If you are a beginner in crypto, Seasonal Tokens can be your guide to the fundamentals concepts of cryptocurrency technology, because it combines elements of the two most important prototypes of crypto: Bitcoin and Ethereum, and there are many aspects of web3 technology involved in the Seasonal Tokens ecosystem.

You can learn while trading real crypto in a reduced-risk environment, where cooperation emerges spontaneously from economic incentives alone.

But even if you are an experienced crypto user, Seasonal Tokens are different:

In other cryptos you buy them with the expectation that they will rise in price.

The Seasonal Tokens system does not rely on prices rising,

It works even if the average prices remain constant.

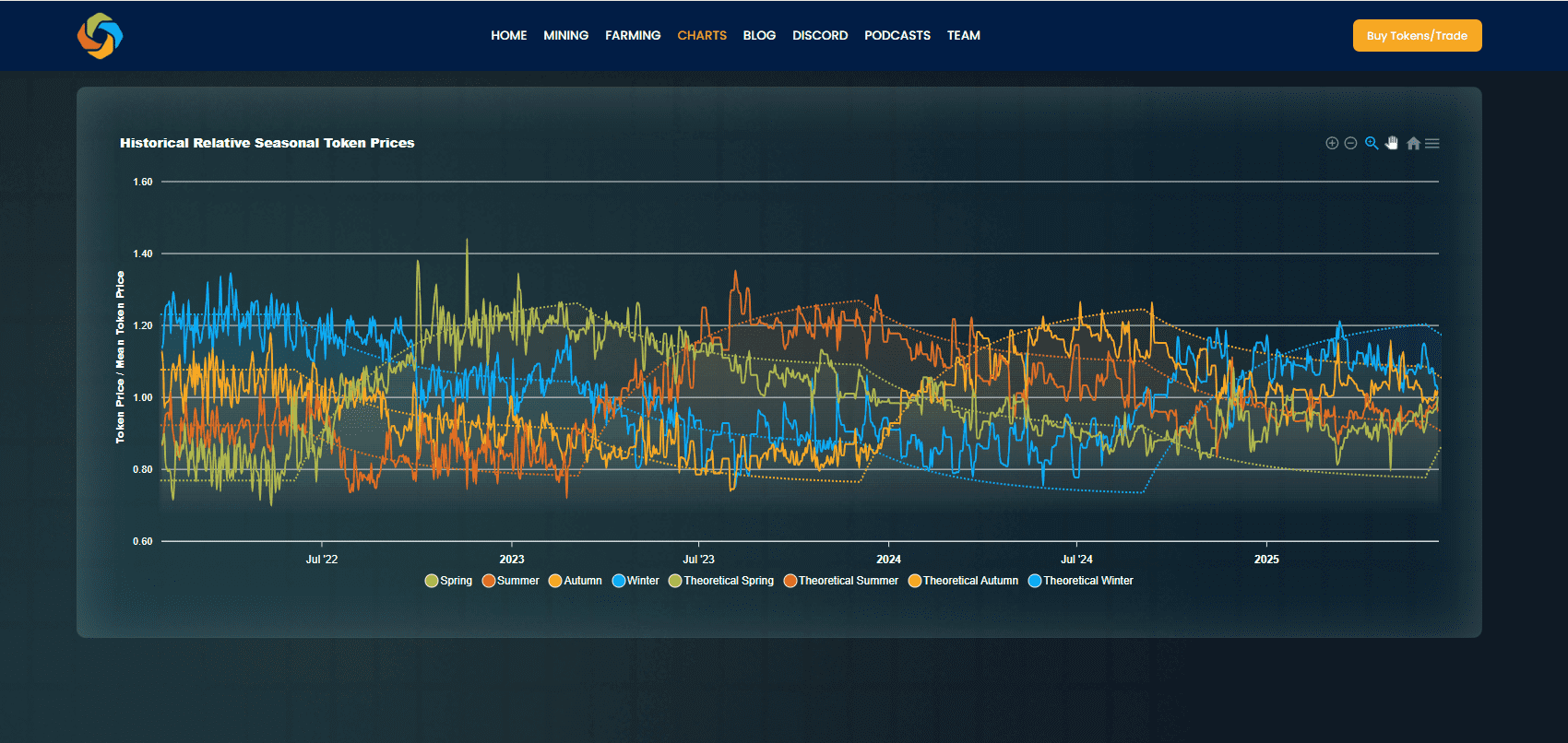

Historical Relative Seasonal Tokens Prices

We can explain the system with one picture, then dive into the details on the How Does it Work page.

The historical relative price chart shows four years of data covering the first full cycle of the four-token seasons. (right click to open the image in a new tab)

Notice the recurring price oscillations.

These oscillations can be used to increase the total number of tokens you hold without adding more fiat.

Example:

Imagine it’s early 2023. Spring is the most expensive token, and Summer is the cheapest. At that time, you could swap a given amount of Spring for a larger amount of Summer. As Summer’s relative price rose, by Q3 2023 you could have swapped those Summer tokens for an even larger amount of Autumn.

By repeating this cycle, participants can increase the total number of tokens they hold without investing more fiat.

Outperform Buy and Hold

Regardless of the tokens’ dollar prices, increasing your total token holdings is better than leaving them idle. Seasonal trading can outperform a simple buy-and-hold approach.

Risk Management

The only risk, of course, is if prices go down. Seasonal Tokens are produced on the Ethereum network and are typically priced in Ether (ETH), so when ETH moves up or down, token prices tend to move with it. This is one layer of risk—but it can also be an advantage when ETH rises, and ETH is highly correlated to Bitcoin´s 4 year cycle of bull runs.

The tokens’ dollar value is ultimately driven by supply and demand. On the supply side, issuance is continuously decreasing, so the risk of the dollar value dropping depends mainly on demand. Visit the risk page for more information.

Next Steps:

On the How Does it Work page, we explain the Seasonal Tokens ecosystem in more detail—but you can also jump straight into the Trading Simulator and see how it works for yourself.

If you’re just starting your crypto journey, you can learn for free at your own pace with the Test Drive tutorials. And if you’d like one-on-one help, join us on Discord—we’d be glad to have you there.

GET STARTED!

FAQ

Proof of Work cryptocurrencies have a floor value given by their cost of production. Seasonal Tokens also have a use value, because they allow the possibility of increasing the total number of tokens by using the recurring price oscillations. Seasonal traders earn tokens by helping the mining economy recover after the halving of mining supply.

The dollar value comes from the balance between supply and demand, and the supply is constantly decreasing, leaving demand as the main factor.

The Relative Price chart shows the token prices divided by the average of the 4 prices.

For example, if the prices for Spring, Summer, Autumn, and Winter are 1, 2, 3, and 4 cents, respectively, the average is 2.5 cents, so the relative prices are 0.4, 0.8, 1.2, and 1.6 These are just proportions, so they don’t depend on whether prices are shown in dollars, cents, ETH, or anything else. This filters out external market conditions and highlights the tokens’ internal economics.

This is useful because it lets us focus only on relative value. For example, you might see that one Winter token is worth about two Summer tokens, or about four Spring tokens, and so on.

Seasonal Tokens are designed for investing, but their reduced-risk environment also makes them a great place to learn the fundamentals of crypto technology.

There’s no company or institution behind the tokens. The smart contracts run autonomously on the Ethereum and Polygon networks. Some token holders—including the original creator—hang out in our Discord server, where you can connect with the community and access learning resources and member perks.

You can learn for free by following our Test Drive, and Polygon network fees are so low that you can try it out with just a few cents before deciding whether you want to invest more. Crypto offers lots of opportunities—and also lots of risk. Investing time in learning is the best approach.