How Does Seasonal Tokens Work?

Seasonal Tokens are designed around a simple idea:

Instead of relying on prices going up, the system is built so relative prices between tokens change over time in a predictable way.

This page explains why that happens, and how participants interact with the system, without assuming prior knowledge of crypto trading.

From Prices to Relative Prices

In most cryptocurrencies, people focus on absolute prices:

● How many dollars is one token worth?

● Is the price higher or lower than before?

Seasonal Tokens shift the focus to relative prices:

● How many units of one token are worth one unit of another?

For example:

● One Winter token might be worth two Summer tokens

● Or four Spring tokens

● These relationships matter even if dollar prices are unchanged.

Relative prices:

-Are independent of fiat currencies-

-Filter out broader market noise-

-Reveal the internal structure of the system-

Why Four Tokens?

Seasonal Tokens are not one asset, but four independent Proof-of-Work tokens:

Each token:

They do not interact directly with each other at the contract level.

What connects them is how they are produced over time.

Mining and Staggered Supply Reductions

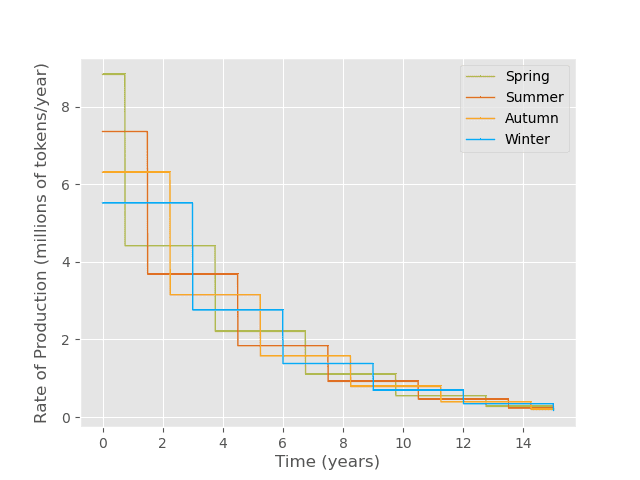

All four tokens follow Bitcoin-style economics:

The key design choice is this:

The four tokens do not reduce their mining supply at the same time.

Mining Supply Schedule:

This means that at any given time:

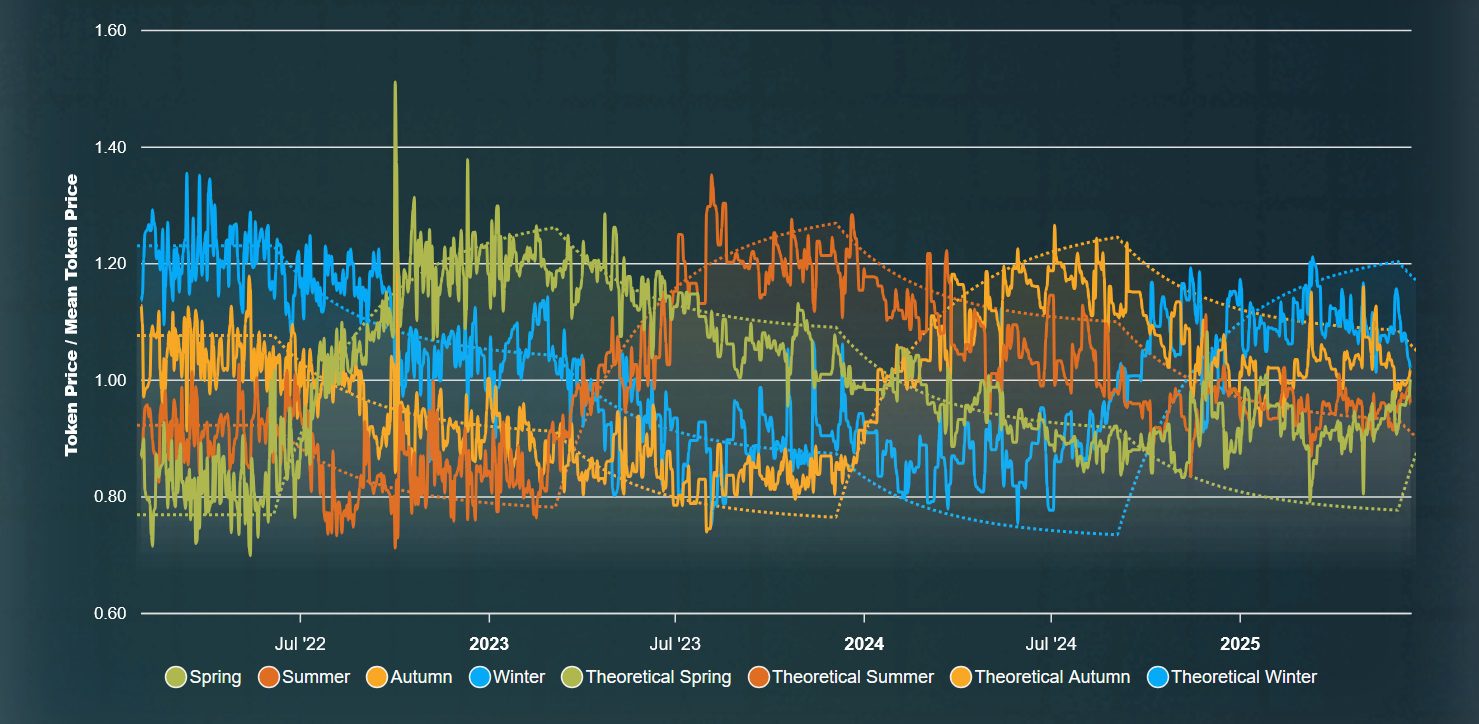

This mining supply schedule produces predictable oscillations in the relative prices of the four tokens:

Rate of Production in Millions of Tokens per Year.

How Seasonality Emerges:

Because supply changes are staggered, scarcity rotates among the tokens.

This leads to:

These cycles do not depend on:

They emerge from:

The following chart shows over four years of relative price history proving that the differences in mining supply cause differences in the relative prices of the four tokens.

What Participants Do:

Seasonal Tokens are a real on-chain economy.

People interact with the system in different roles.

Miners

Traders

Liquidity Providers

No central coordination is required.

Each participant acts independently based on incentives.

Emergent Coordination

When mining supply is reduced:

● Production becomes more expensive

● Some miners shift to other tokens

● Scarcity increases in the affected token

At the same time:

● Traders often move toward the cheaper, slower-produced token

● Demand increases where supply is tightening

● Relative prices adjust

This interaction:

● Helps restore mining profitability

● Encourages trading activity

● Strengthens the overall system

Coordination emerges from incentives, not management.

Seeing it in Practice

If you’d like to explore these dynamics interactively, the Seasonal Trading Simulator lets you experiment with relative price cycles in a simplified environment.

It is not required to understand the system, but it can help visualize how seasonal trading works in practice.

Explore the Seasonal Trading Simulator