income from the mining pool.

The donations to the farm are covered by a investment fund and nobody has to pay for it.

Mining

Mining is the core of the Seasonal Tokens ecosystem. The mining supply of tokens is the driving force behind the price oscillations that are the main feature of the system.

The original price of the tokens at the beginning of the project was estimated by the cost of production of the tokens using graphic cards GPU, but after few months of operation the project was discovered by miners using the BlackMiner F1 which can produce tokens at a much lower cost. This, together with the beginning of the worst bear market in Bitcoin history made a big impact on the token prices.

At the time of this writing, the token prices are below the cost of production in most countries. And these BlackMiners are dominating the token economics.

Trading

Trading is the basic way of making money with assets whose price varies in time. The idea is you buy it when the price is low, and sell it when the price is higher. In Seasonal Tokens there are additional variants of this that traders can profit from: Seasonal Trading, and trading "mining time". This is a more advanced topic and needs some discussion.

Trading Price Fluctuations

This is the standard trading, buy low sell high. This is easier to say but not so easy to do.We will discuss a special variation of this unique to seasonal tokens at the end of the "trading" section.

Seasonal Trading

Together with mining, this is the second ingredient in the unique Seasonal Tokens system. Here traders can profit from predictable price oscillations. Seasonal Tokens prices are engineered to oscillate around each other over time. The token produced at the fastest rate becomes the cheapest one. When its mining supply is cut in half, it becomes the slowest token to produce. This puts upward pressure on the token price and few months after the halving of mining supply it becomes the most expensive of the four tokens.

Seasonal Traders make profits by helping the mining economy to recover after the halving of mining supply.

With other proof of work assets, when the halving of mining supply occurs, miners have to absorb all the loses. This puts some miners out of business. In Seasonal Tokens, a collaboration between miners and investors occurs.The halving of mining supply makes the production of the cheapest token unprofitable overnight. But investors buy the cheapest token in expectation of the prices to rise, helping to recover the mining profitability of the token.

Trading Mining Time

The relative prices of the tokens tend to show the differences in mining time of the four tokens. In other words, the tokens that take longer to mine tend to be the most expensive. Traders benefit from the token price differences and can increase the total number of tokens they have trading the most expensive tokens for the cheaper ones.

However, sometimes it may happen that large volumes of trading activity tend to collapse the prices onto each other.

If the two tokens have the same price, traders can decide to trade the token that is faster to produce for the token that takes longer to produce.

When the token prices return to their natural values reflecting the mining time, their token holdings will rise in value.

Advanced Seasonal Trading

The basic conceptual framework of the Seasonal Tokens system can be explained with a picture: Every nine months the token that is produced at the fastest rate becomes the one produced at the slowest rate. This is reflected on the token prices in such a way that every nine months the cheapest token begins to rise in price and few months later becomes the most expensive of the four.

The mining supply of the tokens is cut in half every 3 years, but it is arranged in time so that every nine months the mining supply of the token produced at the fastest rate is cut in half. (Nine months times four tokens equals three years, and the cycle repeats)

One way to profit from this is that you buy the cheapest token, then wait until it becomes the most expensive of the four and then you can trade it for the cheapest one, increasing the total number of tokens you have with each trade. Or you can choose to have always the same number of tokens and trade the excess number of tokens for any other currency like wrapped Bitcoin, or stable-coins for example.

This process can be repeated every nine months.

However, in Seasonal Tokens there is a Trading Simulator to teach users the basic principles of Seasonal Trading. And there are contest where participants earn tokens by playing with the simulator. It was discovered that some traders found a way to make a lot more profit than the simple strategy described above.

Advanced traders do not trade the most expensive token for the cheapest tokens. Instead, they wait for price fluctuations to be favorable, and trade the most expensive token for the next most expensive. Then wait for another price fluctuation and trade the second most expensive for the third most expensive, then wait for another price fluctuation and trade the third most expensive for the cheapest of the four tokens.

This procedure allows traders to trade three times in the nine month period. By following this procedure, by the time they get to the cheapest token they have more tokens than they would have if they just went for the cheapest token from the beginning.

This trading strategy is described in the article: How to use Seasonal Tokens to get Bitcoin. And it is the result of the community experimenting with the trading simulator.

Arbitrage

Seasonal Tokens are produced by Proof of Work in the Ethereum network only. This process known as "mining" effectively converts energy into currency, and it gives the tokens a real cost of production, connecting it to the real world economy. In this way, the tokens are hard digital assets that behave like physical commodities. There will be only 37 million tokens of each type, and they have a non zero value given by their cost of production.

Ethereum gas fees are high though. This is good for giving the tokens a real cost of production. But it is bad for the Seasonal Trading system, and trading in general.

For this reason the Polygon bridge was implemented so that trading can be performed at a minimal cost on the Polygon network. A layer 2 solution on top of Ethereum.

Therefore, there are tokens on Ethereum network, traded on the Uniswap DEX on Ethereum. And there are Polygon representations of the tokens, or "wrapped" tokens on the Polygon network, that can be traded on the Polygon Uniswap DEX.

In other words, the Polygon tokens, (sometimes refered to as PoS tokens on price trackers) are representations of Ethereum tokens, for the convenience of moving them around at a lower gas fees. But they are really Ethereum tokens.

It may happen that the token prices on the Polygon network are different than the prices on the Ethereum network. And some profit can be made by buying in one network and selling on the other network. This is called "Arbitrage".

Moving tokens from one network to another across the Polygon bridge cost gas fees.Therefore, for arbitrage to be economically feasible, the price difference between networks has to be enough to cover the cost of using the bridge.

Free Tokens

And last bun not least, you can get tokens for free by joining the Seasonal Tokens community on Discord. Community members can earn tokens supporting the project on social media platforms such as Telegram, YouTube, LinkedIn, and Twitter, learning about the project, participating in trading contests, playing games, and receiving tips for helping other members and being active in the Discord server.