Benzinga 01: Difference between revisions

No edit summary |

No edit summary |

||

| Line 2: | Line 2: | ||

Bitcoin is the first hard digital asset in history, the proof of work mechanism effectively converts energy into currency by a process referred to as "mining". | Bitcoin is the first hard digital asset in history, the proof of work mechanism effectively converts energy into currency by a process referred to as "mining". | ||

It's cost of production connects it to the real world economy | It's cost of production connects it to the real world economy and provides a fundamental value thus behaving like a physical commodity. | ||

Mining is a way to create new coins without a central mint of trusted parties. In order to make sure that only a finite number of bitcoins will be created, the mining supply of new coins is cut in half approximately every four years, an event called Bitcoin Halving. | Mining is a way to create new coins without a central mint of trusted parties. In order to make sure that only a finite number of bitcoins will be created, the mining supply of new coins is cut in half approximately every four years, an event called Bitcoin Halving. | ||

| Line 10: | Line 10: | ||

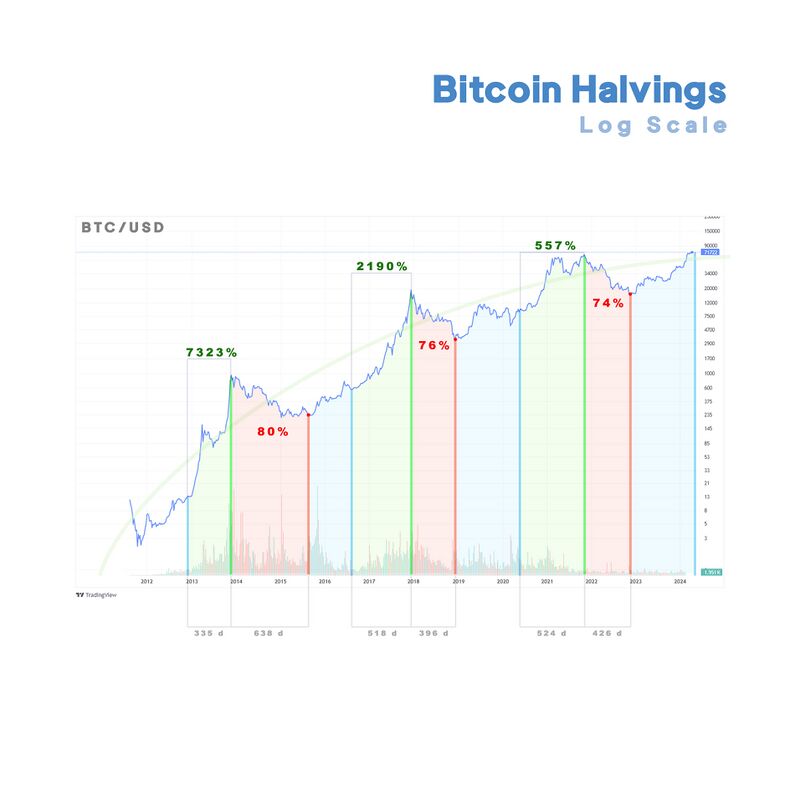

[[File:Halvings Log.jpg |800px|left]] | [[File:Halvings Log.jpg |800px|left]] | ||

Ever four years on average, the Bitcoin mining supply is cut in half. Months after the halving of mining supply a bull market sends the Bitcoin price to all time highs, reaching prices well above the cost of production, and the whole thing ends up with a price bubble leading to a bear market that may last for more than a year until the next halving occurs. | |||

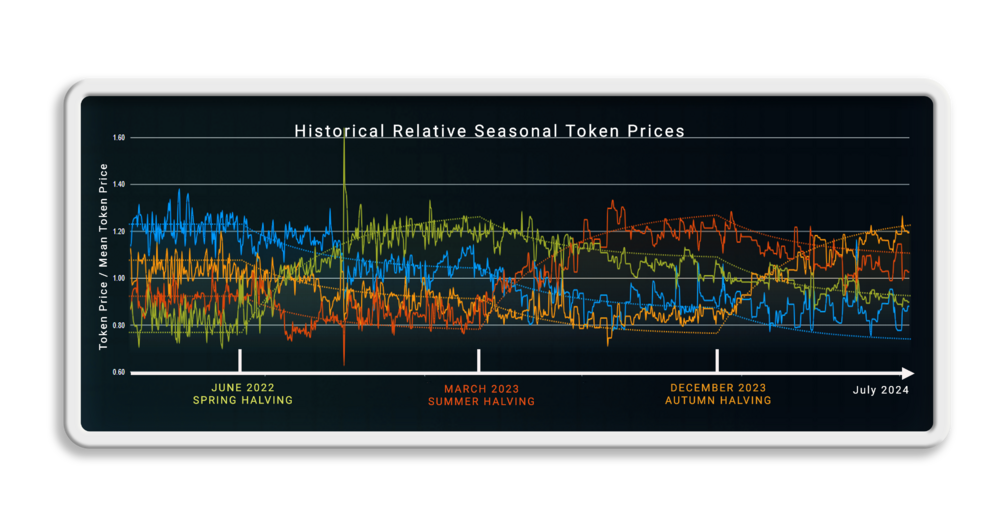

[[File:HistoricalRelPrice.png |1000px]] | |||

=GPT Title Variations= | =GPT Title Variations= | ||

Revision as of 01:56, 16 July 2024

Bitcoin-Inspired Hard Digital Assets on the Ethereum Network: A New Frontier

Bitcoin is the first hard digital asset in history, the proof of work mechanism effectively converts energy into currency by a process referred to as "mining". It's cost of production connects it to the real world economy and provides a fundamental value thus behaving like a physical commodity.

Mining is a way to create new coins without a central mint of trusted parties. In order to make sure that only a finite number of bitcoins will be created, the mining supply of new coins is cut in half approximately every four years, an event called Bitcoin Halving.

A key observation in crypto is that the Bitcoin Halving has introduced seasonality in the cryptocurrency markets. This is hard to see due to the large price fluctuations, but if we look at the Bitcoin price history on a logarithmic scale, a pattern emerges:

Ever four years on average, the Bitcoin mining supply is cut in half. Months after the halving of mining supply a bull market sends the Bitcoin price to all time highs, reaching prices well above the cost of production, and the whole thing ends up with a price bubble leading to a bear market that may last for more than a year until the next halving occurs.

GPT Title Variations

"Exploring Hard Digital Assets: How Bitcoin-Inspired Innovations Thrive on Ethereum" "Bridging Blockchains: The Rise of Bitcoin-Inspired Digital Assets on Ethereum" "From Bitcoin to Ethereum: The Evolution of Hard Digital Assets" "Hard Digital Assets: Harnessing Bitcoin’s Principles on the Ethereum Blockchain"