Benzinga 01: Difference between revisions

No edit summary |

No edit summary |

||

| (6 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

=Bitcoin-Inspired Hard Digital Assets on the Ethereum Network: A New Frontier= | =Bitcoin-Inspired Hard Digital Assets on the Ethereum Network: A New Frontier= | ||

''Seasonal Tokens | ''Seasonal Tokens comprise four trustless, decentralized digital assets, issued through proof of work and operating on the Ethereum network. Inspired by the economic principles of Bitcoin, these tokens are designed with a mining supply that induces predictable price fluctuations. Traders can capitalize on these built-in seasonal variations to generate profits.'' | ||

==Bitcoin Halving== | ==Bitcoin Halving and Seasonality== | ||

Bitcoin | Bitcoin represents the first hard digital asset in history. Its proof of work mechanism effectively converts energy into currency through a process known as 'mining.' The cost of production ties Bitcoin to the real-world economy, providing it with a fundamental value and making it behave similarly to a physical commodity. | ||

Mining | Mining allows for the creation of new coins without the need for a central mint or trusted intermediaries. To ensure that only a finite number of bitcoins will be issued, the supply of new coins is halved approximately every four years in an event known as the Bitcoin Halving. | ||

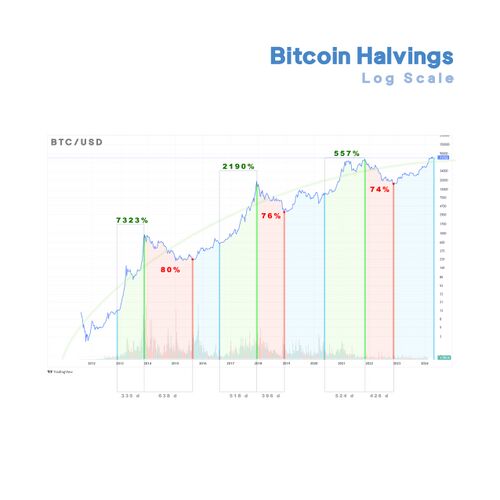

A | A notable aspect of cryptocurrency market dynamics is the seasonality introduced by the Bitcoin Halving. Although the significant price fluctuations can obscure this pattern, analyzing Bitcoin’s price history on a logarithmic scale reveals a discernible pattern: | ||

[[File:Halvings Log.jpg | | [[File:Halvings Log.jpg |500px]] | ||

Approximately every four years, the supply of Bitcoin mined is halved. This event is indicated by blue vertical lines in the graph. Months after each halving, a bull market ensues (marked in green), propelling Bitcoin's price to new all-time highs, well above the cost of production. Eventually, this leads to a price bubble, which results in a bear market (marked in red) that can last more than a year. This cycle is followed by a recovery period that persists until the next halving. | |||

[[File:HistoricalRelPrice.png | | As the price of Bitcoin skyrockets, investors begin searching for alternative opportunities, leading to the phenomenon known as 'altcoin season.' During this period, other major cryptocurrencies experience a rise in price, triggered by Bitcoin's bull run. | ||

Many other cryptocurrencies also use a proof of work mechanism. If some of these cryptocurrencies were to experience a bull run while Bitcoin is in a bear market, traders could potentially exploit this seasonality by trading Bitcoin for those rising in value. Unfortunately, technical analysis of the price action of other major proof of work cryptocurrencies does not consistently reveal the expected seasonal patterns. | |||

==Ethereum and Innovation== | |||

Creating another blockchain comparable to Bitcoin, but with a different halving schedule, is practically impossible due to the significant resources required, including hardware, energy consumption, and widespread adoption. However, thanks to Ethereum, this is no longer necessary. ERC20 technology enables the creation of digital assets that incorporate the economic principles of Bitcoin's design without needing their own blockchain. Decentralization and security are managed by the Ethereum network. | |||

==Designed for Investment== | |||

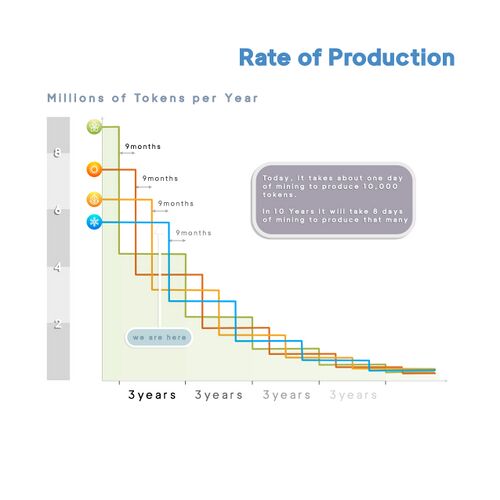

There are four Seasonal Tokens: Spring, Summer, Autumn, and Winter. Their mining supply is halved every three years. The distinctive feature of these tokens is that their production rates are staggered so that every nine months, the token currently being mined at the fastest rate has its supply cut in half, thereby becoming the token produced at the slowest rate. | |||

[[File:Rate of Production 2.jpg |500px]] | |||

Scheduled halvings lead to predictable oscillations in the relative prices of the tokens, which traders can exploit for profit. | |||

By concentrating on the relative prices of the four tokens, traders can effectively disregard fluctuations in the dollar value of the assets, focusing solely on the tokens' performance relative to each other. | |||

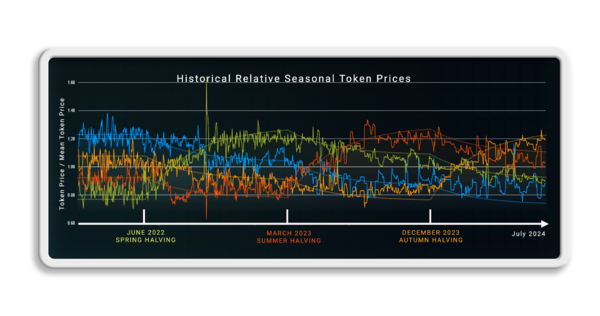

On September 4, 2024, the mining supply of Winter tokens will be halved, completing a full cycle of halvings. Historical data on the relative prices confirm that the system functions as intended, with the mining supply driving predictable price oscillations among the tokens. | |||

[[File:HistoricalRelPrice.png |600px]] | |||

This closed ecosystem operates autonomously, governed solely by supply and demand. It stands as a technical achievement, demonstrating that complex organizational structures can arise purely from economic principles in a completely trustless environment, without the need for governance or management. | |||

To learn more about how Seasonal Tokens outperform the simple buy and hold strategy, please visit this page: | |||

https://seasonaltokens.org/benzinga | |||

=GPT Title Variations= | =GPT Title Variations= | ||

Latest revision as of 08:57, 16 July 2024

Bitcoin-Inspired Hard Digital Assets on the Ethereum Network: A New Frontier

Seasonal Tokens comprise four trustless, decentralized digital assets, issued through proof of work and operating on the Ethereum network. Inspired by the economic principles of Bitcoin, these tokens are designed with a mining supply that induces predictable price fluctuations. Traders can capitalize on these built-in seasonal variations to generate profits.

Bitcoin Halving and Seasonality

Bitcoin represents the first hard digital asset in history. Its proof of work mechanism effectively converts energy into currency through a process known as 'mining.' The cost of production ties Bitcoin to the real-world economy, providing it with a fundamental value and making it behave similarly to a physical commodity.

Mining allows for the creation of new coins without the need for a central mint or trusted intermediaries. To ensure that only a finite number of bitcoins will be issued, the supply of new coins is halved approximately every four years in an event known as the Bitcoin Halving.

A notable aspect of cryptocurrency market dynamics is the seasonality introduced by the Bitcoin Halving. Although the significant price fluctuations can obscure this pattern, analyzing Bitcoin’s price history on a logarithmic scale reveals a discernible pattern:

Approximately every four years, the supply of Bitcoin mined is halved. This event is indicated by blue vertical lines in the graph. Months after each halving, a bull market ensues (marked in green), propelling Bitcoin's price to new all-time highs, well above the cost of production. Eventually, this leads to a price bubble, which results in a bear market (marked in red) that can last more than a year. This cycle is followed by a recovery period that persists until the next halving.

As the price of Bitcoin skyrockets, investors begin searching for alternative opportunities, leading to the phenomenon known as 'altcoin season.' During this period, other major cryptocurrencies experience a rise in price, triggered by Bitcoin's bull run.

Many other cryptocurrencies also use a proof of work mechanism. If some of these cryptocurrencies were to experience a bull run while Bitcoin is in a bear market, traders could potentially exploit this seasonality by trading Bitcoin for those rising in value. Unfortunately, technical analysis of the price action of other major proof of work cryptocurrencies does not consistently reveal the expected seasonal patterns.

Ethereum and Innovation

Creating another blockchain comparable to Bitcoin, but with a different halving schedule, is practically impossible due to the significant resources required, including hardware, energy consumption, and widespread adoption. However, thanks to Ethereum, this is no longer necessary. ERC20 technology enables the creation of digital assets that incorporate the economic principles of Bitcoin's design without needing their own blockchain. Decentralization and security are managed by the Ethereum network.

Designed for Investment

There are four Seasonal Tokens: Spring, Summer, Autumn, and Winter. Their mining supply is halved every three years. The distinctive feature of these tokens is that their production rates are staggered so that every nine months, the token currently being mined at the fastest rate has its supply cut in half, thereby becoming the token produced at the slowest rate.

Scheduled halvings lead to predictable oscillations in the relative prices of the tokens, which traders can exploit for profit.

By concentrating on the relative prices of the four tokens, traders can effectively disregard fluctuations in the dollar value of the assets, focusing solely on the tokens' performance relative to each other.

On September 4, 2024, the mining supply of Winter tokens will be halved, completing a full cycle of halvings. Historical data on the relative prices confirm that the system functions as intended, with the mining supply driving predictable price oscillations among the tokens.

This closed ecosystem operates autonomously, governed solely by supply and demand. It stands as a technical achievement, demonstrating that complex organizational structures can arise purely from economic principles in a completely trustless environment, without the need for governance or management.

To learn more about how Seasonal Tokens outperform the simple buy and hold strategy, please visit this page:

https://seasonaltokens.org/benzinga

GPT Title Variations

"Exploring Hard Digital Assets: How Bitcoin-Inspired Innovations Thrive on Ethereum" "Bridging Blockchains: The Rise of Bitcoin-Inspired Digital Assets on Ethereum" "From Bitcoin to Ethereum: The Evolution of Hard Digital Assets" "Hard Digital Assets: Harnessing Bitcoin’s Principles on the Ethereum Blockchain"