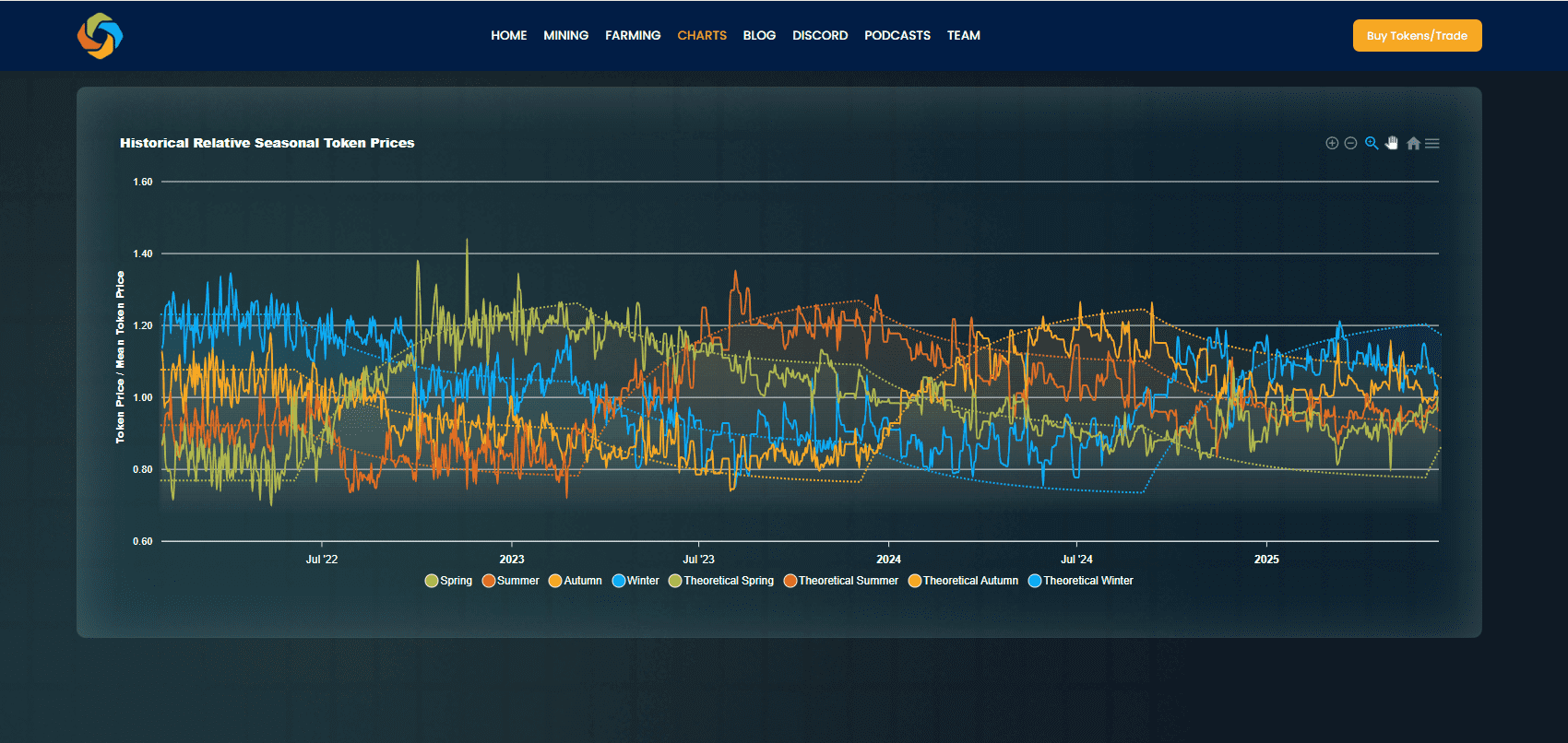

Instead of relying only on prices going up, Seasonal Tokens form a system where you can participate in a real on-chain economy, and learn how crypto works while focusing on structure, cycles, and relative value rather than guessing market direction.

A Different Way to Think About Crypto

Seasonal Tokens are a set of four Proof-of-Work cryptocurrencies that interact through their relative prices, not through promises of dollar value appreciation.

Rather than asking:

“Is this token worth more dollars than yesterday?”

The system encourages questions like:

“How much of one token is another token worth right now?”

This Shift Matters Because:

- Relative prices are independent of fiat currencies

- They highlight internal dynamics instead of market noise

- They allow learning and experimentation even when markets are uncertain

.

Learning While Participating:

You learn the fundamentals of crypto exploring Seasonal Tokens features.

Beginners can:

- Explore wallets, transactions, and decentralized exchanges

- See how mining, trading, and liquidity work in practice

- Start with very small amounts, especially on low-fee networks.

More experienced users can:

- Explore a system built around predictable supply changes

- Focus on process and discipline instead of constant market timing

What makes Seasonal Tokens different

Seasonal Tokens are designed as a structured environment where understanding matters more than hype.

What would you like to explore next?

Learn how relative prices, mining supply schedules, and participant behavior create recurring cycles inside the system.

See how token prices are formed, what risks exist, and why understanding risk is part of learning crypto.

Connect your wallet to www.seasonaltokens.org and start exploring the token ecosystem. You can Buy/Sell, Mine, and Farm Seasonal Tokens.

Learn how Seasonal Tokens are organized, why fairness matters, and how the system stays decentralized.

A Note on Expectations:

Seasonal Tokens do not promise guaranteed returns.

Token dollar prices depend on external market conditions and participant behavior.

However, the tokens’ relative prices reflect the scheduled changes in mining supply encoded in the smart contracts.

The system is designed around transparent rules and predictable structure,

so participants can focus on understanding how it works rather than guessing outcomes.

This allows seasonal traders to outperform the simple buy and hold strategy. And it gives the opportunity to grow your token holdings, even during bear markets, and it gives the opportunity to wait for favorable external market conditions.